Executive Summary

The European Commission (EC) sees itself as a trailblazer in creating an overarching framework to certify all kinds of carbon removals. “Carbon farming” — primarily, carbon sequestration in land sinks, such as forests or soils — has become a new buzzword in recent climate debates, and the EC is promoting carbon farming as a key solution in the upcoming European Union (EU) Carbon Removal Certification Framework.

This report shows that “carbon farming” is part of a rapidly growing corporate agenda pushed by big polluters from the agriculture and fossil fuel industry alike. It plays a crucial role in corporate net-zero pledges that rely on the assumption that companies’ continued and even increased emissions can be balanced out by removing carbon from the atmosphere, particularly by buying carbon offsets. Corporate polluters see the new framework as a massive opportunity to generate great amounts of carbon credits that will allow continued emissions and delay urgently needed emissions cuts. The EC framework will likely allow the trade of carbon farming credits on voluntary carbon markets and possibly even the integration into government-run compliance schemes as early as 2030.

Our analysis shows that corporate demands for carbon farming focus on three main areas:

1. EU-certified offsets designed to maintain the status quo

Corporates from all sectors are eager for EU-certified carbon credits but are not aligned on the specifics of how this should be done. Agribusiness is pushing for voluntary offsets within their own supply chain, so-called “insetting,” taking note of the increasing competition for offsets with other sectors. Fossil fuel companies — regulated under the EU’s cap-and-trade scheme — are asking for the integration of the credits into the EU Emissions Trading System (ETS) compliance market to meet their obligatory emissions reduction targets. Companies involved in the generation of those credits, especially agrochemical giants, aim to make removal credits widely usable to ensure a large and stable market. While the EC plans to restrict the framework to the EU, at least for now, companies from different sectors advocate for opening the framework up for international markets — private markets, as well as potential schemes at the United Nations Framework Convention on Climate Change (UNFCCC) level — to generate an even larger supply of offsets, causing major concerns for climate justice, human rights abuses and land grabbing. From the perspective of many companies, public funds, such as the EU Common Agricultural Policy, should subsidize the expensive carbon market scheme that primarily benefits them.

