Download the PDF.

Introduction

The Farm Bill has long been criticized as out of step with consumer desires for healthier foods, stronger connections with local farmers and environmental goals. But the Farm Bill has also not worked well to support a marketplace for farmers and ranchers that provides a stable and fair return. The current farm economy is underwater after multiple years of low prices, low farm income and increasing debt. Many of the problems in the farm economy are linked to a Farm Bill that reinforces a low price, export-dependent system. This dependence on highly-volatile global markets is a policy choice that benefits global agribusiness firms operating in multiple countries, but it has pushed hundreds of thousands of U.S. farmers off the land, and contributes to a lagging rural economy. President Trump’s trade fights with major export markets like China, Mexico and Canada threaten to further drive down prices for farmers and ranchers connected to global markets. While conventional agriculture markets struggle, the U.S. does have smaller, but fast-growing and higher-value markets emphasizing health, environmental and ethical improvements in farming; but entering these markets poses challenges for many farmers. As Congress debates another Farm Bill, greater resources and improvements should focus on a series of underfunded Farm Bill programs to complement reforms in trade and competition policy that could better support farmers who want to pursue these higher-value domestic markets. U.S. programs should also acknowledge the right of other countries to support their farmers in meeting their own countries’ food demand through more sustainable production methods. For U.S. farmers and rural communities, new thinking on how we can better support farmer profitability and rural development—rather than repeating past mistakes—is urgently needed.

The Farm Bill’s Unhealthy Dependence on Export Markets

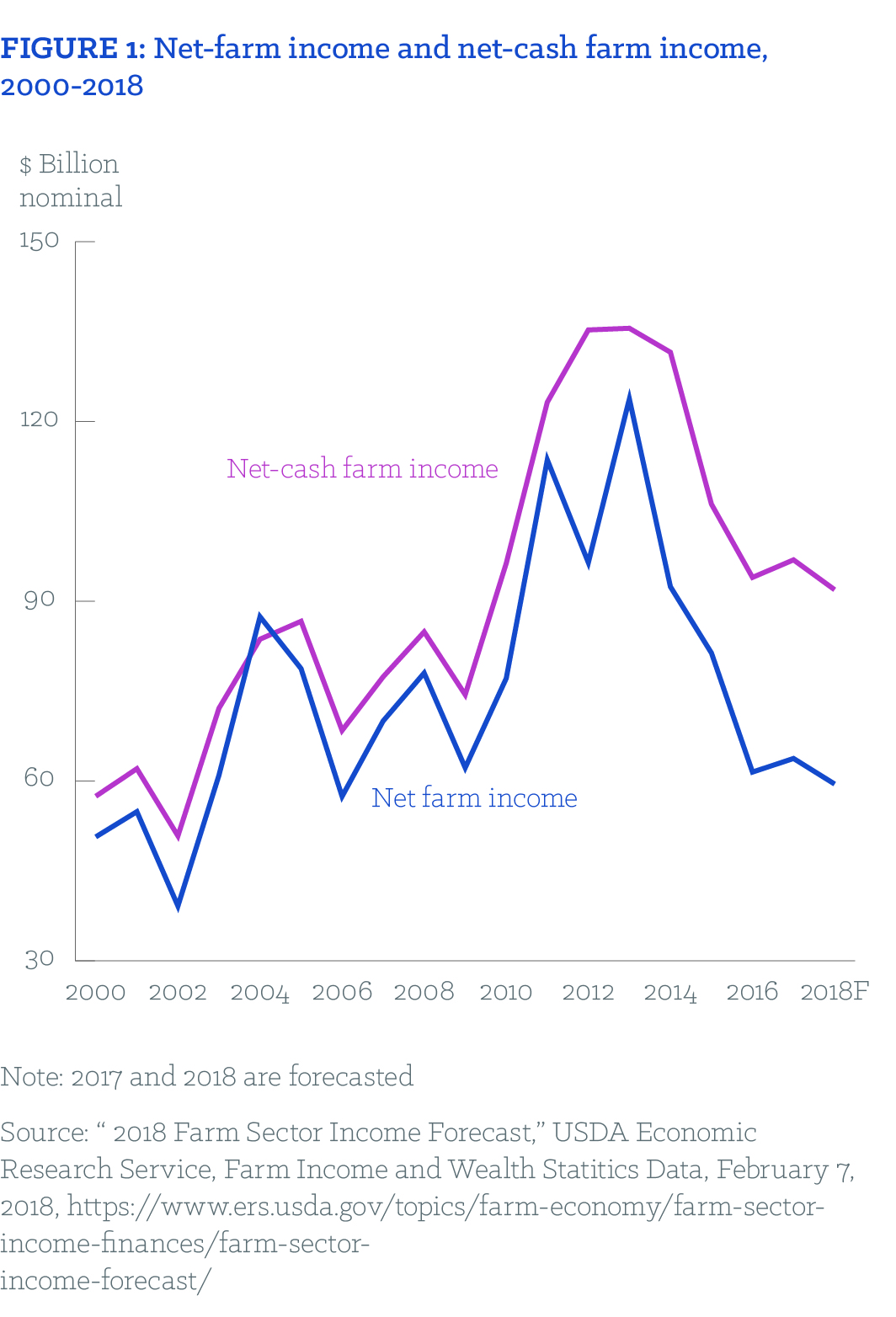

U.S. farmers are now experiencing four straight years of low farm income, and the USDA projects that income will drop another eight percent (a 12-year low) in real dollars (adjusted for inflation) in 2018.1

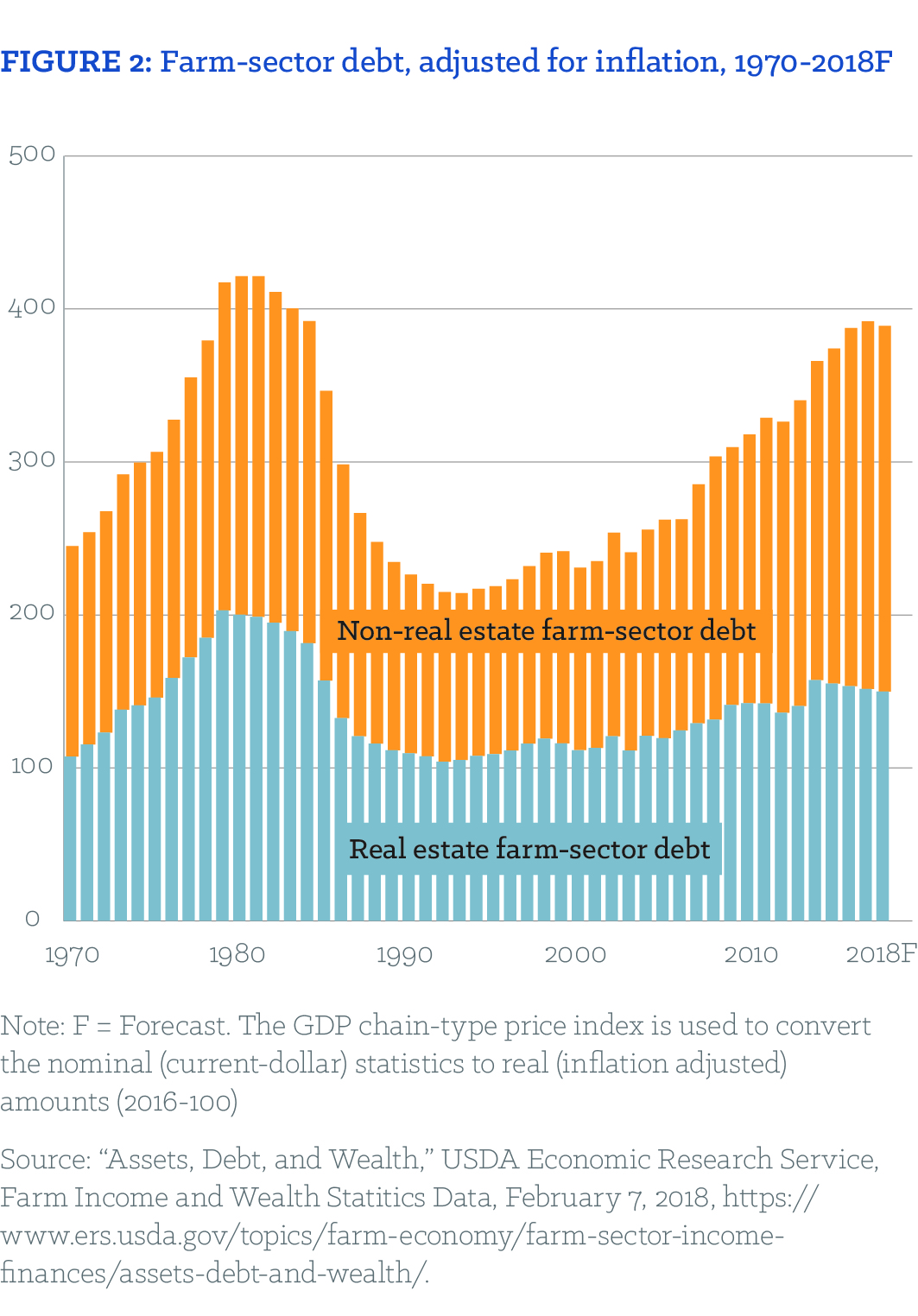

Current and past Farm Bills play a role in today’s farm crisis. A variety of Farm Bill programs support expanded production of a handful of commodity crops to feed into a global agricultural market. Commodity and crop insurance programs help manage both financial and weather-related risks for farmers growing commodity crops. These risk management programs, combined with federally-backed credit, encourage bankers to provide loans for these crops. Much of USDA-led research into seeds and production systems also support the expanded production of these same commodity crops, used primarily for animal feed, processed foods, and biofuels.

