Today, more than 40 years after the first World Food Day,1 the problem of hunger remains intractable, in part, due to food price spikes and price volatility exacerbated by excessive speculation. Developing countries that are net food import dependent are most vulnerable to high degrees of price volatility.

According to the latest State of Food Security and Nutrition in the World (SOFI) report, 735 million people faced hunger (measured in terms of prevalence of undernourishment) in 2022. Over 122 million more people faced hunger in 2022 than in 2019, due to the global pandemic, extreme weather and the Russia-Ukraine war. The 2023 Global Hunger Index (GHI) released last week shows that, after many years of advancement up to 2015, progress against hunger worldwide remains largely at a standstill.

Thanks to increasingly extreme inequalities, hunger is experienced unevenly across the continents — Africa (19.7% of the total population in 2022), Asia (8.5% in 2022), and Latin America and the Caribbean (6.5% in 2022). Often, those who suffer from hunger are concentrated in the most vulnerable regions within continents and countries. Rural communities, women and especially marginalized individuals among them are particularly vulnerable to higher food insecurity. Even those who can access food may not have access to nutritious food. The continuing food price rise pushes people who were not previously facing acute hunger over the edge to now face malnutrition. Crucially, it also pushes food importing countries further into debt, diminishing their capacity to invest in their own food systems development.