2. A wide scope of certification for a large supply of offsets

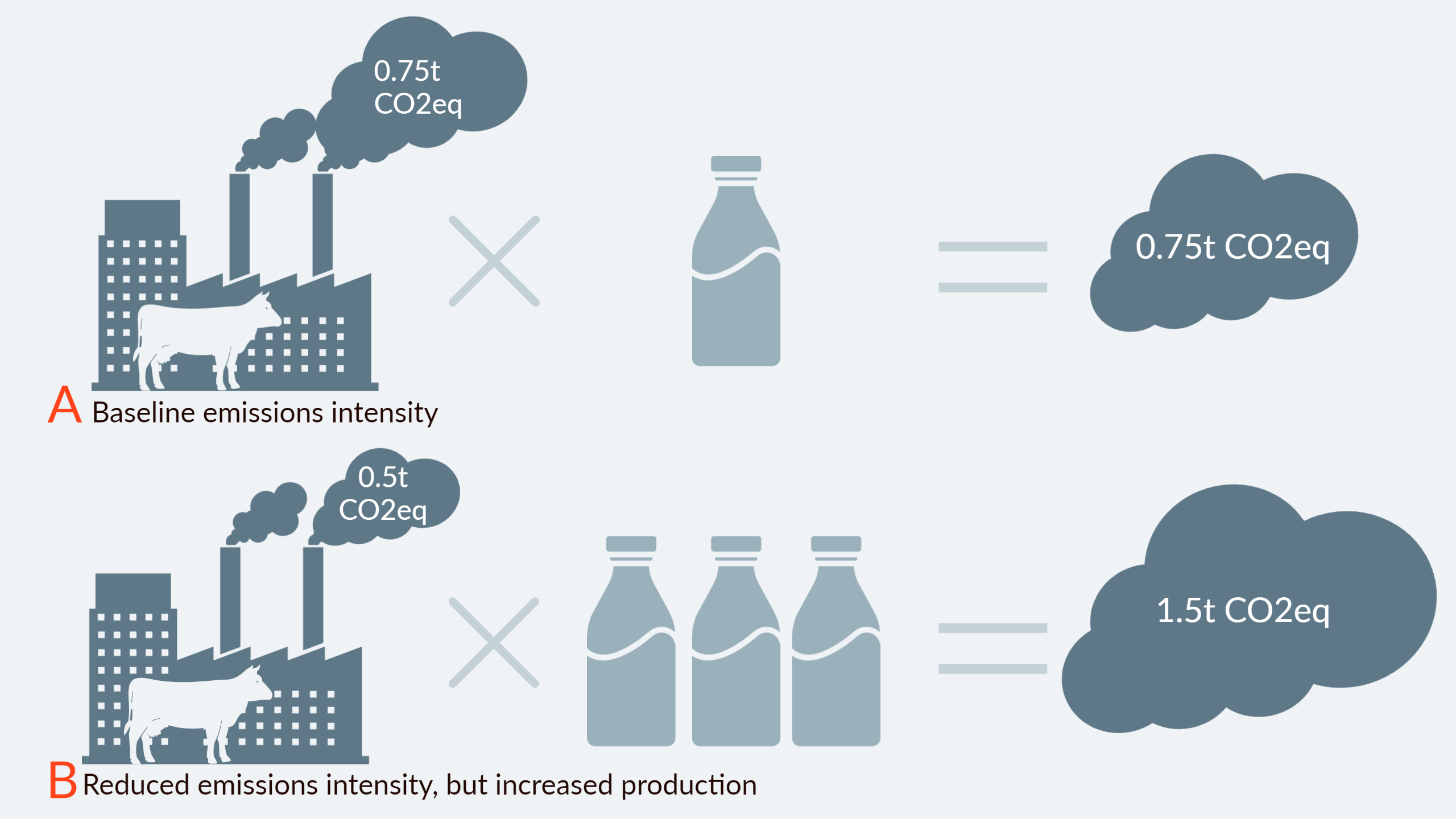

To increase the supply of available offsets and potentially push their prices down, companies are pushing for a wide scope of certification beyond carbon removals that could undermine the entire integrity of a removal framework. They encourage the certification of avoided emissions, as well as emissions reductions, as carbon credits, confounding and conflating the fundamental differences with carbon removals. To add even more offsets to the market, some advocate for creating offsets from business-as-usual scenarios instead of baselines in the present, artificially inflating the number of carbon credits that can be certified. Industrial livestock and agrochemical companies also call for credits for reducing emissions per kilogram of meat, milk or agrochemical product, an accounting trick that allows companies’ absolute emissions to continue to rise as long as production continues to increase.

3. Brushing aside concerns about non-permanence and measurement of land-based carbon sequestration

To bypass the fact that land-based sequestration is highly reversible due to human actions, natural disturbances, such as droughts or floods and climate crisis itself, companies both downplay the importance of permanence when carbon credits are generated from carbon farming and design creative accounting mechanisms. While concepts, such as buffer or insurance systems or shortening assumed storage periods, might solve the non-permanence issue in the books, these strategies do not solve the climate impact of generating carbon credits from impermanent removals. To create credits that are as cheap as possible, companies advocate for systems to measure and verify carbon removals based on unreliable and immature technologies, such as modelling and remote sensing. Or, they propose to avoid measuring altogether. In both cases, such soil carbon credits are based on assumptions instead of verified carbon sequestration.

The powerful and outsized representation of agribusiness and fossil fuel corporations in the legislative process put the EU on a dangerous trajectory, potentially opening the floodgates for offsets, watering down compliance targets and allowing companies to greenwash their operations. The initiative diverts critical public human and financial resources away from the urgent task of emissions reductions. Financing that would go to setting up these carbon farming offsets that benefit big polluters would be far better utilised for directly supporting farmers toward an agroecological transition. The European Commission must reject to the industry proposals that would be disastrous not only for the climate and biodiversity but would also hamper a necessary transformation of the EU’s agricultural system.

Photo by NRCS Soil Health. Used under creative commons license.

1. The corporate push for carbon farming

1.1 Introduction

The EU wants to reach its climate neutrality target by 2050. Instead of doubling down on significant emissions reductions, net-zero targets, such as the EU’s, rely on the unrealistic expectation that ongoing emissions will be balanced out by practices that actively remove carbon from the atmosphere. Lately, industry has championed these carbon removals as a silver bullet to tackle the climate crisis.

