Download a PDF of this brief.

Introduction

The 20th African Growth and Opportunity Act (AGOA) Forum 2023, which took place in Johannesburg, South Africa in November 2023, renewed debate about the future of the AGOA and its effectiveness in improving United States-Africa trade relations. This comes amid long-standing criticism that AGOA has not met expectations in promoting broad-based trade, economic development, product diversification, and development of labor and other human rights among beneficiary countries. Out of 31 beneficiary countries, over 80% of duty-free non-oil exports came from just five countries: South Africa, Kenya, Lesotho, Madagascar and Ethiopia. AGOA is set to expire in 2025, and talks between Congress (House Ways and Means Committee) and African delegations in Washington, D.C. are taking place on how best to renew the trade-preference program.

Preferential trade programs are based on the concept that mutually beneficial North-South trade is better than aid. They are meant to help developing countries overcome structural disadvantages and provide a sustainable avenue to economic development. The impact of trade preferences varies widely across beneficiary countries and sectors, and other factors such as production costs, competitiveness, non-tariff barriers, standards, sanitary and phytosanitary issues all play a part in trade performance. Trade and support for trade facilitation and supply-side assistance are complementary to achieve development outcomes for AGOA beneficiaries. Over the years there has been a gradual reduction of U.S. most-favored nation (MFN) tariffs (roughly 39% of tariff lines in the U.S. tariff schedule have 0% duties), thereby reducing the value of trade preferences while making measures to support trade facilitation and sustainable production of increasing importance. Many of the fastest rising exports from AGOA countries to the U.S. are either duty free or faced average tariffs below 1% between 1996-2000, with some in the range of 1.9-5.5%. Moreover, for many AGOA beneficiaries, natural resources were a significant factor in their exports.

A comparative analysis of U.S. imports from various regional partners shows that while AGOA countries have faced the lowest tariffs since 2000, this group of countries also has the lowest trade growth. Preferences are still relevant but have less impact than underlying competitiveness, trade facilitation and other factors. It is critical for legislators and policy makers in the U.S. to use this opportunity to re-imagine AGOA and improve its economic offer coupled with robust foreign assistance in ways that can deepen its future economic relationship with Africa. The U.S. should commit to a predictable and stable trade relationship with sub-Saharan Africa (SSA), one that promotes fair, inclusive and sustainable economic development in the region. It is critical for AGOA to support and complement regional integration in Africa, and to align with the objectives of the African Continental Free Trade Area (AfCFTA) in promoting the development of regional value chains and regional supply chains.

Trade and economic growth are not a panacea for development, as the development process involves a diverse mix of domestic policies and conditions, as well as favorable external conditions like commodity prices and market access. The decades-long participation of African countries in trade as a tool for growth has partly contributed to skewed growth (with over-dependence on commodity exports), the establishment of enclave sectors, a race to the bottom in the competitive provision of incentives in a quest to lure investors and spark industrialization between countries. This includes low wages and labor rights issues in some industrial parks. Increased production to support export growth can also produce negative environmental impacts. This is a major challenge, for example, in the apparel — textiles and leather value chains — sector, which has enjoyed significant trade growth under AGOA. Textile and garment production with related “fast-fashion” is associated with significant adverse environmental impacts, which include use of hazardous pesticides, chemical pollution, wastes and microfiber from production activities, and substantial greenhouse gas emissions across the supply chain. The industry produced an estimated 1.2 billion tons of CO2 in 2015, which exceeded greenhouse gas emissions from the aviation and maritime sectors. Cotton farming and other textile production activities use an estimated 4% of global freshwater annually. Significant waste is generated from production to finishing (e.g., offcuts and discards). Just 1% of clothing is recycled, while the rest (worth some US$500 billion) ends up barely worn and in landfills.

Ultimately, AGOA is intertwined with broader geopolitical implications, amid rising great power competition, other countries also look to deepen economic and political ties with Africa. An escalation of geopolitical tensions would actually undermine economic development, as African countries could face higher import prices for items such as food or even lose access to key export markets, as well as suffer from potential loss of inward capital flows if foreign investments are cut off due to geopolitical tensions. Therefore, U.S. economic engagement with Africa has to offer 360-degree coverage and go broader than AGOA if it is to achieve inclusive, transformative and sustainable economic development. This includes greater support for key areas like infrastructure development and food security. Such initiatives include the multiphase Vision for Adaptive Crops and Soils (VACS) (in partnership with the U.N. Food and Agriculture Organization and African Union); broader foreign assistance programs designed to develop diverse, climate-resilient crop varieties; and building healthy, fertile soils across Africa’s five sub-regions. Other critical areas for support include human capital development, humanitarian needs, climate adaptation and the renewable energy transition. Given this wide gamut of issues, it is important that the U.S. does not over promise beyond what is realistic and feasible through AGOA as a trade program, while recognizing that complementary action to make AGOA successful is required through these other initiatives.