This commodity crop expansion greatly benefits global grain traders (like Cargill and ADM) and meat companies (like JBS and Smithfield) who can access cheap grain for animal feed. But when supply outstrips demand, prices drop and farm income follows. Researchers at the Agriculture Policy Analysis Center at the University of Tennessee report that corn, wheat and cotton have all averaged financial losses per acre since 2013, while soybeans have only averaged a very marginal gain.2 In fact, the current state of the farm economy, with below cost commodity crops, is not an anomaly, but rather “a return to normalcy,” according to Ohio State University and University of Illinois economists.3 This low price “normalcy” has driven long-term trends towards fewer, large farms, the steady erosion of mid-sized farms, and the need for most farm families to find off-farm income to stay on the land.4

Meat and dairy producers are also struggling with low prices as the industry undergoes an unprecedented expansion—nearly all of it devoted to export markets. Successful Farming’s Pork Powerhouse reported last year, "Never before in the pork industry has there been this kind of packing plant expansion, live production expansion, and absolute necessity of export expansion in the presence of cheap grain.”5 The USDA’s Chief Economist projects that record total meat and dairy production in 2018 “is expected to depress prices” for producers.6

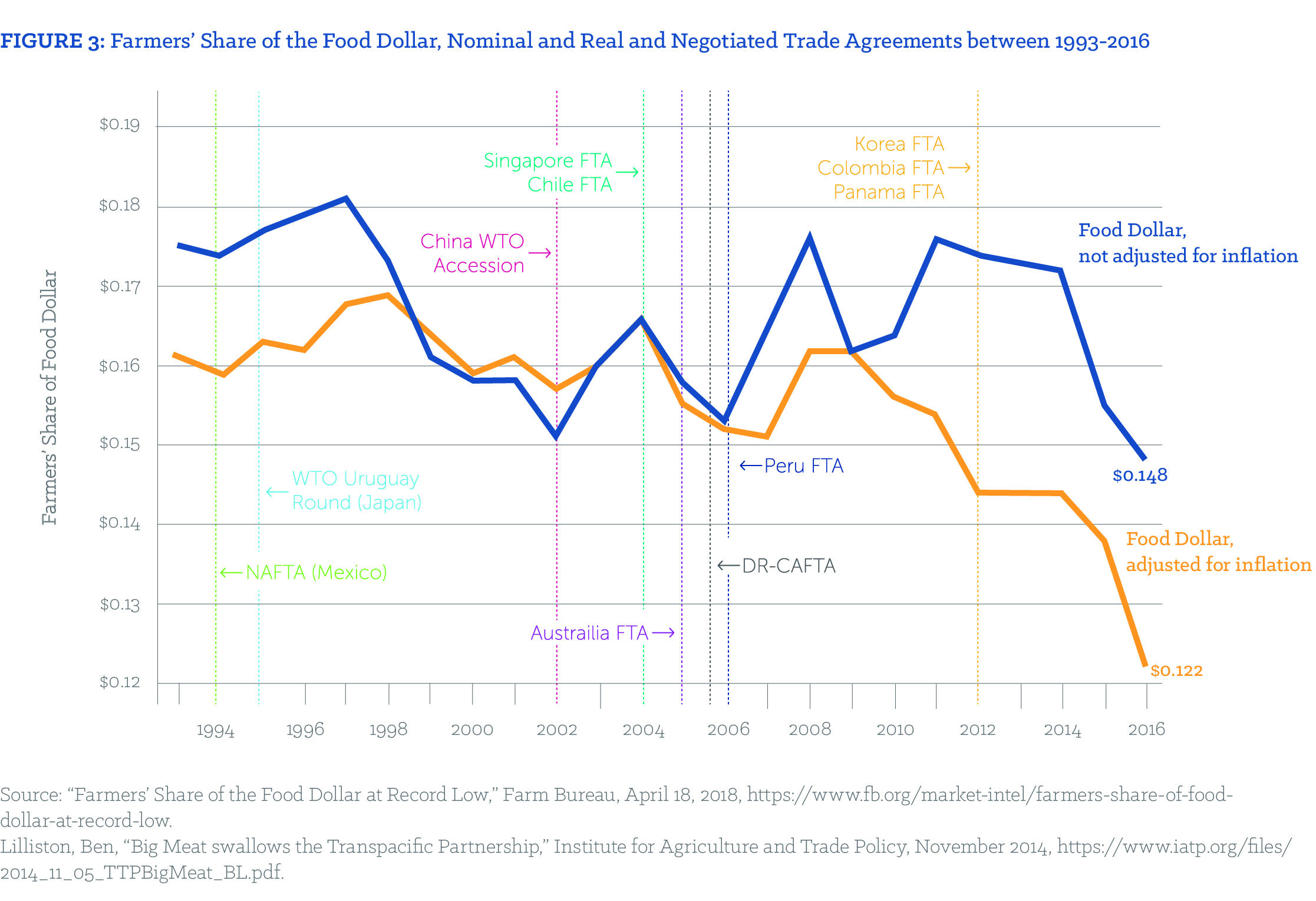

The Farm Bill has combined with a series of free trade deals (like the North American Free Trade Agreement, known as NAFTA) to deepen U.S. agriculture’s reliance on expanding exports to sop up excess production—whether corn or dairy or pork. Several decades of mergers within the agribusiness sector have left a handful of global companies controlling most segments of agriculture. Within this system, U.S. farmers are highly vulnerable to the whims of global agricultural markets and the global firms that play there.

The recent Trump administration trade spat with China exposes how farmers often find themselves caught in market disruptions beyond their control. When China announced a 25 percent tariff on U.S. pork, in response to the Trump administration’s new steel tariffs, pork futures prices dropped immediately on the Chicago Mercantile Exchange. A few days later, in response to additional proposed tariffs by the Trump Administration, China announced plans for new tariffs on soybeans, corn, cotton, wheat and beef. The price of soybean futures dropped 50 cents per bushel after the announcement.7 China is far and away the largest U.S. export market for soybeans.8 The USDA projects more acres will be in soybeans in 2018 than any other crop.9

The Trump administration’s threats to pull out of NAFTA has raised similar fears for the U.S. farm economy—Canada is the biggest and Mexico the third biggest market for U.S. agriculture exports.10 The Trump administration’s escalating tensions with major trading partners, during an already down agriculture economy, prompted the Kansas Farm Bureau President to admit in March that trade was a higher priority than the Farm Bill.11

U.S. farm policy beginning in the 1930s focused more on stabilizing fair prices for farmers, including price floors and other supply management tools. After decades of aggressive lobbying by agribusiness, the 1996 Farm Bill ended the last of those programs. Prices plunged almost immediately and Congress had to pass a series of emergency payments to keep farmers on the land. Since the 2002 Farm Bill, Congress has built in so-called “safety net” programs with the expectation that in many years farmers will lose money from the marketplace (prices will dip below the cost of production). This system serves agribusiness companies in search of low-priced commodities well. And, while various commodity and insurance programs have kept many farmers afloat, they have not worked effectively when farmers experience a series of consecutive low-price years as we are seeing right now.

Aside from economic hardship, farmers are facing other stresses, including increasing severe weather events and other climate-related shifts; poor access to health care; out-migration (particularly of young people) from rural communities; and a rural economy that has recovered more slowly than urban economies from the financial crisis. These pressures can become overwhelming. A 2016 study by the Center for Disease Control found that farmers, fisherman and foresters have the highest rates of suicide of any sector.12 States, farm groups and the dairy industry are expanding outreach services for mental health to address these serious issues.13 According to psychologist, and one of the nation’s leading farmer behavioral health experts, Dr. Mike Rosman, “The rate of self-imposed (farmer) death rises and falls in accordance with their economic well-being. Suicide is currently rising because of our current farm recession.”14

While the current farm economy is linked to policy choices made in past Farm Bills, inside Washington agribusiness interests rule. There appears to be little desire to address core market challenges, like below-cost prices and the decline in farm income. The wisdom of the Farm Bill’s implicit premise—to encourage overproduction of a handful of commodities for the benefit of agribusiness and plan for ongoing financial stress for farm families—generally has gone unquestioned. As Congress deliberates on the 2018 Farm Bill, both the House and Senate Agriculture Committee Chairs are currently promising more of the same.

Opportunities and Challenges of Emerging Markets

While the farm economy tied to the global economy is stumbling, there are relatively smaller, but faster-growing domestic markets where demand actually outstrips supply, and where a growing number of farmers are seeing a profitable path forward. Rising consumer and food company demand is driving price premiums in the organic, grass-fed, free-range and locally-sourced markets. Food and agribusiness companies are also responding to investor demands for greater environmental sustainability in their sourcing—and trying to access these emerging markets. Increasingly, buyers are asking farmers and ranchers to reduce their fertilizer and pesticide use, lower greenhouse gas emissions and protect waterways.