In November 2022, the European Commission (EC) will propose a legislative framework for the certification of carbon removals. To date, the EC remains unclear on how these certificates will be used. But once certified, carbon removals certificates are likely to be sold to polluters as carbon credits on voluntary and government-run compliance markets. This would create a major escape hatch for corporations and governments to offset their continued emissions rather than making urgently needed emissions cuts to meet their climate targets.

Land-based sequestration through what is called “carbon farming” will be a central part of the EC’s proposal. The EC proposal would primarily incentivise agriculture and forestry practices that sequester carbon from the atmosphere. Though carbon farming has been presented as a “new business model” for farmers and other land managers, it is part of a rapidly growing corporate agenda. The EC emphasizes that “an increasing number of private carbon farming initiatives have emerged where the land managers sell carbon credits on voluntary carbon markets. The potential for carbon farming is significant and it is the right moment to scale up high quality supply at EU level.”1

To shed light on the reality of net-zero pledges and the significance of the EC’s proposal for a carbon removal certification scheme, this report analyses the corporate demands for carbon farming that agribusiness and fossil fuel companies would like integrated into the legislation. It examines the positions of big polluters as exhibited in their inputs to public consultations and public statements. It also outlines the dangers of these demands for climate action, food growers and a just agricultural transition.

1.2 Net-zero and the EU’s Carbon Removal Framework

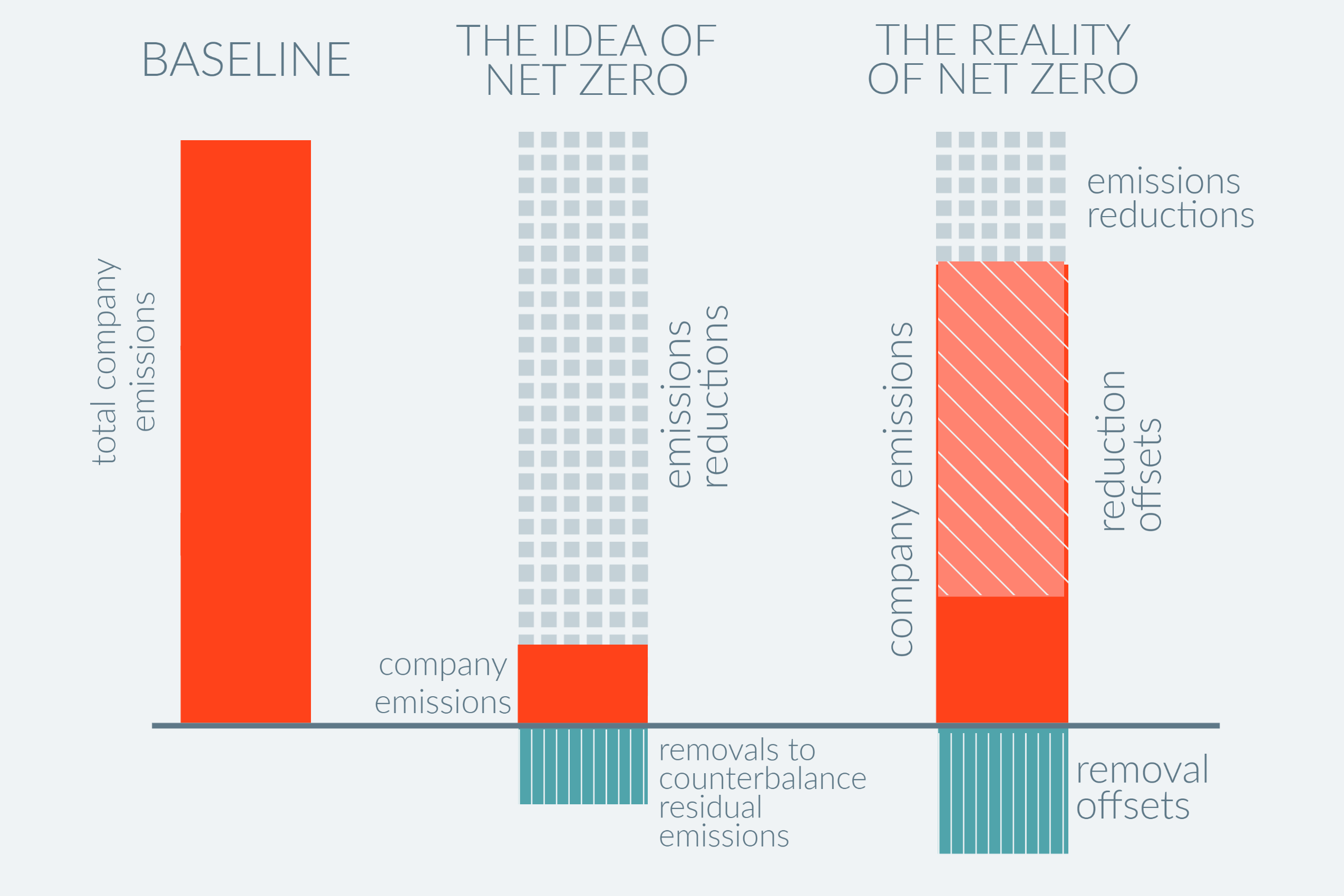

The promise of a net-zero world — the balance between greenhouse gas emissions and carbon removals achieved without fundamentally changing our economies — has enabled numerous corporations to greenwash their operations (Figure 2). Agribusinesses such as Nestlé2 and Bayer3 and fossil fuel giants like Shell4 and Eni5 have all declared net-zero targets and plan to use offsets to meet them (see Box 1). Yet, an emerging body of literature is debunking many corporate net-zero plans as empty pledges that delay real climate action.6

Corporate partners in a net-zero initiative at COP27, Sharm el-Sheikh, Egypt, 2022.