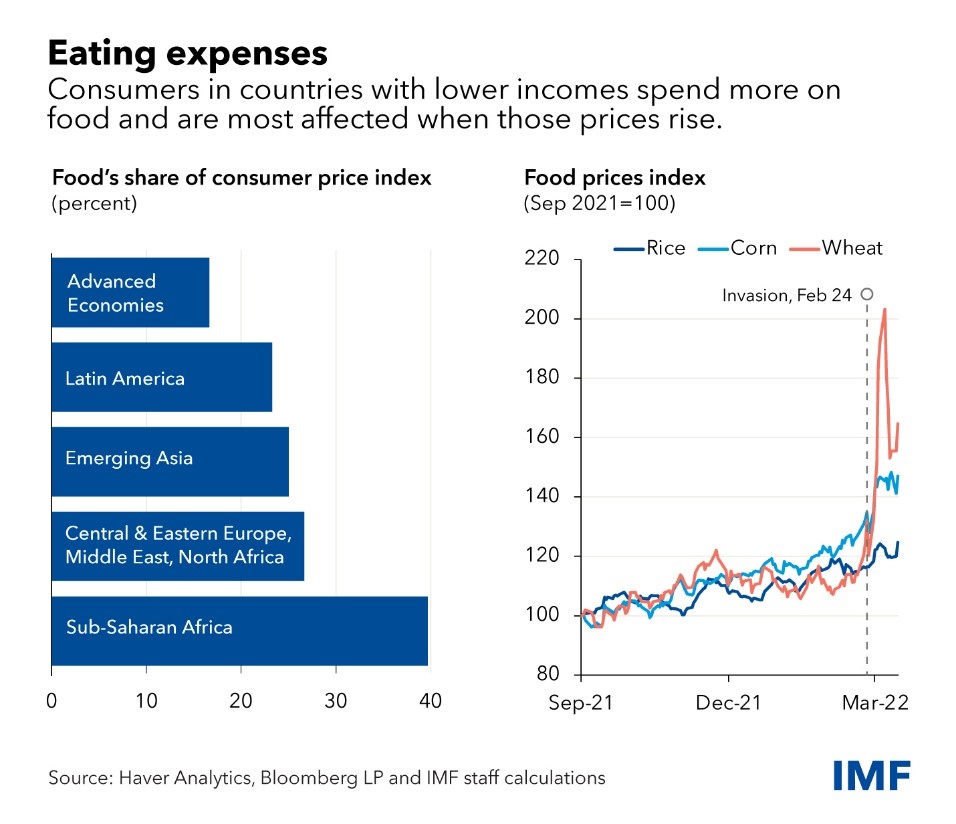

The food price rise of 2007-08 led to food riots in many countries. At that time, SOFI 2009 estimated that the number of people going hungry every day had reached a historic high, 1.02 billion people, with one-sixth of humanity suffering from hunger. According to the FAO, “the combination of rapidly rising food prices and higher transport costs resulted in sharply higher food-import costs. Globally, food import bills surged to $820 billion in 2007.” The total food import bill of developing countries rose from about $191 billion in 2006 to $254 billion in 2007. Higher food import bills result in inflationary pressure in developing countries dependent on food imports since a significant proportion of the average household income is spent on food in those countries.

During the crisis, there were calls for political change in many countries. The governments that had been underinvesting or misdirecting their investments in the food and agriculture sector were urged to change direction. There were renewed calls to refocus on grain reserves and to regulate commodity speculation.

Against this background, the newly reformed U.N. Committee on World Food Security (CFS) identified price volatility and social protection among the key outstanding issues2 for addressing the global food and nutrition security. CFS tasked its High Level Panel of Experts (HLPE) to gather available evidence on price volatility (2011) and social protection (2012). These HLPE reports went on to inform the CFS policy recommendations on Price Volatility and Food Security,3 as well as on Social Protection for Food Security and Nutrition. These distinct sets of recommendations identified a series of action points targeted to governments and all relevant stakeholders to address the structural causes of food price volatility; to ensure that its impact does not undermine producers and consumers’ right to food; and to design and implement, or strengthen, social protection systems for food security and nutrition, respectively.