Consumer demand for healthy, sustainable, and locally-produced food has been rising steadily over the last several decades. According to the Food Marketing Institute, “Consumers are looking for the story of meat, and special attributes are seeing growing shopper uptake and sales. Shoppers increasingly seek transparency into meat/poultry ingredients and production practices, fueling double-digit growth for organic, antibiotic/hormone-free, grass-fed and other special attributes.”15

Consumers want to know more about the food they are purchasing, including greater detail in labeling. Consumer surveys are consistent with market growth trends in each of these segments. A 2016 survey by Consumer Reports found that:

- 58 percent of consumers purchase organic food

- 74 percent want to know the state of origin of their food.

- Nearly 70 percent don’t want their meat or poultry raised with antibiotics to speed up growth

- 86 percent of consumers believe genetically engineered (GE) foods should be labeled.

- 82 percent expect humanely raised eggs, dairy and meat were inspected to verify this claim.16

These shifts in consumer preference, and the marketplace that serves them, offer new opportunities for both higher prices and in some cases, lower production costs for farmers. But the transition to new crops or new systems of grazing and production require farmers to take risks—a difficult proposition in the current downturn. Some certifications needed for farmers to access those markets can be costly and take time—for example, the transition for organic certification takes three years. Additionally, a strong infrastructure to process, store and transport foods targeting these new markets lags behind consumer demand. And while agribusiness and food companies are demanding more of farmers in terms of environmental sustainability, they often aren’t willing to pay a high enough premium price to aid farmers in that transition. In all these areas, supportive Farm Bill programs outlined later in this paper could play an important role in aiding farmers who want to access these emerging, and potentially more profitable, markets.

Organic

What is it?

Organic farming requires third-party certification to meet standards set by the USDA through its National Organic Program and further defined at the National Organic Standards Board. Those standards include bans on synthetic pesticides, genetic engineering and the use of antibiotics in meat production.

Market growth

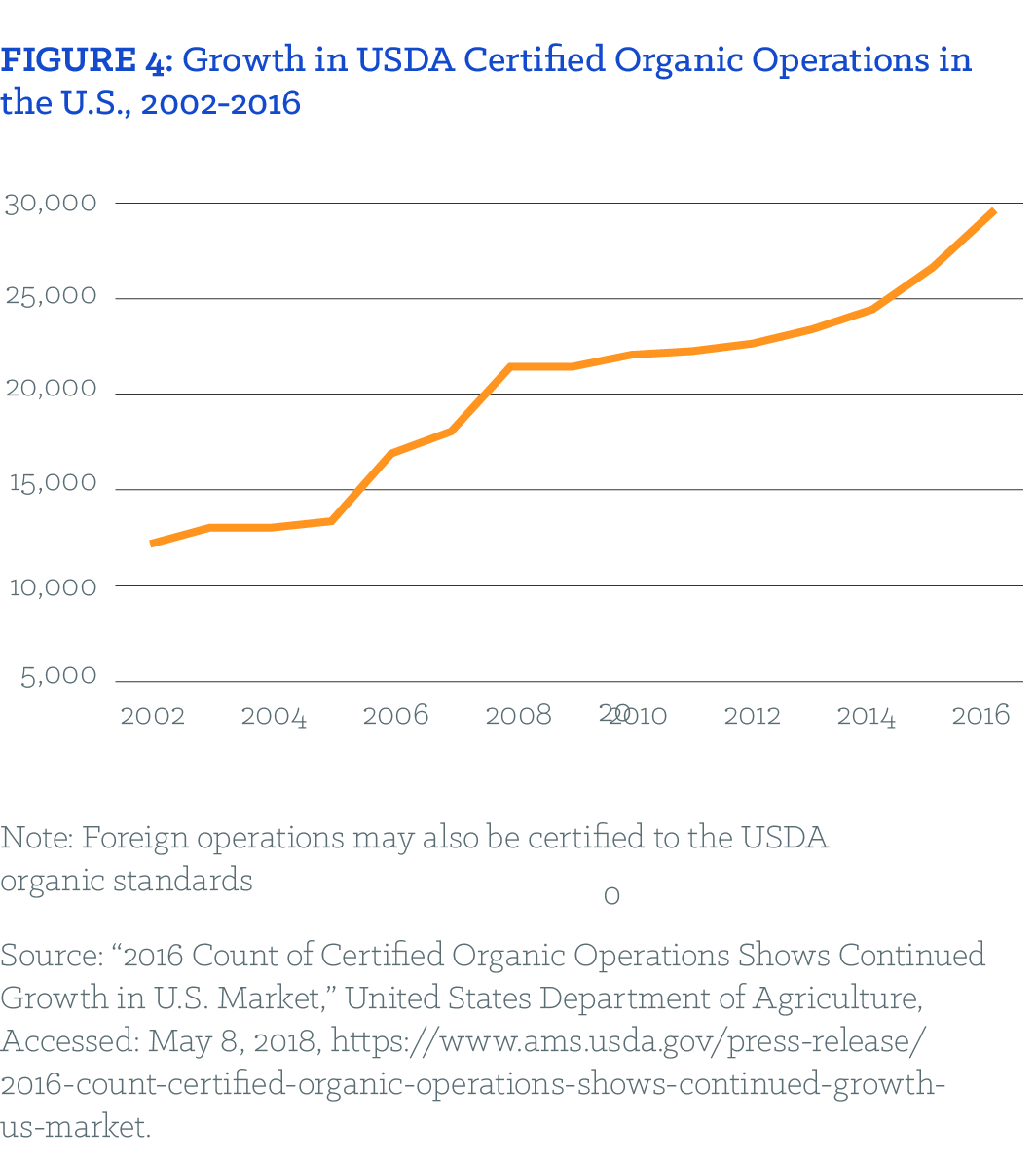

The certified organic market has been growing steadily since the mid-1990s. Nearly every major food company has an organic line of products. Despite its rapid growth, organic still accounts for less than five percent of total food sales.17

According to the USDA’s 2016 Organic Survey, U.S. farms and ranches sold $7.6 billion in certified organic commodities in 2016, up 23 percent from the $6.2 billion the year before. Of the 2016 sales, 56 percent were for crops ($4.2 billion) and 44 percent for livestock, poultry, and related products ($3.4 billion).18 The number of organic U.S. farmers and land converting to certified organic is also growing. Between 2015 and 2016, the number of certified organic farms in the U.S. increased 11 percent to 14,217, and the number of certified acres increased 15 percent to 5.0 million.19

Farmer premium

Organic products generate a price premium to farmers and often have lower input costs. These economic benefits override what can be a drop-in production when compared to conventional production. While conventional farmers are facing less than $4 per bushel of corn, organic corn is selling for more than $9 a bushel; conventional soybeans are selling for under $11 per bushel, while organic soybeans are selling for more than $17 per bushel.20,21