Recent shifts in African trade flows in a multipolar world

According to the International Monetary Africa (IMF) and the Economist Intelligence Unit, Africa will be the second fastest-growing economic region in 2024 after Asia, with annual GDP growth of between 3.3 to 4%, led by East Africa. As the largest regional bloc in the United Nations, Africa represents nearly 28% of U.N. General Assembly votes, giving the bloc influential sway. Africa is also attractive for its natural resources, including minerals like cobalt and lithium that are required for the green energy transition. The continent also faces various domestic and external challenges which impact prospects for development. These challenges include rural and urban poverty, poor infrastructure — especially in transport and energy, overdependence on a narrow range of commodities in some economies, conflict leading to insecurity, economic and institutional fragility, food insecurity, a relatively small private sector in many countries, exposure to adverse climate change impacts, lack of skills and rising debt levels. According to the World Bank's Debt Sustainability Analysis, as of September 2023, nine African countries were in “debt distress” (unable to fulfil their repayment requirements). Another 15 African countries were at high risk of debt distress, while another 14 faced moderate risk.

Despite the above-stated challenges, things have changed in Africa over the past two decades which merit closer economic interest from the U.S. The continent has diversified its export destinations, and Africa’s internal market continues to grow in both incomes and number of consumers, creating opportunities for both increased intra-African trade and trade and investment with the U.S. China’s investments and trade with Africa have grown over the past three decades to surpass the U.S. as Africa’s single largest trading partner. In 2022, total China-Africa trade amounted to a record US$282 billion, up 11% from the previous year. Trade was boosted by the re-opening of the Chinese economy since the COVID-19 pandemic, higher commodity prices and Chinese initiatives to address imbalance by importing more African agricultural products. Chinese exports to Africa amounted to US$164.1 billion representing an increase of 11.2% from 2021, while African exports to China grew by a similar rate to reach $117.51 billion in 2022. In contrast, U.S.-Africa trade amounted to US$73.7 billion in 2022. Africa exported $43.1 billion worth of goods to the U.S. and imported U.S. goods worth $30.6 billion.

Although the European Union’s 27 countries remain the main trading partner as a bloc for Africa, China has engaged in diplomatic and commercial efforts, such as the Forum on China-Africa Cooperation, that have resulted in China today accounting for 17.7% of total African exports, compared to the U.S. which accounts for 6.5% of African exports. Observers note that China’s approach to Africa has shifted from simple resource extraction towards investment, especially in infrastructure, and growing restraint on debt. Russia appears to be focused on building relations with Africa as a security partner and an investor in key sectors like energy, mining and agriculture and as a major supplier of both agriculture products and inputs like fertilizer.

AGOA and GSP concerns require a coordinated strategy for renewal in 2024

Historically, the U.S. has had a complicated relationship with Africa, and some approaches that are focused on containment of geopolitical rivals have resulted in missed opportunities to deepen the economic relationship with Africa, including under AGOA. Enacted in May 2000, the AGOA program was designed as a non-reciprocal arrangement of trade preferences granted by the U.S. to deepen and expand the trade and investment relationship between 49 potentially eligible countries in sub-Saharan Africa (SSA) and the U.S. It was seen by successive U.S. administrations, Congress, private sector proponents and labor and civil society as a policy with the potential to promote democratic development across the continent. AGOA is an extension of the broader U.S. Generalized System of Preferences (GSP) program established in 1974. Countries must be eligible for GSP to qualify for AGOA preferences (6,800 tariff lines). This includes 5,138 tariff lines covered by the U.S. GSP and roughly an additional 1,800 tariff line items covered only under the AGOA legislation. Under AGOA, just under 3% of products are still subject to tariffs and include various items of iron and steel (duty free on MFN basis but subject to Section 232 tariffs averaging 19.5-25%), textiles and apparel products (ranging from 0.1-8.8%), petroleum oils and crude, and various horticulture products (ranging from 2.3-29.8%).