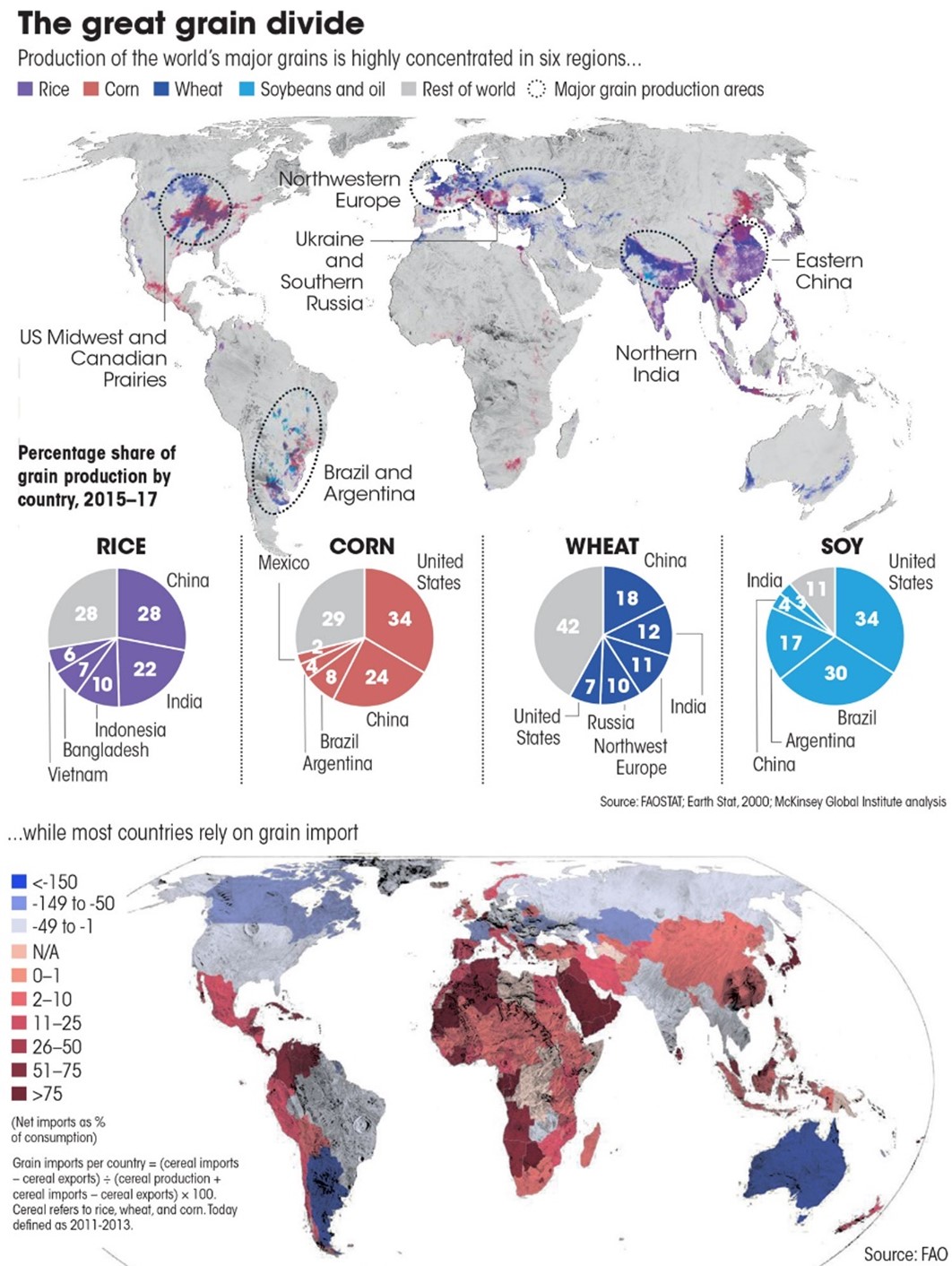

Yet, less than a decade later, the global pandemic-related supply chain interruptions led to steep increases in food prices, lack of access to and availability of food and global food insecurity, with nearly one in three people not having access to adequate food in 2020. This is despite a recent analysis showing that, for “the world as a whole, population increased 2.5 times from 1961 to 2020, while food production increased 3.7 times, implying that per capita food production was 47% higher in 2020 than in 1961.” It is important to note, however, that this increase in food production is not evenly distributed across the regions. For example, many developing countries — agriculture-dependent economies — such as those in Africa, “have become especially food import dependent, following the adoption of [World Bank] Structural Adjustment Programs in the 1980s,” which “dismantled the structural foundations of food production in many African countries,” as an IPES-Food report from last year points out.

Source: Down to Earth

This food production is not only concentrated in some regions, but also on select crops. According to the data from U.N. FAO, 20-30 crops today feed the world, with 60% of the plant-based calorie intake provided by rice, wheat and maize. The COVID-19-related lockdowns and supply chain interruptions revealed the vulnerabilities of a highly concentrated food production system and the challenges faced by food import dependent developing countries. While most developed country governments were able to release emergency funds for shock-responsive social protection (SRSP) programs to help vulnerable people cope with food security and other challenges, a majority of countries simply could not afford to do so. This was especially true for food import-dependent nations that are already heavily indebted.

Communities across the world were hit with yet another price hike in the immediate aftermath of the Russia-Ukraine war. The Russian invasion of Ukraine on February 24, 2022 had major impacts on global agri-food markets, thanks to the disruption of Ukrainian and Russian grain exports, with the two countries accounting for 12% of all food calories traded globally. The price impact was unlike any before: The FAO Food Price Index (FFPI), which tracks the monthly changes in the international prices of the commonly traded select food commodities, peaked in March 2022, marking it the highest on record since its inception in 1990. The impact was much worse for poorer households that spend a higher share of income on food and for low-income countries, where consumer spending on food is much higher compared to advanced economies.

Source: International Monetary Fund

So, what went wrong? “Speculative activity by powerful institutional investors who are generally unconcerned with agricultural market fundamentals are indeed betting on hunger, and exacerbating it,” said Olivier De Schutter, U.N. Special Rapporteur on Extreme Poverty and Human Rights (and former U.N. Special Rapporteur on Right to Food) in a report, The Hunger Profiteers.