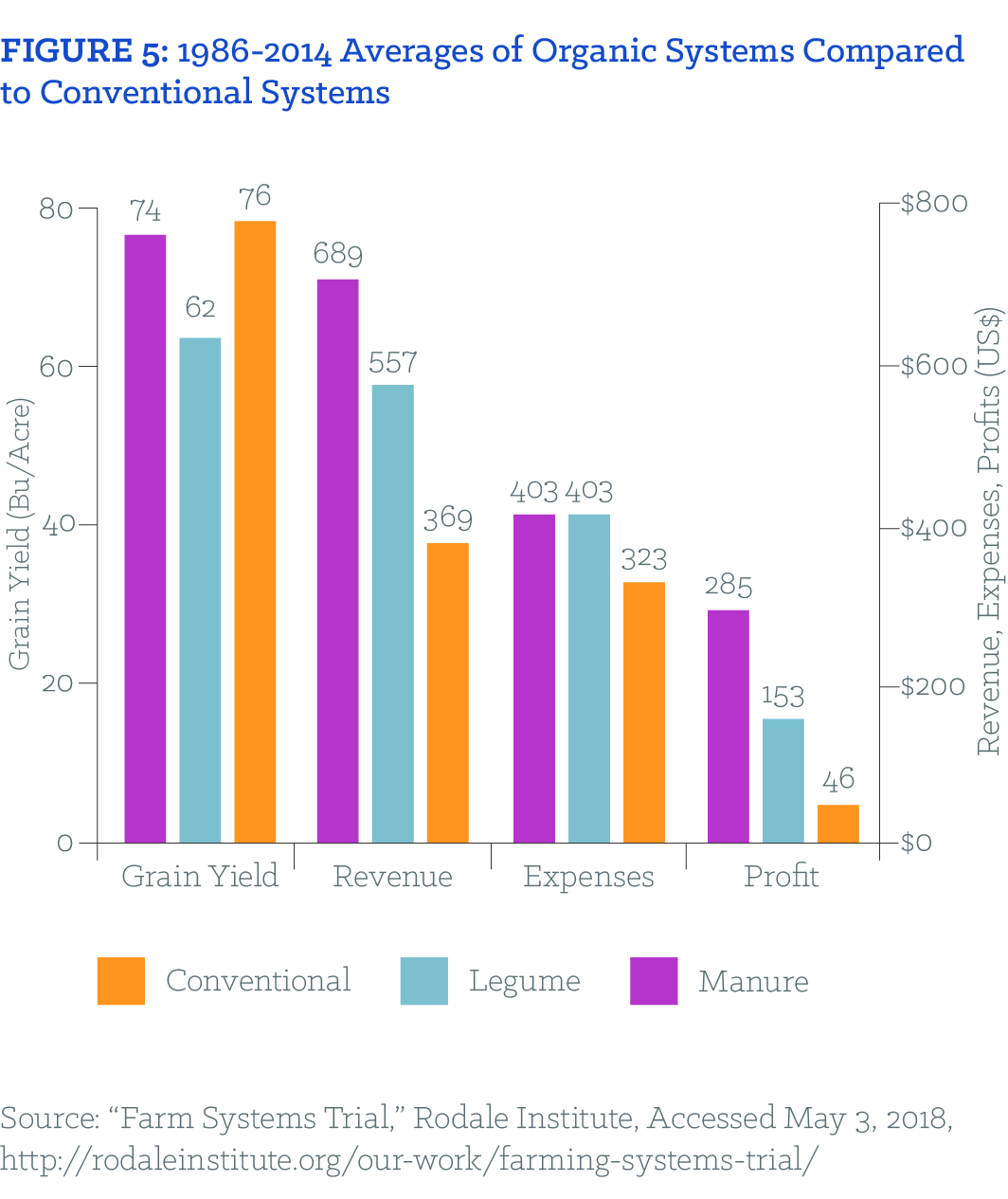

The Rodale Institute has done the longest running side-by-side research of organic systems versus conventional grains, considering yield, revenue, expenses and profit. Organic systems using manure or legumes consistently out-perform conventional systems from a farmer profit basis.

According to an analysis of net returns of five crops (corn, soybeans, oats, alfalfa hay, mixed hay) in 2015 for organic and conventional farming in the Upper Midwest, organic consistently outperformed conventional crops.22 A comparison of organic corn and soybeans to their conventional counterparts can be difficult; organic production requires a crop rotation plan with typically four to six crops, while conventional production generally does not rotate or only includes one other crop in the rotation plan. The longer rotations in organic production often include hay, which can increase profitability by feeding into another fast-growing market—the grass-fed beef and dairy sectors.

There is also evidence that a cluster of organic farms can provide greater economic benefits at the community-level than conventional agriculture. Penn State University researchers found that so-called “organic hotspots,” adjoining counties with high levels of organic activity (such as crop and livestock farmers, businesses and processors), can generate enough economic activity to raise medium household income by $2,000 and lower poverty rates relative to comparable counties.23

Challenges

While the organic sector is growing, demand for some foods is increasing at a faster rate than U.S. organic production. In response, organic imports are surging, particularly for feedgrains like organic corn and soybeans that U.S. producers could grow. Several investigations have uncovered that much of the organic soybean crop imported from Eastern Europe may be fraudulent (not organic).24,25 The USDA National Organic Program has identified 90 fraudulent organic importers. The downward pressure of cheap and possibly fraudulent imports, going primarily to organic mega-dairies for feed, is adversely affecting the price premium for smaller and mid-sized U.S. organic farmers.26

Organic farmers also must deal with the threat of genetic contamination from neighboring farmers planting GE crops. Such contamination can strip organic farmers of their certification for three years. The USDA estimates that organic farmers suffered more than $6 million in losses between 2011 and 2014 due to GMO contamination.27 Organic farmers have also struggled to gain access to good crop insurance programs through the Farm Bill that cover the organic premium price, the value of organic land, and diverse operations (i.e. a variety of crops and possible integration of livestock).

Grass-fed beef

What is it?

The grass-fed beef sector is one of the fastest-growing segments of the food industry. Grass-fed beef distinguishes itself from conventional beef at the finishing stage. Most cattle in the U.S. are grass-fed through their first 9-15 months, and then finished on grain to fatten them up. Grass-fed cattle stay on grass, take longer to finish, and are often slaughtered between 20-28 months.

Unlike organic, there is no certified USDA system for grass-fed beef and dairy. However, several strong private standards have been developed by the American Grassfed Association, the Food Alliance and Animal Welfare Approved, which require third-party verification.28,29,30

Market growth

Consumers are seeking out grass-fed beef for a variety of reasons, including health. Grass-fed beef has a significantly better omega-6 to omega-3 fatty acid ratio, a higher concentration of conjugated linoleic acids (CLAs), higher levels of antioxidants and a lower risk of E. coli infection and antibiotic-resistant bacteria. Animal welfare, environmental protection (reducing water and air pollution connected to feedlots), and endorsements by many of the nation’s top chefs are additional market drivers.

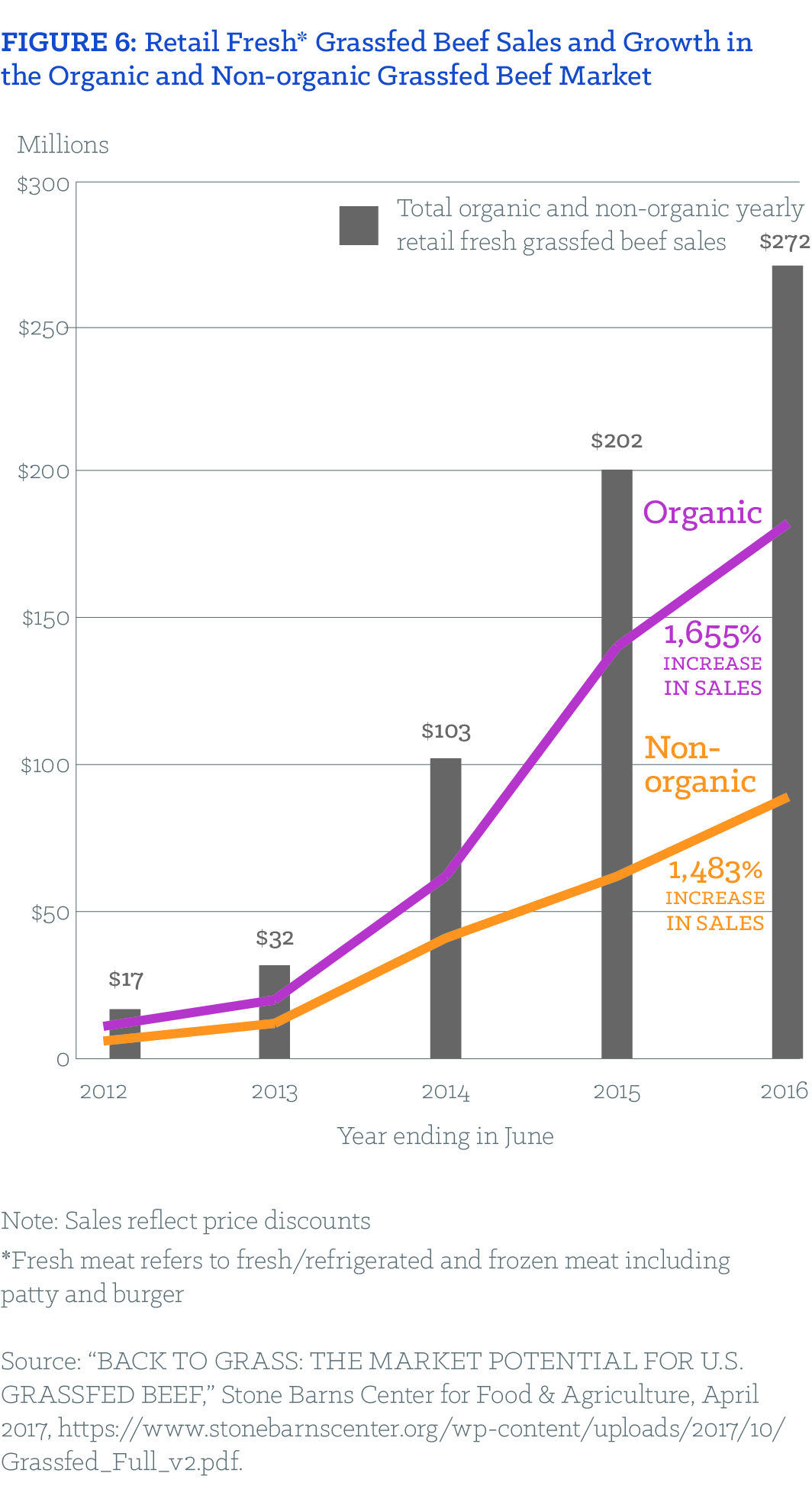

Retail sales of grass-fed beef are doubling each year, growing from $17 million in 2012 to $272 million in 2016, according to a 2017 report by the Stone Barn Center for Food and Agriculture, and the investor firms Armonia, Bonterra Partners and SLM Partners. According to Beef Magazine, grass-fed now makes up seven percent of total sales, growing between 25 and 30 percent per year. Some of the bigger players in the meat industry like JBS and Perdue are starting to invest in the sector.31 While much organic beef is grass-fed, not all grass-fed beef is certified organic.

Two other meat and poultry focused market segments are also responding to growing consumer demand—hormone and antibiotic free, and stronger animal welfare standards. According to the National Marketing Institute, 67 percent of consumers want their grocery store to carry meat and poultry raised without hormones, and 66 percent want meat raised without antibiotics.32 Food companies are increasingly employing animal welfare standards, and states are starting to establish more welfare regulations such as crate sizes for birds and gestation crates for pigs.33 These segments can have crossover with the grass-fed market.