Since 1974, the GSP has been renewed 14 times (every 2-3 years) and last expired in December 2020. There are reasonable expectations that the program will be reauthorized in the future. The GSP provides non-reciprocal preferential duty-free access to the U.S. market for 3,500 products from 119 designated beneficiary developing countries (BDCs) and territories. Roughly 1,524 additional products are also GSP-eligible specifically when imported from 44 least-developed beneficiary developing countries (LDBDCs). In 2020, out of US$152 billion worth of total imports from GSP-eligible countries, at least US$16.9 billion worth of imports qualified for GSP treatment. By 2021, at least US$21.5 billion worth of imports would have been eligible for GSP treatment, dominated by travel goods and apparel.

A 2023 review of the GSP’s effectiveness by the Congressional Research Service (CRS) found that it is difficult to determine the full impact of the U.S. GSP program in promoting the economic development of developing countries and stimulating U.S. exports in developing country markets. GSP is one of many initiatives used by the U.S. to advance economic development. Trade and economic development are influenced by a diverse range of factors, including macroeconomic factors, industrial policy and the external environment. In 2021, out of total U.S. imports from GSP beneficiary countries valued at $191.9 billion, about $18.7 billion worth of imports would have been eligible for GSP preferences had the program been reauthorized. Again, expansion of exports does not necessarily translate into development, but under the right circumstances, it can be an important tool.

Countries can lose and regain AGOA eligibility based on criteria that includes compliance with issues such as trade openness, sound governance, respect for worker and human rights. The U.S. president has discretion to disqualify countries, which has been done recently to Central African Republic, Gabon, Niger and Uganda citing reasons such as gross rights violations, protectionist policies, failure to establish or make progress on the protection of internationally recognized worker rights, rule of law and political pluralism. Today there are 31 beneficiary countries, from a peak of 40, meaning at least 18 SSA countries are excluded from AGOA. This includes Equatorial Guinea and Seychelles, who both graduated from the U.S. GSP and are ineligible for AGOA benefits. Countries graduate out of AGOA if per capita gross national income reaches a level that the World Bank considers “high income.” Graduation has been subject to criticism as developing economies experience volatile GDP performance with annual fluctuations. Moreover, loss of access to trade preferences like AGOA can result in economic contraction of both the directly affected economy and the regional economies.