In December 2021, the EC announced plans for an overarching legislative framework for carbon removals, also referred to as the Carbon Removal Certification Framework. The EC argued that the legislation is necessary to achieve the European Union’s own 2050 climate neutrality goal.7 The framework will set principles for the certification of carbon removal certificates that could be traded as credits on voluntary carbon markets (VCMs), used in government-run compliance frameworks, or financed through national or EU-wide public schemes. The legislation would allow for EU-approved carbon offsets with more assumed credibility than other credits. An EU stamp of approval for offsets would likely increase the number of polluters on the demand side and incentivise corporations to create EU-certified offsets, putting urgently needed real emissions reductions across the economy in grave peril.

The IPCC states that “CDR [carbon dioxide removal] cannot serve as a substitute for deep emissions reductions.”8 Emissions reductions are the first and highest order of business. Permanent removals will be necessary to counterbalance “hard-to-abate residual emissions.”9 Currently, we are nowhere near the emissions reductions required to stop catastrophic climate change.

The EU likes to consider itself a trailblazer in creating an overarching framework for the certification of different types of what they claim to be removals, including carbon farming. As offsets, such carbon removals are supposed to balance out ongoing and future emissions: one tonne of carbon removed “neutralizes” one tonne of carbon emitted. However, ongoing fossil emissions remain in the atmosphere for centuries, while land carbon sinks are reversible through human action, natural disturbances such as floods, droughts and fires and rising temperatures from climate change itself.10 Land carbon sinks have been depleted over decades. While the restoration of ecosystems all over the planet is crucial, it cannot compensate for the levels of emissions caused by our fossil economies and industrial food system.11

In its Sustainable Carbon Cycles communication, the EC states that the removal framework should identify “solutions that unambiguously remove carbon from the atmosphere sustainably. ”12 However, the communication also aimed to “propose… concrete actions how to better reward land managers for reducing emissions and increasing removals.”13 The EC leaves the door wide open for a framework that could also certify carbon credits for reducing or avoiding emissions in the land sector. Offset credits sold on carbon markets attempt to conflate these vastly different actions of removal, reduction and avoidance. This conflation insinuates that all offsets are created equal. It makes it seem like any offset reduces carbon dioxide in the atmosphere: this is not the case (see Box 1).14