Farmer premium:

Similar to organic, 100 percent grass-fed beef sold under a third-party certified label offers ranchers up to a 50 percent premium for those who sell directly, and up to 25 percent for those who sell into supply chains, according to the Stone Barn Center. There are an estimated 3,900 grass-fed cattle producers currently, up from just 100 in 1998, according to the Center.

Challenges

A major obstacle to growth for the grass-fed beef industry is the lack of infrastructure, namely meat processing plants in strategic locations around the country that grass-fed ranchers can access. One of the outcomes of the consolidation of the conventional beef industry (JBS, Cargill, Tyson and National control 80 percent of the market34) is the loss of small- to mid-sized beef processing plants around the country. Those that remain are often costlier per pound or per carcass to process. The current mega-sized processing plants serve the conventional market.

And like organic, another major challenge in the grass-fed market is under-priced imports. According to the Stone Barn study, 75-80 percent of labeled and unlabeled grass-fed beef in the U.S. marketplace are imports. The lack of mandatory Country-of-Origin-Labeling for beef in the U.S.—undermined and ultimately killed by the conventional beef industry in Congress—makes it difficult for consumers to know where their grass-fed beef was raised. There is also a lack of a broadly accepted certification or verification of grass-fed (despite some strong certification systems out there) by consumers, allowing for meat producers to make fraudulent labeling claims.

Non-GMO

What is it?

A non-GMO product is simply a crop that did not come from genetically engineered seed. Certified organic food is non-GMO, but not all non-GMO is organic.

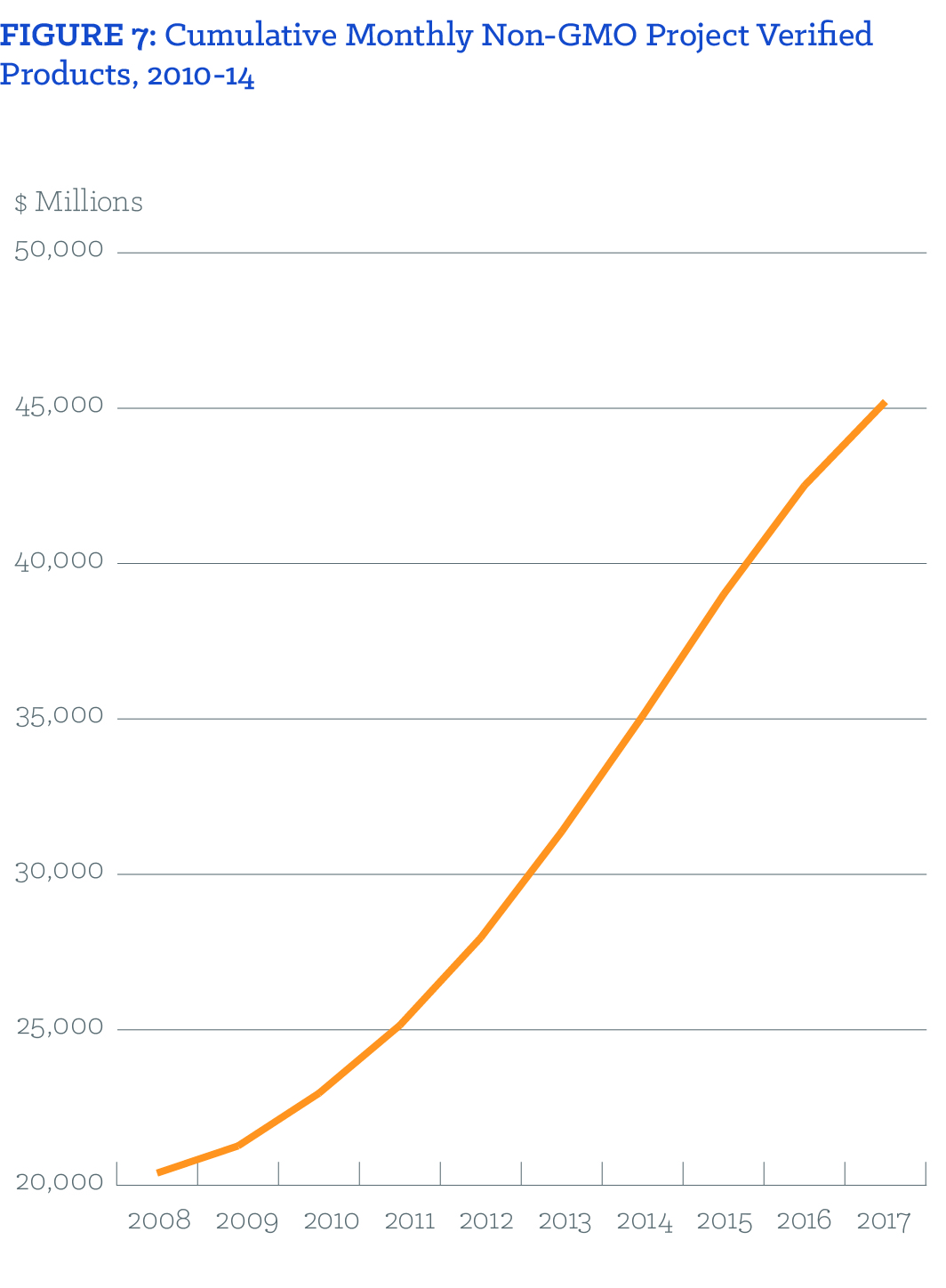

Market growth

The non-GMO market (non-Genetically Modified Organisms) has grown by $8 billion since 2012 to $21.1 billion in 2016, reports Progressive Grocer.35 Since GMO crops first entered the market in the mid-1990s, polls have consistently shown that 90 percent of consumers want GMO labeling. In 2016, Congress passed a controversial GMO-labeling bill requiring the USDA to develop new label requirements—the agency is expected to roll out its proposal later in 2018. The 2016 law was highly criticized because it gave food companies the option to use QR codes to be read on smartphones instead of on-package labeling to disclose GMOs, which adds a barrier to consumers accessing the information. The federal labeling law was passed largely to override a series of stronger state-level labeling bills, which the food industry had opposed as an unworkable state-by-state approach. Now that mandatory GMO labeling in some form is coming, the market for non-GMO foods is likely to grow further. The primary GMO crops on the market are corn, soy, cotton, canola and sugar beets, with some additional crops like papaya and apples and potatoes. Food companies are looking for non-GMO sourcing for all these foods.

Farmer premium

In 2014, U.S. farmers planted 6.4 million acres of non-GMO corn and 5.1 million acres of non-GMO soybeans, according to the USDA.36 The USDA publishes a weekly non-GMO market report. In March of this year, non-GMO soybeans were selling for around $11 per bushel and non-GMO corn for $3.80 per bushel, while conventional soybeans were selling for $9.80 per bushel and conventional corn for $3.65 per bushel.37

Challenges

A major challenge is a lack of infrastructure (storage and processing facilities, transportation and equipment) to keep non-GMO crops separate from the conventional GMO crop. The variability in price premiums continues to be a challenge for farmers. However, the lower associated seed costs (especially if purchasing untreated, non-GMO seed) can help regardless of market premiums with today’s low conventional prices.

Locally produced

What is it?

Locally-produced food does not have a specific definition; however, it is broadly described as products grown and consumed within a given state or region. Often, it is either purchased directly from the farmer, or the farm where it was produced is identified in some way—either through a label, on a menu, or by an institution—giving the food extra value to the consumer.