AGOA's limited impact on economic development must be addressed

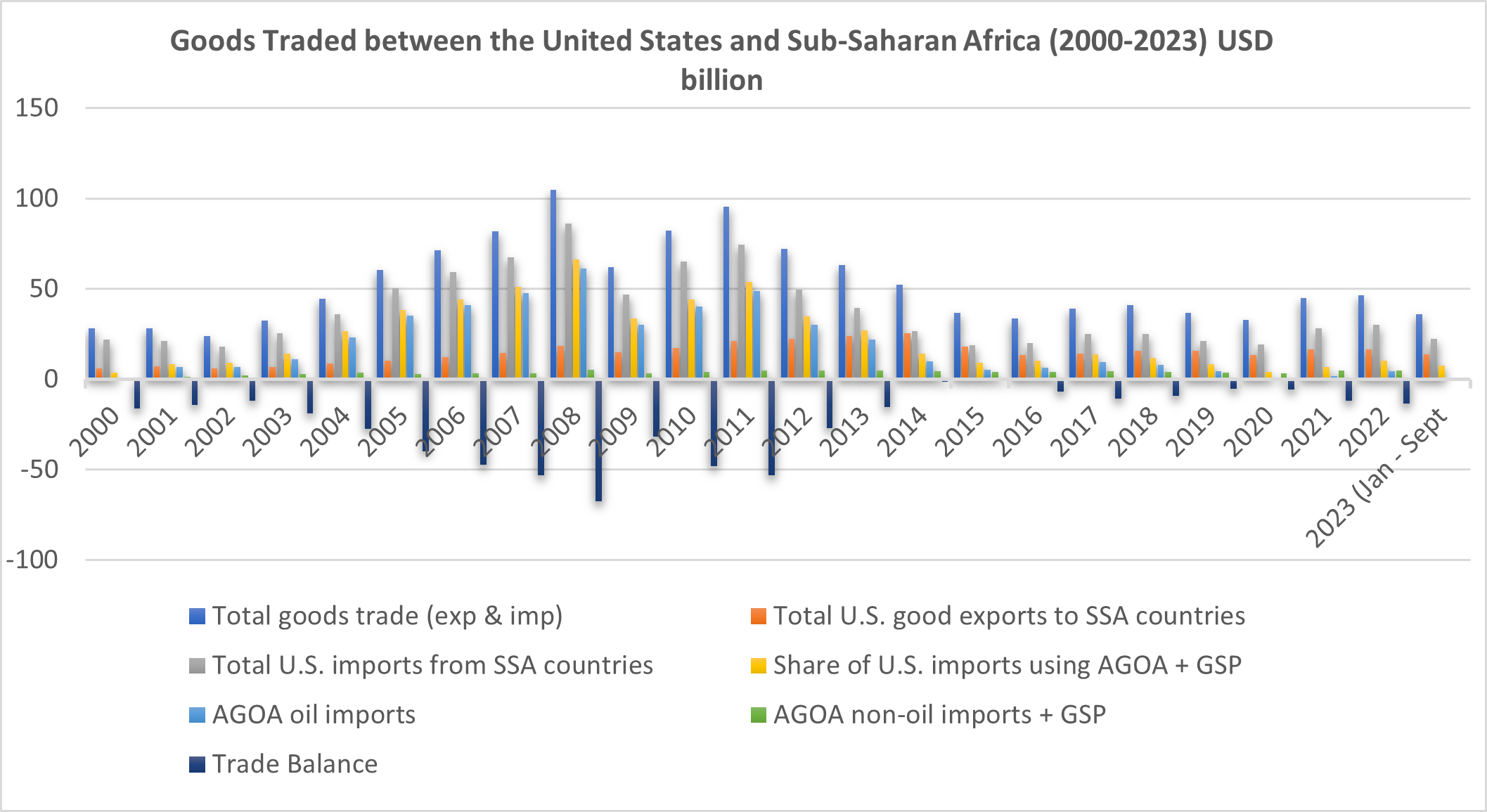

Early signs suggested AGOA could spur economic and jobs growth, as trade volumes grew from $17 billion in the first year to $80 billion in 2008. Initially, AGOA enjoyed strong bipartisan support as policymakers highlighted a 300% increase in African exports to the U.S. in the first decade with estimates of between 300,000 to 1.3 million direct and indirect jobs created by 2012. South Africa saw its automotive exports to the U.S. grow from $150 million in 2000 to $2.2 billion in 2013 and down to $1.48 billion in 2022. Diversification has been limited, as oil and apparel exports have dominated AGOA since 2001. AGOA (including GSP) exports stood at $10.3 billion in 2022, representing an increase of 26% compared to 2001 (the first full year of AGOA trade). AGOA exports have averaged $11.6 billion over the last decade. Petroleum oil products accounted for the major share of AGOA exports with 45% ($4.6 billion) of overall AGOA exports. Non-oil exports under AGOA amounted to $5.7 billion in 2022. Leading AGOA exports in 2022 were Mineral Fuels ($4.6 billion), Transportation Equipment ($1.5 billion), Textiles and Apparel ($1.4 billion), Agricultural Products ($914 million), Minerals, Metals, and Associated Products ($755 million), and Jewelry and Precious Stones ($420 million).

Source: U.S. International Trade Commission, U.S. Department of Commerce, U.S. Census Bureau https://www.census.gov/ and https://agoa.info/

In 2022, at least nine AGOA beneficiary countries each exported more than $100 million worth of qualifying goods to the U.S. under AGOA/GSP. A further 11 countries each exported more than $10 million in AGOA goods during the same year. The remaining countries had relatively miniscule exports under AGOA or in some cases none.

AGOA exports by country, 2023

| Countries with exports over $100 million |

South Africa, Nigeria, China, Ghana, Angola, Côte d'Ivoire, Madagascar, Kenya, Senegal |

| Countries with exports over $10 million |

Lesotho, Mauritius, Congo-Brazzaville, Tanzania, Gabon, Democratic Republic of Congo, Mozambique, Zambia, Uganda, Togo |

| Countries with exports below $10 million or no AGOA exports |

Botswana, Eswatini, Namibia, Niger, Guinea Bissau, Liberia, Central African Republic, Comoros, Chad, Sao Tome and Principe, Chad, Benin, Djibouti, Burkina Faso |

Source: U.S. Census Bureau https://www.census.gov/ and https://agoa.info/

Out of 39 AGOA beneficiary countries, for the period 2000-2021, South Africa and two major oil exporters (Angola and Nigeria) accounted for 78% of all AGOA exports. By contrast, the 18 smallest eligible countries accounted for just 1% of AGOA exports. Five exporting countries accounted for about 90% of non-energy AGOA exports in 2021, dominated by South Africa (56%). According to U.S. Census data, the leading five country exporters under AGOA were South Africa ($2.7 billion; largely motor vehicles and parts, jewelry and ferroalloys), Nigeria ($1.4 billion; largely crude oil), Kenya ($517 million; largely apparel, cut flowers and macadamia nuts), Ghana ($324 million; largely crude oil, cocoa powder/paste and cassava) and Angola ($300 million; entirely crude oil).