CFS meeting will consider food price volatility and social protection for food security

When the U.N. CFS meets in Rome next week, one session will be dedicated to taking stock of the use and uptake of the CFS policy recommendations on Food Price Volatility and Food Security and on Social Protection and Food Security and Nutrition. The session provides member states and all other participants at the U.N. CFS51 an opportunity to reflect on the challenges posed by the current global food crisis, such as the impacts of price volatility on the food security and nutrition of the most vulnerable, and the role of social protection mechanisms as a means to mitigate vulnerability and tackle food insecurity and hunger.

But will the session look at ways to address the root causes underlying food price volatility?

The structural causes of the food price crisis in 2022 are more complex and more severe than in 2008. As was the case of 2008, a key factor is price volatility. Many of the causal factors for price volatility are familiar: supply shocks resulting from the Russia-Ukraine war and climate-change-related extreme weather events, as well as plant and animal disease-related supply impacts. However, the return to light touch regulation has exacerbated this price volatility.

United States: Return to “light touch” regulation and legalized excessive speculation

Regulatory policy failure was and is a major factor that contributes to price volatility. A 2011 study evaluated 30 years of commodity derivatives data, particularly in maize and wheat futures contracts, to show the radical change in positions in those contracts that began with the rise of Commodity Index Traders (CITs) in 2004 and that peaked with the 2007-08 boom bust in commodity prices. Historically, users of physical commodities (commercial hedgers) took the largest share of positions to manage short-term price risks in those commodities. However, that commercial hedger share diminished from 70% of the contract market in 1995 to about 30% by 2011 with the huge investments by the unregulated CITs, since most hedgers could not compete with the position unlimited CITs, such as Goldman Sachs. The authors of the 2011 study write “Commodity Index Funds have a unique structure in which large volumes of futures market trading occurs at specific times without regard to price considerations.” (italics in the original, p.8) CIT trading formulas, such as the “Goldman Roll,” enable profit taking from the price volatility created by the huge volume of trading positions that are “bet” to increase and/or decrease prices. A 2017 econometric study of trading data by economists at the Federal Reserve Bank of Chicago characterize commodity index dominant trading as the “financialization of commodities,” in which financial formulas preempt supply and demand factors in price formation.

In 2011, when the CFS adopted the policy recommendations on food price volatility, legislative and regulatory initiatives were underway in the United States to repair commodity and financial markets to prevent a reoccurrence of the 2007-09 defaults, as well as rein in the unregulated “shadow banks” that traded contracts in all asset classes, including agriculture. In G20 jurisdictions, the implementation of reforms was inconsistent and staggered, allowing banks and their “shadow banks” to move assets to the most favorable jurisdictions and evade regulation. In the U.S., a globally influential regulatory jurisdiction, industry lobbies and lawsuits blocked reform until the Trump administration Commodity Futures Trading Commission (CFTC) issued rules to delegate CFTC authorities to trading platforms, reinstituting “light touch” self-regulation of markets and market participants.

One rule in 2020 greatly expanded the position limit that financial institutions with no commercial interest in a commodity could hold in a contract. Furthermore, the rule allowed the exchanges to determine which positions should count towards the limit. A dissenting CFTC Commissioner protested, “The Final rule declares that the players on the field are the referees. In this arena the public interest loses.” Position limits are applied to the most economically influential exchange contracts, including the internationally traded agricultural raw materials that are an important part of food security.

Russia’s invasion of Ukraine triggered a sharp increase in investment bank funds in agricultural futures contracts, usually through the vehicle of agricultural Exchange Traded Funds. By March 2022, financial traders accounted for 50% of positions that were “bet long,” in other words, taken in anticipation of prices increasing for hard winter wheat. That spike approached the peak of speculative activity during the commodity market boom-bust of 2007-08.