Market growth

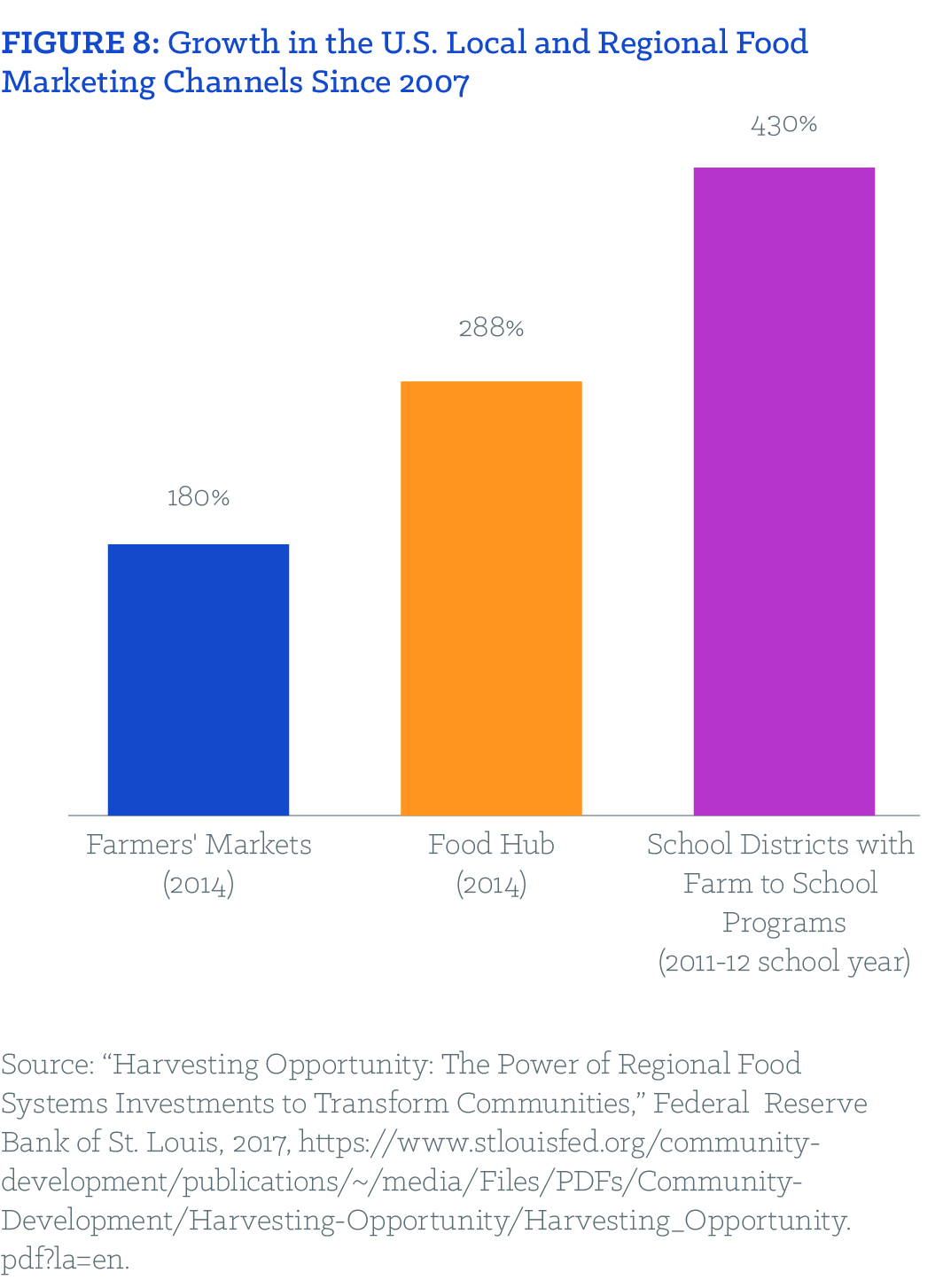

Local foods sales jumped from $5 billion in 2008 to $12 billion in 2014, according to Packaged Facts.38 Surveys find that 75 percent of shoppers bought local food within the last month and 87 percent of shoppers say the availability of local food is important to them.39

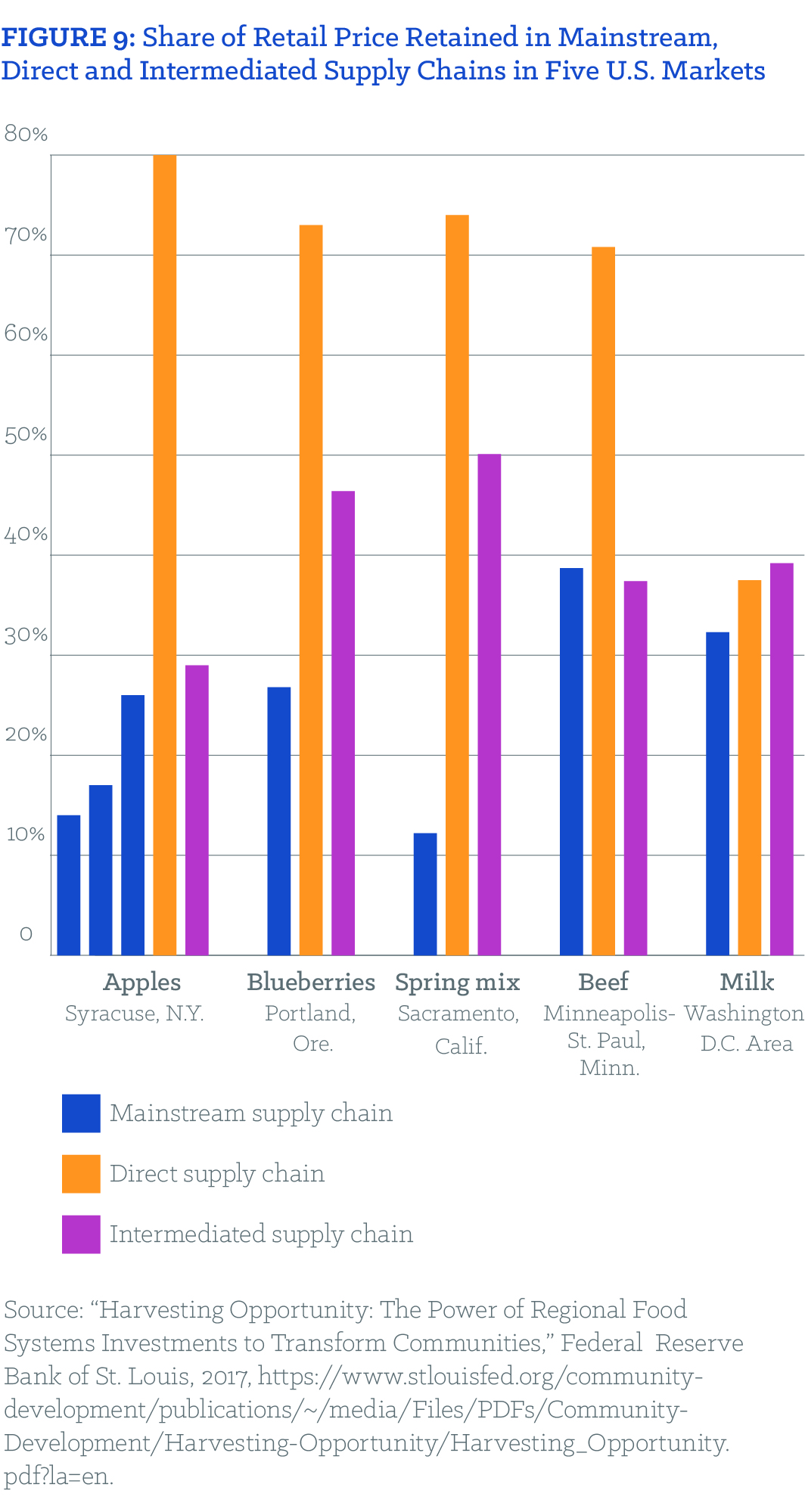

Efforts to meet rising consumer demand for locally-produced food can be found nearly everywhere, and investors are paying attention.40 From schools and universities to hospitals, to grocery stores and restaurants, locally-produced food is infiltrating the marketplace. Last year, the Federal Reserve Bank of St. Louis, the Federal Reserve Board of Governors and the U.S. Department of Agriculture published a report tracking the growth and economic benefits of investing in local food systems.41

In 2015, more than 167,000 U.S. farms produced and sold food locally through food hubs and other intermediaries, direct farmer-to-consumer marketing, or direct farm to retail, according to the National Sustainable Agriculture Coalition.42 Those sales resulted in $8.7 billion in revenue for local producers. Some 42,000 schools in all 50 states now have Farm to School programs with an estimated $780 million in value.43

The Fed report highlights how local and regional food systems strengthen rural-urban linkages and even local business-to-business connections as money re-circulates within the community, rather than being extracted by multinational food companies. Studies have shown that each dollar invested in Farm to School programs stimulate up to an additional $2.16 of local economic activity, sustaining local jobs and supporting local businesses.44 A 2017 report from the National Farm to School Network analyzing the economic impact of Farm to School activity in the Minneapolis Public Schools showed that “for every additional employee added to the payroll to the Farm to School production sector, an additional 7.55 jobs are generated in backward-linked industries in the Minneapolis area.” 45

The value of local food systems goes deeper than just economics. Farm-to-Head Start and Farm-to-School programs incorporate local food and farming themes into educational curriculum, shaping children’s understanding of food and farming to value local farmers and solidify healthy eating habits right as they are forming.

Challenges

Infrastructure like storage, aggregation facilities and transportation to serve local markets continues to be a major challenge. Local markets without adequate produce and meat processing facilities, transportation and delivery can raise costs and create hurdles for local food system development. Potential buyers, like major institutions (i.e. universities or hospitals), need locally-produced food aggregated and processed in a usable way. Banks and credit institutions often don’t have experience in financing local foods-oriented projects and are reluctant to take risks.

New Sustainability Demands from the Food Industry

Food companies and agribusiness firms are demanding greater sustainability practices from farmers in their supply chains.46 For the first time, many are tracking issues like water quality, greenhouse gas emissions, and soil health in their production and sourcing. New developments in agricultural technology, like so-called Big Data and blockchain technology, could push the market further toward greater sustainability and transparency in supply chains.

These industry shifts are a result of growing consumer and shareholder interest in these issues. But, there are also concerns that many of these industry initiatives reflect marketing goals more than real commitments to sustainability. Food companies often refuse to pay farmers and ranchers a premium for shifts in practice, many of which are costly in the short-term. The lack of third-party verification also raises questions about following through on public pledges. Nevertheless, there is little question that the food industry is looking to show progress on a variety of sustainability indicators to the public and to shareholders.