Debate on AGOA renewal proposals

With discussions between Congress (House Ways and Means Committee) and African delegations underway in 2024, debate around reauthorization of the GSP and by extension AGOA, centers around eligibility criteria. Some Members of Congress have proposed changes to the program and adoption of new eligibility criteria to include issues like human rights, gender equality, environmental standards, good governance and digital trade. There is a push for a 10-year renewal (or more) of AGOA with a review every three years instead of annually. This compares to other developed countries that have a 10-year program cycle. Sen. John Kennedy (R-LA) introduced the AGOA Extension Act of 2023, a reauthorization bill to extend AGOA for 20 years through to 2045, while Sen. Chris Coons (D-DE), an influential voice on Africa on the foreign relations committee, circulated the AGOA Renewal Act of 2023 proposing extension of the program for 16 years from 2025 to 2041. A long-term extension would go a long-way to provide certainty and stability in the U.S.-Africa trade relationship, especially for business and workers under the program. However, Coon’s proposed AGOA Renewal Act of 2023 also contains a troubling provision in Sec 5(b), calling for a mandatory out-of-cycle review of eligibility of South Africa not later than 30 days after the date of the enactment of the AGOA Renewal Act of 2023. This appears to be linked to political differences between the U.S. and South Africa over Russia and Israel. Such political issues should not cloud the otherwise fruitful economic relationship. For example, in 2024, House Digital Trade Caucus Co-chair Darin LaHood (R-IL) reintroduced a bill (initially tabled in 2021) to enable the Office of the U.S. Trade Representative to revoke GSP benefits for countries with barriers to digital trade. The bill would require GSP beneficiaries to work towards improving the digital environment by supporting consumer protections, privacy of personal information and open digital ecosystems. The bill aimed at addressing alleged “restrictive” digital policies in areas such as cybersecurity.

Proposals on digital trade raise some new concerns. Over the last two decades, rising digitalization in Africa has played a key role in facilitating rapid information exchange, increasing connectivity, reducing transaction costs, new opportunities for e-commerce and fostering economic growth thanks to the expansion of ICT infrastructure and mobile broadband usage. The number of internet users across the continent has doubled since 2015 to surpass 570 million in 2022. There is ambition under the African Continental Free Trade Area (AfCFTA) to develop the continent’s digital economy. However, there remain multifaceted challenges that are associated with digital trade to be addressed in Africa, such as limited digital infrastructure and internet penetration. With 60% of the continent’s population still offline, there is a $100 billion financing gap to provide universal access. There are concerns over limited cyber security and data protection systems, lack of policies and regulation, and low levels of digital literacy. As a result, countries would want to develop digital trade rules with adequate policy space to address African concerns and based also on emerging multilateral principles.

The U.S. must not include conditions on AGOA that restrict African governments’ ability to determine the rules they need. Big Tech has sought to use trade negotiations to lock-in international rules that undermine consumer privacy and data security, insist on free cross-border data flows, prohibit national requirements for data localization, mandate reviews of software source code, limit regulations that protect gig workers and prevent consolidation of Big Tech monopolies. Like Congress, African governments must have space to appropriately regulate Big Tech firms’ behavior and the digital economy. Numerous African regional initiatives are underway to address e-commerce and other digital trade issues. There is no reason to constrain those conversations with AGOA conditions.

GSP reauthorizing legislation is seldom moved on its own. Typically, it is combined with other legislation as part of a package bill. For example, in the past, Congress has combined the GSP reauthorization bill with funding bills and other trade legislation, like AGOA and the Andean Trade Preference Act. There are current proposals to pair GSP renewal with Trade Adjustment Assistance, which provides support to U.S. workers displaced by trade. Given that AGOA expires in September 2025, it could be an opportunity to package together renewal of GSP and AGOA in 2024, especially to avoid delays with AGOA reauthorization.