The G7 response to extreme food price volatility

In response to the unprecedented spike in food prices that saw FAO Food Price Index reaching an all-time high, the G7 agriculture ministers, in an extraordinary meeting on March 11, 2022, declared, “We will also fight against any speculative behaviour that endangers food security or access to food for vulnerable countries or populations. Therefore, we are closely monitoring markets affecting the food system, including futures markets, to ensure full transparency. We will continue to share reliable data and information on global food market developments, especially through the relevant international organisations.”

While governments and the FAO Agricultural Markets Information System do monitor agricultural supplies and policies, such monitoring hardly ensures transparency into price volatility factors and actors. And governments do not monitor the impact of automated trading systems and algorithmic trading on price volatility because governments do not regulate automated trading. Self-regulatory organizations “regulate” automated trading primarily by exchange set price up down limits and computer “kill switches” to temporarily stop trading and prevent the degree of volatility that could result in regulator and/or legislative investigations.

The German research institute Zef noted in 2022 that, “Prices for agricultural products are often subject to strong fluctuations. Nevertheless, price spikes and volatility, as currently observed, are highly unusual and indicate an abnormal market situation.” There are several reasons for this abnormality that are not related to regulatory policy and enforcement activities. Supply shocks resulting from the Russia-Ukraine war, from drought and excessive precipitation; increased costs in maritime shipping and insurance; plant and animal disease supply impacts — these are among the fundamental factors for explaining price volatility.

The G7 monitoring promised in 2022 has resulted in no government investigations into excessive speculation in commodities, much less regulatory reforms that would diminish excessive speculation and price volatility not caused by fundamental factors. Commodity market regulators have no means to control these contributing fundamental factors to price volatility. However, they can and must use their regulatory authorities and data surveillance capacity to prevent speculation by financial instruments and actors with no material nexus to the price risk management of physical commodities, including the price of maritime diesel fuel that is an important factor in Freight on Board agricultural prices.

Impacts of exchange rate volatility on imported food and agricultural inputs

The depreciation of national currency rates against the U.S. dollar for net food importing developing countries exacerbates food insecurity in those countries. Among the many policy options outlined in the 2011 High Level Expert Panel report on “Price Volatility and Food Security” is a policy recommendation on the impact of exchange rate volatility on agricultural import shipments and imported agricultural inputs was missing. However, according to Gro Intelligence, between January and June 2022, the value of the Pakistan rupee and the Egyptian pounds fell by “17.8% and 15.8% respectively against the U.S. dollar.” As a result of the currency depreciation, importing countries not only pay more for crucial food security staples and inputs, but also cannot increase stocks of critical food imports, unless they decrease spending on other essential imports, such as vaccines.