One of the more widely-adopted platforms for sustainability used by the food industry is Field to Market.47 Field to Market focuses on making continual improvement in sustainability along supply chains, convening stakeholders to measure, define, advance sustainability in food, fiber and fuel production in the U.S. Members include most of the major agribusiness firms (e.g., Cargill), food companies (e.g., Kellogg) many university extension programs, commodity crop groups, retailers (e.g., Walmart) and restaurants (e.g., McDonald’s). They have an equivalency agreement with the Sustainable Agriculture Initiative—a global effort to advance sustainable agriculture founded by Nestle, Unilever and Danone in 2002.48

Some companies are focusing on particular attributes of sustainability. For example, General Mills has stated that soil health is a priority.49 The company is working through its organic cereal brand, Cascadian Farms, to commercialize the perennial wheatgrass Kernza, developed in partnership with The Land Institute.50 Kernza has a deeper root system than traditional wheat, which improves soil health, retains water better and can capture carbon. The company also recently announced that it would help convert 34,000 acres in South Dakota to organic wheat production to supply its Annie’s Macaroni and Cheese line.51 Land-o-Lakes’ SUSTAIN tools work with companies and farmers to improve water quality, reduce air pollution and improve soil health.52 The Soil Health Partnership, an initiative of the National Corn Growers Association with support from Monsanto and General Mills, emphasizes practices like cover crops, nutrient management, and minimum tillage.53

Climate change considerations are also becoming more of a public priority for food companies, driven both by the specter of possible climate regulation and increasing calls by shareholders for companies to disclose their climate risk. Many global agribusiness and food companies have been engaged in climate policy, including joining more than 1,000 other businesses calling on President Trump to support the global Paris Agreement.54 Prior to the Paris Climate talks, a series of agribusiness and food firms made their own pledges to reduce greenhouse gas emissions including Cargill, General Mills, Hershey’s, Kellogg’s, Mars, McDonald’s, Monsanto, Nestle, Starbucks, Syngenta, Unilever, Target and Walmart.55 Companies like Unilever, Stoneyfield, Ben & Jerry’s, Nestle, Kellogg, General Mills, and Clif Bar are all part of CERES Business for Innovative Climate and Energy Policy (BICEP), pushing for state- and national-level climate policy.56

Meat companies like Smithfield, JBS and Tyson Foods are all making pledges to reduce greenhouse gas emissions. These voluntary pledges often rely on something called “emissions intensity”—in other words, emissions per kilo of meat or poultry. The emissions intensity approach avoids the more substantive goal of addressing overall greenhouse gas emissions, something that would likely require a reduction in production for these meat companies.

Will Companies Pay for Sustainability?

While most of agribusiness and the food industry are involved in sustainability initiatives that make demands of farmers, the costs of implementing these new practices and systems fall squarely upon the farmer. Many of these programs aren’t paying farmers a premium price, or high enough of a premium price, for the changes they need to make, some of which could affect short-term production yields and profits. While most shifts toward greater sustainability have long-term benefits, particularly around supporting soil health or pollinator habitat, those benefits may not come soon enough for farmers facing immediate, short-term economic challenges.

There is also concern that various business initiatives reflect more of a marketing strategy to make the company look good rather than a deeper commitment to sustainability. For example, Walmart’s push to encourage more efficient fertilizer use through the SUSTAIN program does not include helping spur markets for new grains that would both reduce fertilizer use and help farmers build soil health. Furthermore, the company has a longstanding reputation for squeezing suppliers to maintain its low-price reputation.57

Agribusiness announcements on climate and sustainability—marketing or real action?

- Archer Daniels Midland (ADM) is investing in a project to inject carbon dioxide underground, hoping to store more than a million tons of carbon dioxide each year.

- Hog giant Smithfield has pledged to reduce GHGs in its supply chain by 25 percent by reducing fertilizer used to produce animal feed, decreasing water use, increasing energy efficiency at their facilities and improving their manure management. The company is investing in biogas production that converts hog manure on some of its operations in Missouri into natural gas pipelines.

-

- General Mills pledged in 2015 to reduce the company’s GHGs by 28 percent by 2025, with much of the reduction focused on upstream sourcing from agriculture. General Mills is partnering with USDA and Xerces to fund pollinator projects on 100,000 acres of farmland over five years to protect and restore pollinator habitat.

- Kellogg has also been outspoken on climate commitments, including the Paris Agreement, and is working to reduce emissions in its agricultural supply chains through reduced fertilizer use and water quality efforts around the Great Lakes region.

- The seed and pesticide company Monsanto is working on an initiative with universities to measure and report GHGs in agriculture.

- Walmart stepped up demands of its suppliers in 2014 to reduce fertilizer use in its supply chains. Costco has taken a stand against pollinator-killing neonicitinoid insecticides when it comes to their garden supplies and have pushed for more organic products in its food sourcing, according to the company’s bee policy established last year.

- DanoneWave, Ben & Jerry’s, General Mills and MegaFood are working with partners to develop a new global standard for regenerative agriculture that encourages farmers to restore the carbon cycle and build soil health.

As we’ve seen in the market growth of organic or grass-fed beef, paying more for sustainability works. Payments in the form of government programs can also be effective if the payments are high enough. For example, on Maryland’s Eastern Shore, the state pays farmers extra money per acre to grow cover crops as part of an initiative to protect the Chesapeake Bay. Farmers there now plant cover crops on more than 50 percent of the acres in the region.58 Iowa and other states have similar programs, but their success rate depends largely on the price per acre.

While there is a perception that higher prices for farmers means higher costs for consumers, that is not necessarily the case. Most of the money from food is made through other parts of the chain (marketing, processing, wholesaling, distribution and retail). The National Farmers Union, which regularly updates this data, reports that the farmer receives only 15 cents for every dollar spent by consumers on food.59

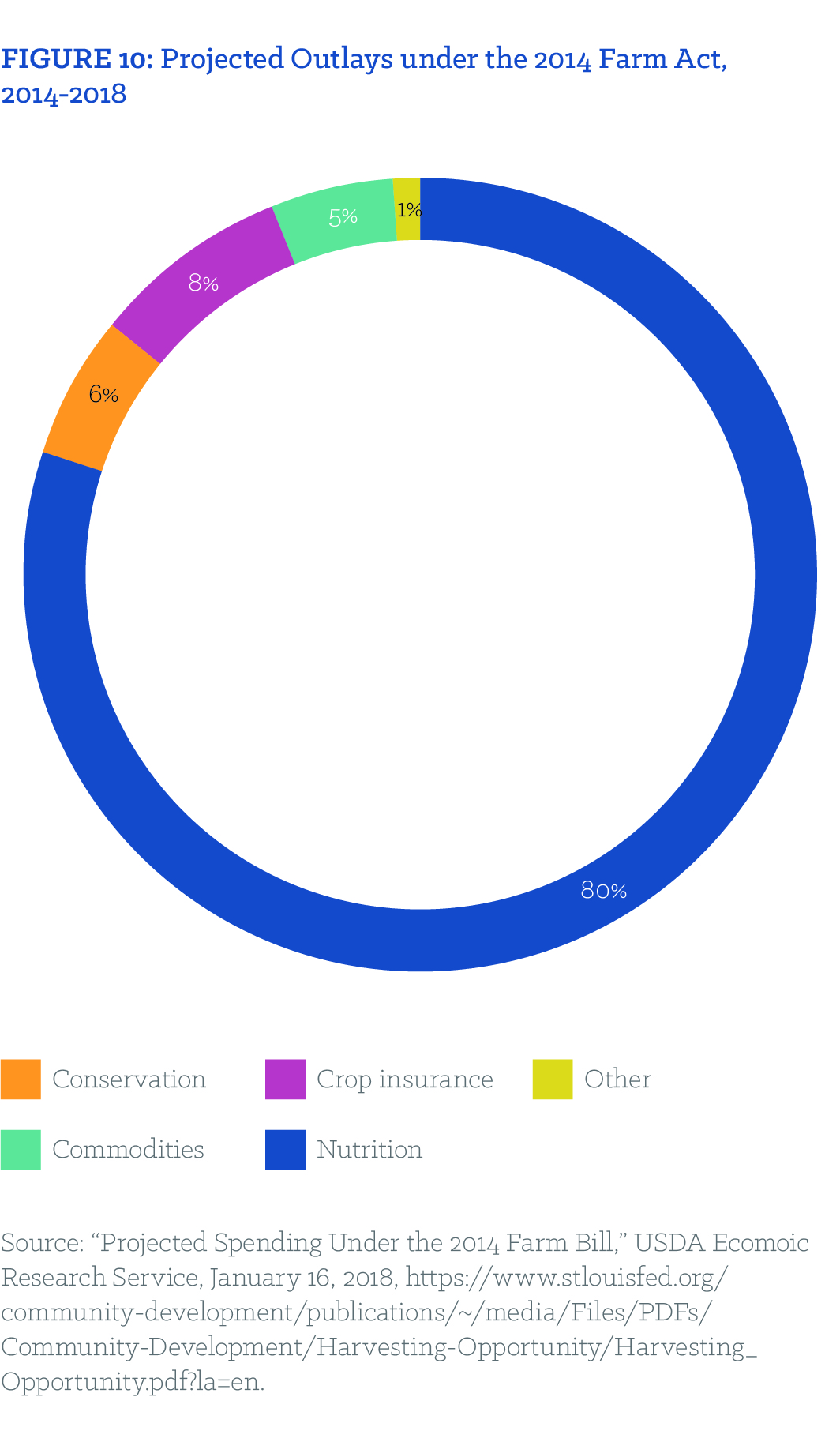

How the Farm Bill Could Support Farmers Accessing New Markets

The U.S. Farm Bill is a wide-ranging, massive piece of legislation. Passed every five years, the Farm Bill’s dozen or so titles cover areas such as commodity programs, crop insurance, conservation, nutrition, energy and rural development. And while the bulk of Farm Bill spending comes through the nutrition title (somewhere between 70-80 percent), much of the farmer-oriented resources go through two big programs: The commodity title and the crop insurance programs. Those programs are designed primarily to provide farmers who grow commodity crops with a safety net if the market drops and prices dip below the cost of production.