Two recent studies by UNCTAD and the U.S. International Trade Commission (USITC) on AGOA’s utilization and impact on economic development, job growth and poverty reduction find that overall, the influence of AGOA across SSA has been minimal or positive but limited. Impact can be considerable for individual beneficiary countries depending on the sector, most notably oil, apparel and textiles. AGOA utilization rates reflect the percentage of U.S imports under AGOA from a beneficiary country as a share of total U.S. imports from that country. They vary among countries but have generally averaged about 2% or lower. The exceptions are Lesotho and Kenya, which had utilization rates of 88% and 99% respectively, predominantly due to apparel exports which enjoy more liberal rules of origin.

Success in the apparel sector can be improved

USITC reports that the apparel sector has contributed to employment, wages, tax revenues and foreign exchange for the beneficiary countries creating a positive impact for the economy and economic development. It notes that many apparel firms across SSA are located in industrial parks to take advantage of incentives offered by African governments and generally pay higher wages than employers outside the special economic zones. Apparel factories also provide opportunities for training and upward mobility, creating avenues for income growth for employees. Factories also provide additional benefits. For example, in a survey by the U.S. Embassy in Madagascar, 75% of firms reported providing meals for employees, while others provided transportation, schooling, childcare facilities and clinics for family members. The apparel and footwear sectors impact many people directly and indirectly. For example, in Tanzania the average apparel industry worker supports roughly nine people.

Employment in the apparel sector has grown significantly. In Kenya the apparel industry grew from 23,000 workers in 2002 to between 70,000 to 80,000 workers across 45 large and medium-sized companies at peak in 2018, and down to about 50,000 workers in 2022 — predominantly women. Growth has been driven by investments from Asia and the Middle East taking advantage of AGOA and locating in export processing zones (EPZs) established by the government. When a country loses AGOA eligibility, the impact can be seismic. For example, in Madagascar, between 50,000 to 100,000 workers lost their jobs over a five-year period when Madagascar became ineligible for AGOA benefits.

Some experts have argued that the U.S. needs to revisit AGOA’s conditionalities as removal of benefits negatively impacts the very people the U.S. wants to uplift. They suggest targeted sanctions on political actors and politically connected individuals directly responsible for rights violations as opposed to wholesale suspension which would affect jobs and livelihoods.

Typically, women with rural and inner-city backgrounds and limited education work in urban apparel factory locations. They come from areas with high unemployment and a large informal sector. They learn skills in sewing and operating machinery that can also be applied in future employment. Still, there remain challenges that must be addressed robustly under a renewed AGOA, such as incidences of labor violations and unfair labor practices. This was the case, for example, in Mauritania, which lost GSP and AGOA eligibility in 1999 and 2019, following a petition filed by the AFL-CIO in 2017, urging the U.S. government to terminate Mauritania’s AGOA eligibility due to forced labor concerns and insufficient progress toward combating forced labor, specifically, the scourge of hereditary slavery.

The case of Mauritania highlights the need for beneficiary countries themselves to leverage participation in trade programs like AGOA as a stimulus for domestic reforms, to enact and strengthen rights. Following a review in 2023, Mauritania regained eligibility in January 2024, albeit against some opposition from House members like Rep. Richard Neal (D-MA), who felt Mauritania’s reinstatement was premature and more evidence needed to be demonstrated by the Government of Mauritania in addressing issues of forced labor and hereditary slavery. The USTR led an investigative interagency mission to Mauritania in February 2023 and concluded that the government had demonstrated willingness to work diligently with the U.S. to continue to make substantial and measurable progress on worker rights and eliminating forced labor across the country. This includes increasing funding for the anti-slavery courts, limiting the rotation of judges, legalizing NGOs, and increasing outreach and engagement with civil society to address forced labor. More on-going work is required, including an assessment of the ability of the criminal justice system to investigate and prosecute cases of hereditary slavery and forced labor.