Box 1: Carbon offsets and carbon removal credits

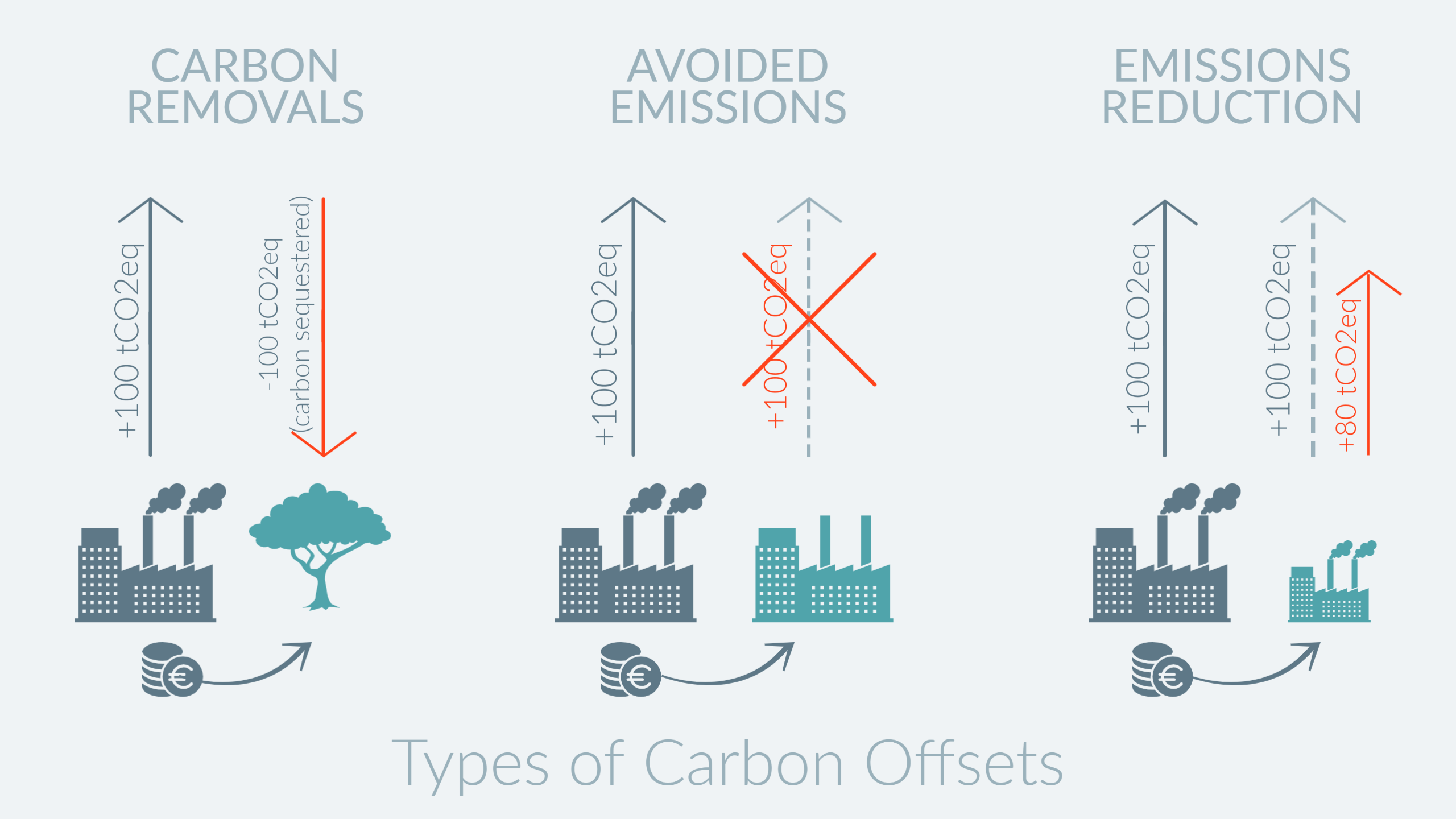

The IPCC defines an offset as “the reduction, avoidance or removal of a unit of greenhouse gas (GHG) emissions by one entity, purchased by another entity to counterbalance a unit of GHG emissions by that other entity” (Figure 1).15 Carbon offsets — often sold as carbon credits — are used to compensate for an entity’s own emissions, allowing a polluter to buy credits rather than reduce their own emissions. Polluting corporations are also increasingly in the business of creating such offset credits.