Despite its many titles, the Farm Bill does not explicitly support transitioning the farm economy toward a system grounded in farmer profitability, rural resilience or sustainability. This is not to say that the Farm Bill doesn’t have a wide range of important programs that could significantly aid the transition toward greater sustainability and profitability, but those programs are grossly underfunded to meet demand. And their goals, whether it is soil or water quality, pollinator health, organic transition, seed breeding, or infrastructure, operate separately from commodity and crop insurance programs. Instead of integrating sustainability throughout all farm programs, conservation programs are siloed within their own title and program, separating the bottom line of farming from environmental goals.

A new approach to the Farm Bill could help farmers engage in new, potentially more profitable markets, by providing farmers with the much-needed resources to make long-term investments in their operations. Many of the reforms needed to aid in this transition do not require radical restructuring and the creation of new programs, but rather shifting the resources and goals of existing programs.

What needs to be done?

Reforming the Farm Bill and other policies to aid farmers in the transition toward more profitable, sustainable markets should focus on three areas: Transitions on the farm, infrastructure, and marketplace integrity.

Transitions on the Farm

A number of Farm Bill programs aid farmers in managing their farm. A sustainable transition should focus on the following:

Working Lands Conservation Programs

Working lands conservation programs, where farmers implement conservation practices on land actively being farmed, provide much-needed support for farmers to engage in climate, water, and soil-friendly practices. The Conservation Stewardship Program has initiatives that focus on soil health, water quality, perennial grasses, sustainable livestock management and cover cropping.60 The Environmental Quality Incentives Program (EQIP) and the Agricultural Conservation Easement Program (ACEP) are working lands programs that can support agricultural resilience, strengthening farmers’ ability to absorb and recover from weather extremes and other stresses. Recent Farm Bills have cut conservation programs, and there are signs that further cuts are coming in the 2018 Farm Bill. These cuts come despite the popularity of these programs among farmers, where applications far exceed available resources. These programs should be expanded to serve farmers of all types, sizes and geography. Rep. Tim Walz (D-MN) has introduced the SOIL Stewardship Act that would increase funding and technical assistance, improve coordination between working lands programs and aid farmers transitioning to organic.61 Better conservation outreach, planning and implementation support—as well as better measurement, evaluation and reporting—can make these programs more effective for farmers.

Insurance Reform

Crop insurance has taken a larger share of the Farm Bill, but it doesn’t serve all farmers or farming systems well. Crop insurance is critical for farmers in today’s age of increased extreme weather, but it must do more than just enrich the insurance industry. In its current form, the program discourages some sustainable farming practices, like cover cropping by requiring early termination of the crop, or diverse cropping systems.62 A reformed program would expand access to better serve all types of farmers in all regions of the country, including farmers with diverse crops and enterprises, specialty crop operations, organic farmers, and farmers using non-wholesale markets. Improving and expanding the Whole Farm Insurance program would be a major improvement. Insurance programs should promote conservation by linking premium subsidies to stewardship practices that protect the land, water and health.63

Agricultural extension

The nation’s agricultural extension service housed at land grant universities around the country is essential for the nation’s farmers. There has been a disinvestment in agricultural extension and an increasing reliance on private industry to work with farmers and perform research over the last several decades. A reinvigorated, better-resourced agricultural extension system focused on transitioning farmers toward emerging sustainable markets is essential.

Shifting Research Resources

Much of the current USDA agricultural research dollars go toward the current system of commodity crop and large-scale animal production. As public research dollars have shrunk, private industry research, particularly from a handful of global agribusiness firms, has stepped in to serve their own needs. Public dollars should be focused on a system that brings public goods and shifts toward greater farmer profitability. A critical area of focus needs to be public plant breeding research and development to ensure all farmers have access to high performing, locally-adapted seeds. In agriculture, biological diversity is key to ensuring success; having a variety of well-adapted crops not only reduces the impacts of extreme weather, pests, and disease, it also protects against price fluctuations in the market. An effective research agenda should focus on increasing seed options for farmers, expanding crop diversity, and improving connections with a reinvigorated extension system.64

Cost Share Programs for third-party certification

The Organic Cost Share program helps farmers pay for organic certification. A greater investment would aid farmers in their three-year transition process before they can access the organic premium and other third-party certifications such as “grass-fed” and “humanely raised” that bring public benefits.

Farm Service Agency loans

These funds are critically important in this difficult financial environment. A larger percentage of these loans are going toward the continued construction of large-scale animal and dairy operations. The loan programs should shift away from those specialized animal operations and offer greater access to farmers seeking to target more profitable, emerging markets. USDA-backed loans focused on these emerging markets would aid banks in further engaging in local food development and finance.

Infrastructure

A major barrier to expanding new, more profitable markets for farmers is infrastructure. For example, there are fewer than 200 facilities that are certified organic and able to handle certified organic feed grain corn.65 More facilities are needed for the market to become accessible to farmers. A major push toward building new food system infrastructure also should be part of a rural development plan to create new jobs in rural communities. Investments in regional food economies could target areas such as storage, aggregation, transportation, and processing capacity. A growing number of Food Hubs are setting up around the country to meet these needs.66 Assistance in marketing and business planning can help farmers and local food businesses and investors.

A number of Farm Bill programs could greatly help in building this infrastructure. The Local FARMS Act introduced by Sherrod Brown (D-OH) in the Senate and Chellie Pingree (D-ME), Jeff Fortenberry (R-NE) and Sean Maloney (D-NY) in the House would solidify funding for a number of already successful local foods system programs in the Farm Bill. The bill brings together the Farmers Market and Local Food Promotion Program and the Value-Added Producer Grants Program to streamline support for farmers markets, farm to retail marketing, local food infrastructure projects and producer-owned enterprises. It stabilizes money for the Organic Cost Share Certification Program, which assists farmers in transitioning to organic production. The bill helps farmers manage additional costs to meet new food safety rules and regulations, while also provide additional training. The bill would make it easier for schools to procure locally- and regionally-produced food. And it would expand the ability of rural development and farm service agency grants and loan programs to be used to support livestock, dairy and poultry supply chain infrastructure.

Marketplace Integrity

As new markets develop, it is critical that they retain a strong differentiation from the conventional market while sidestepping the mistakes of that market. Here are several key issues to address:

GMO contamination

Because GMOs are prohibited under organic standards, any level of contamination found in organic product or on organic farms directly threatens the livelihoods of organic producers. A legal liability regime needs to hold GMO seed companies liable for losses associated with their product.

Import Integrity

The organic feed market has been severely harmed over the last several years from likely fraudulent corn and soybean imports coming through Eastern Europe. Cheap imports of grass-fed beef from Australia and New Zealand also undermine U.S. grass-fed beef producers, particularly if they have not been third-party certified. Stronger enforcement to ensure the integrity of products targeting specialty markets will be essential, as will mandatory Country of Origin Labeling (COOL) to improve transparency for consumers.

Strong standards/transparency

Consumers need to trust the labels of these new markets. Robust third-party certification systems are essential. The development and updating of standards must be open and require comment periods. Greater transparency of the supply chain adds to the integrity of the standard. Strong standards are essential to maintain the position of the farmer/rancher in the marketplace. USDA has a role to play in this, just as they did with the USDA Organic program (especially if they also learn lessons from that process).

Competition/transparency in the agriculture markets

Just as consumers want greater transparency in the food they purchase, farmers and ranchers need greater transparency in the market to which they are selling. This means greater transparency in prices paid for the organic, grass-fed, non-GMO and local foods markets. Greater openness in market prices, as well as contracts, provides farmers with some leverage in the marketplace, where they are largely price takers without the economic power to set their own prices to cover costs. The USDA has started to expand reporting for several organic commodities and grass-fed beef in recent years, but more needs to be done.

Antitrust enforcement

The accelerating concentration in agricultural markets has left just a handful of companies controlling most sectors. This level of market power has squeezed farmers on the input/seed side, as well as on the marketing side. As the organic industry has grown, it has seen some of the same shifts toward concentrated markets as the conventional food industry.67 New and emerging markets must maintain competition through aggressive antitrust enforcement—including a recognition and assessment of how mergers affect farmers and ranchers—in order for this emerging system to work for farmers.

Trade policy

The pursuit of expanded export markets, and existing trade rules, have had an out-sized influence over the Farm Bill. A shift toward a more balanced approach that includes a focus on supporting farmers accessing higher-value U.S. markets should also recognize the rights of other countries to support their farmers selling to domestic markets—policies that current trade agreements discourage. Additionally, future trade agreements should serve to lift up and strengthen sustainability-oriented standards in farming, not weaken standards in the name of expanding trade.68

A reorienting of the Farm Bill and other policies toward farmer profitability and sustainability would require a major shift in priorities for those in Washington. But the dire state of the current farm economy, the challenges facing rural communities, and the increasing dependence on the whims of the global market require new thinking—and a very different Farm Bill.

Download the PDF for the endnotes.