The AGOA rules of origin seek to encourage local and regional value addition (including use of U.S. inputs) and to prevent trade diversion and trans-shipment from third countries. Flexible rules of origin can help spur trade, and there are arguments to “align” AGOA rules of origin and the AfCFTA to help boost regional supply chain development. The model of industrial development has transformed over the last 50 years away from vertically integrated value chains within a single country towards geographically dispersed global value chains. Achieving the requirement of 35% value-added under GSP and AGOA is a tall order. It would be better to recognize that countries utilize more intermediate materials from third countries and allow cumulation from member countries in the AfCFTA. The LDC Group has highlighted the limitations of the current value-added rules under the GSP and AGOA to the WTO Committee on Rules of Origin. Suggested improvements to rules of origin include re-thinking the ad valorem calculation methodology and subtracting the cost of insurance and freight from the ad valorem percentage calculation to align U.S. practice with the methodologies under its FTAs. There are notable comparisons. In 2011, the European Union lowered its threshold for some products to 30% value-added and the United Kingdom lowered its rules of origin threshold to 25% for various products. The WTO Nairobi Decision on preferential rules of origin for LDCs (2015) calls for 25% value-added (or 75% non-originating materials).

AGOA as part of an integrated program of development cooperation

A long-standing AGOA program remains useful to economic development and providing assurances of stable market access, especially for goods that support quality jobs for African workers. The foregoing discussion highlighted the direct and indirect employment impact of AGOA in select sectors like apparel and automotive. This success must be expanded to other sectors and countries and replicated broadly. It is important to address challenges, such as low preference utilization rates, lack of operational and effective national AGOA strategies and supply-side challenges. Agriculture, for example, has underperformed but has enormous potential for growth under a renewed AGOA. Although much of Africa’s agricultural production — and its priorities for the sector — remains subsistence-based or for local consumption, agriculture is a critical economic sector in Africa for livelihoods, exports and foreign exchange earnings. There could be some economic opportunities in improving agriculture trade under AGOA. Through support from various U.S. development agencies and development partners, the process involves strengthening domestic production and good agriculture practices, responding to climate challenges and improving farmer incomes. Africa currently imports $78 billion worth of food each year. Increased productivity and output will help address demand for food across Africa. Investments in improving agriculture supply chains, value chains and value addition will help improve incomes for farmers and agro-processors. Currently, inefficient and poor food supply chain infrastructure such as roads, rail, energy, cold chain and ports, adds an additional 30-40% to the cost of food trade by African countries. Each country will have a unique experience given diverse factor endowment and their respective challenges in developing their agriculture sectors. Past and comparative regional lessons as well as best practices on sustainable agriculture must be heeded.

Agriculture sector offers opportunities for trade growth with economic benefits

In 2022, AGOA beneficiaries exported a total of $2.9 billion worth of agriculture products to the U.S., a sizeable increase from $750 million in 2000. Out of this total, $932 million (32%) worth of agriculture products qualified for AGOA/GSP preferences. The bulk of agriculture trade between African and the U.S. occurs using normal tariffs because products do not qualify under AGOA/GSP or products already enter the U.S. duty free. Approximately 600 out of 2,150 agricultural tariff lines (HTS8) are duty-free into the U.S. market. Out of the remaining (1,550) tariff lines, AGOA offers duty free access for roughly 1,300 agriculture tariff lines. The remaining 250 products (about 10%) are subject to import duty in the U.S. outside of AGOA. While many AGOA beneficiaries had some agricultural exports to the U.S. under AGOA during 2022, at least 17 countries registered agricultural exports under AGOA exceeding $1 million, with five countries exceeding $50 million each in agriculture exports. Major agriculture exporters under AGOA include South Africa (2023: $446m) — which accounts for half of AGOA agriculture exports with average annual growth of 16% since the start of AGOA. This has created jobs and opportunities in agricultural industries like citrus, nuts, wine, dairy, grapes, fruit juice, etc.

Top exporters of agricultural products to the U.S. in 2022 (US$ millions)