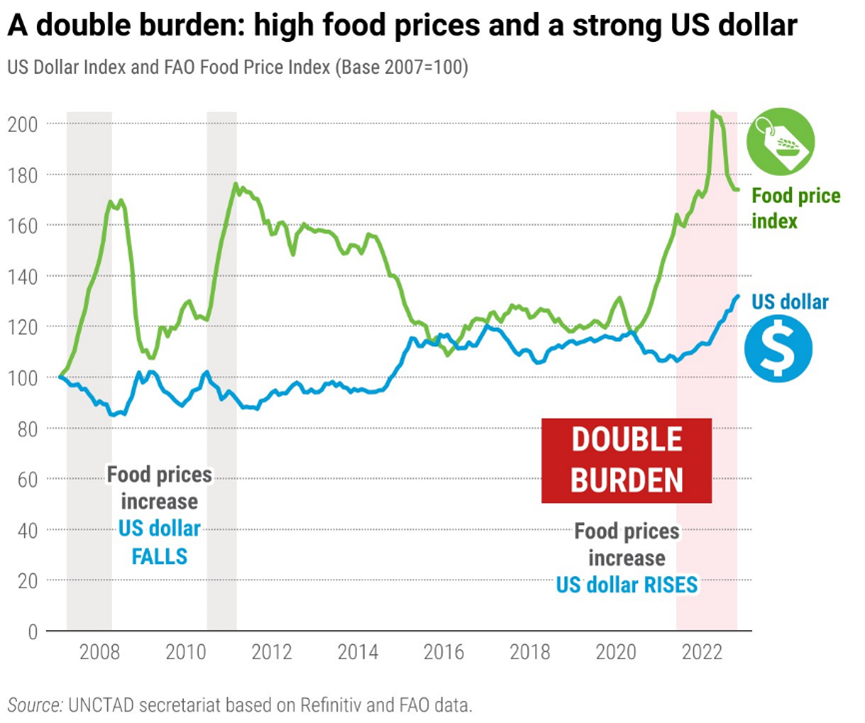

It was difficult for the HLPE to make a policy recommendation about exchange rates applied to agricultural trade because exchange rate policy is a function of monetary policy, even when monetary policy in one jurisdiction affects exchange rates, and indeed financial stability, in many other jurisdictions. In December 2022, the U.N. Conference on Trade and Development (UNCTAD) reported that as the U.S. Federal Reserve System increased interest rates to achieve its inflation target, the exchange rate value of the U.S. dollar appreciated by 24% between May 2021 and October 2022. This made the latest food crisis different in terms of its impact from past crises: “During past [food price] crises the value of the dollar fell as food prices climbed.” The combination of high food prices and a strong dollar is a “double burden”: a strong dollar increases the final price in local currency that people paid for imported food, leaving them to face even harder choices to make ends meet.

Source: UNCTAD

UNCTAD illustrates the impact of the strong U.S. dollar on wheat import prices for six developing countries. It recommends several policy options (in line with proposals by the U.N. Global Crisis Response Group on Food, Energy and Finance) to counter the impact of importing country currency depreciation on food security, none of them involving changes to monetary policy or exchange rate regulation. Notwithstanding the central bank policy failures of the past two decades, only central bank critics dare question the wisdom of applying monetary valuation controls to all economic problems, regardless of the consequences, in this case, for food security.

Conclusion

In conclusion, for net food importing developing countries, the progressive realization of the right to food depends in part on decreasing price volatility and excessive speculation in agricultural commodity derivatives markets. Central banks’ interest rate policies to curb inflation should be targeted and measured so as not to enable exchange rates fluctuations that exacerbate food import price volatility and price levels in other jurisdictions.

The debt burden of net food import dependent developing countries — many of them already facing the impossible choice of servicing their debt or serving their people and home to the majority of the world’s hungry — compromise their ability to invest in their own development, such as transitioning to climate-resilient and sustainable food systems towards food security or providing basic services to their people.

As we celebrate another World Food Day today, let us hope the special session at CFS51 in Rome on the last day of the plenary (October 26, 2023) nudges participants to take effective national and international actions on adopting the policy recommendations on Price Volatility and Food Security, as well as those on Social Protection for Food Security and Nutrition, towards the realization of U.N. Sustainable Development Goals, with special attention to enabling countries address their poverty and hunger. Given that 2023 global food market revenues were about $9.4 trillion as of this October and given myriad government subsidies for agribusiness, there is no reason why rich country governments cannot enable adequate social protection floors to help realize the right to food for our poor and hungry populations.

Endnotes

- The first World Food Day (WFD) was celebrated on October 16, 1981, on the 36th anniversary of the first session of the conference of the U.N. Food and Agricultural Organization (FAO) in 1945, in Quebec, Canada.

- The other two issues identified were land tenure and climate change, which will not be discussed here.

- IATP contributed to the report by responding to the HLPE calls for input and Sophia Murphy (currently IATP’s Executive Director) was a member of the expert team that wrote the HLPE report on Price Volatility (2011).