| |

Cote D’Ivoire |

South Africa |

Ghana |

Madagascar |

Kenya |

Uganda |

Mauritius |

Nigeria |

Togo |

Senegal |

Malawi |

| Total Ag |

$823m |

$622m |

$328m |

$294m |

$176m |

$103m |

$84m |

$74m |

$73m |

$72m |

$53m |

| Share AGOA |

$127m |

$447m |

$86m |

$3.7m |

$78m |

$7.4m |

$4.6m |

$7.5m |

$24m |

$70m |

$37m |

| Key products |

Cocoa beans, paste, nuts, chocolate, cocoa powder, preserved fish, starches

|

Citrus fruit, nuts, wine, grapes, edible, fruit, fish

|

Cocoa beans, paste, cassava, nuts, soy beans

|

Vanilla, cloves, chocolate, vegetable sap, fish

|

Coffee, nuts, live plants, tea, vegetable waxes

|

Coffee, vanilla, soy beans, oil seeds, fish, live plants (NESOI) |

Fish, live animals, sugar, fish fillets, vanilla nuts, cloves

|

Cocoa beans, coconuts, medicinal plants, bran oil seeds

|

Soybeans, soybean oil cake, vegetable waxes

|

Preserved fish, crustaceans, fresh fish, mollusks |

Tobacco, nuts, tea, sugar, coffee, vegetable fats |

Source: Reproduced from https://agoa.info

Broadly speaking, the trade data points to limited AGOA impact on African agriculture under existing approaches with some products performing well, yet the sector has significant potential for poverty reduction and job creation in Africa. Current U.S. trade policy makes a nod to goals of food security, while insisting on countries embracing questionable U.S. rules on agricultural biotechnology. It should instead support national and regional initiatives to build food systems that reduce imported inputs, respond to local knowledge and environmental conditions, and enhance biodiversity. Expanded market access could then complement those local initiatives to create new opportunities for African farmers.

The AGOA renewal process must pay special attention to improving the program to better stimulate development of fair and sustainable agriculture that adopts agroecological practices. This includes development of agriculture value chains and value addition in meaningful ways that can help improve rural incomes and help address some of the development and climate challenges affecting African agriculture. Recent but growing concerns include the need to improve capacity for compliance with sanitary and phytosanitary requirements in the U.S. market, as well as compliance with industry mandated and voluntary sustainability standards (VSSs). Today, there are over 400 VSSs in operation globally, which include organic items, fair trade and the Forest Stewardship Council (FSC). Such standards, while imperfect, can provide guidance to producers, buyers and consumers on sustainably produced products. Technical assistance is being channeled through various U.S. development programs like USAID Feed the Future, technical assistance through the U.S. Department of Agriculture (USDA) and investments in sustainable agriculture through the U.S. International Development Finance Corporation (DFC). Key objectives should be to promote food security and to strike a balance between production of food crops and other income-generating activities like cash crops, horticulture and livestock to ensure farmers enjoy improved livelihoods and income growth.

Recommendations to Congress and beneficiary countries to enhance AGOA

Africa is a dynamic and growing market that is undergoing many changes which call for an improved and 360-degree relationship from the U.S., encompassing various areas such as infrastructure, private sector investments and human capital that will help improve the effectiveness and utilization of AGOA. We submit the following recommendations to Congress:

- Ensure renewal of AGOA and re-authorization of GSP in 2024 for 20 years to 2045 (or at least 10 years) as proposed by Sen. Kennedy to provide greater certainty for traders and workers.

- Instead of an annual eligibility review of all 49 AGOA eligible countries under the current legislation, we recommend adopting proposals by Sen. Chris Coons (D-DE) to require a review of each country at least once every three years, which is standard practice in comparative GSP programs globally. This would free up resources to focus on supporting effective implementation of AGOA and compliance with the program’s requirements. The president would continue to enjoy authority to request an out-of-cycle eligibility review of any country at any time.

- To support regional integration and development of regional supply chains, Congress should ease the 35% value-added criterion under the AGOA rules of origin to possibly 20-25% and extend rule of origin cumulation across all African countries. This would allow countries to use inputs from other AfCFTA members to count toward the requirement that 35% of a product’s value originate in the region.

- Recognizing the continuing economic and climate-related vulnerabilities that African countries face on graduation, Congress should adopt proposals by Sen. Chris Coons (D-DE) that countries do not lose AGOA eligibility (graduate) until they have maintained “high-income” status for five consecutive years. Failing this, the alternative recommendation is to consider proposals by Mauritius for sectoral graduation (targeting competitive sectors) rather than graduation of the whole economy. Graduation based on Gross National Income (GNI) per capita is a misleading measure for determining graduation from AGOA, given high levels of income inequality within countries. Even in the event of graduation, there should be transitional arrangements to support and prevent countries from falling back economically. This would help countries to develop competitive industries and maintain AGOA benefits while developing other sectors.

- Congress should offer greater support to assist those countries struggling to meet eligibility criteria and to effectively utilize AGOA and GSP preferences due to various institutional and capacity weaknesses, especially least developed countries and countries in transition from conflict. Such support will typically be through enhanced technical assistance resources provided to various U.S. development agencies like USAID and co-financed initiatives with other development partners. This should be done in a manner that enhances local and regional economic development, including, strengthening of supply capacity in sectors that support African initiatives for the creation of good jobs and sustainable production.

Download a PDF of this brief.