Fossil fuel giant Shell is promoting its own offsets, stating that it “works with environmental projects around the world that help reduce greenhouse gas emissions... These projects generate carbon credits that can be used to compensate for your company’s emissions.”16

These credits are measured in tonnes of carbon and traded in the form of per-tonne units. As global pressure to reduce emissions increases, there has been a surge in the selling and trading of these credits through private schemes and voluntary carbon markets. Until 2020, even the EU Emissions Trading System (EU ETS) — the EU’s official cap and trade carbon market — allowed international offsets that were generated under the Kyoto Protocol. For the EU’s 2030 emissions reduction goal, the use of those credits is not permitted, as the credits significantly reduce the ambition of the EU ETS.17

Currently, carbon credits are issued for the following:

- Avoided emissions: These credits are granted when a polluter pays another entity to “avoid” doing something that would have resulted in additional greenhouse gas emissions and thus increase the level of emissions. A major critique of this approach is that it is hard to prove that the avoided action, i.e., deforestation, would have happened in absence of such a credit scheme. Australia’s carbon farming credit scheme, for example, has issued credits for multiple projects for the conservation of forests that were never going to be cleared.18

- Emissions reductions: Credits are granted when a polluter pays someone else to reduce emissions i.e., investing in third-party renewable energy projects, such as wind or solar farms. For instance, Shell is offsetting company emissions by buying emissions reduction credits from projects that “reduce carbon emissions by providing more fuel-efficient cook stoves,” for example, in India.19 Again, it is gain hard to prove whether or not these projects would have happened without the purchased credits; if they would have otherwise occurred, the emissions reduction credit would not lead to any additional reductions.

- Carbon removals: Credits are granted when a polluter pays an entity to actively take carbon out of the atmosphere i.e., Nestlé plans to remove 13 MtCO2eq through “natural solutions,” such as tree planting, and technological measures, such as direct air capture, to “neutralize” the company’s own equivalent emissions.20

Currently, most credits are issued for avoidance or emissions reduction.21 Those credits do not actually reduce the accumulated amount of carbon dioxide in the atmosphere and thus do not “cancel out” ongoing emissions in any sense. Meanwhile, carbon removals are intended to take carbon out of the atmosphere. Players in the carbon market seek blend removals and avoided emissions into a single credit that can substitute emissions reductions.22

Figure 1: Types of Carbon Offsets

Figure 2: The idea and reality of net zero

1.3 Corporate initiatives on carbon farming

An increasing number of corporate climate and net-zero targets now rely on land-based carbon sequestration to offset corporate emissions. Soil carbon removals, in particular, which are even more vulnerable to reversals than forest carbon, are becoming increasingly popular. This increased demand has created an opportunity for corporations to cash in on the carbon credit business.

For instance, the agrochemical giant Bayer Crop Science has set up its “Bayer Carbon Program” that aims to engage farmers in “carbon-smart practices;”23 the global fertilizer giant Yara initiated and funds the Agoro Carbon Alliance , a “carbon cropping initiative” that “is creating a new solution to our carbon challenge that’s grounded in the soil.”24 The EU Carbon+ Farming Coalition brings together agrochemical giants Bayer and Syngenta, the food corporation Swiss Hero Group and the European Network EIT Foods (European Institution of Innovation & Technology).25 As a coalition, they champion carbon farming offsets as a viable climate solution.26 EIT’s members include governmental institutions, universities and corporations, such as Danone, PepsiCo and the Irish meat giant ABP.

Dairy corporations are also teaming up to develop their own carbon removal methodologies to minimize their responsibility for climate action. Dairy giants Arla, FrieslandCampina, Danone, Nestlé, Fonterra and others have partnered with the International Dairy Federation to develop their own life cycle analysis methodology to measure and certify soil carbon in their “C-sequ” project.27 This enables them to set their own accounting principles for carbon sequestration for offsetting their emissions. These methodologies could potentially be certified by the EU one day.

An EU Carbon Removal Certification Framework is a novel chance for these corporations to promote and expand their offset markets — this time, with an EU stamp of approval.

2. Corporate demands for the EU’s certified offsets

Corporate actors will likely play an outsized role in influencing the EU’s policy on agricultural carbon removals. Industry stakeholders have been pushing for such an approach even prior to the publication of the EC’s communication on carbon removals. They are eager to have the EU certify voluntary and compliance credits; they are just not aligned on the specifics of how the certification should be done.

There are two key avenues through which agribusiness and fossil fuel firms are pushing for offset credits. Agribusiness is asking for certification of voluntary offsets within their own supply chain —known as “insetting.” Fossil fuel companies that are already part of the EU’s cap-and-trade scheme, the EU ETS, are asking for EU-certified credits to be eventually integrated into this government-run compliance market. Companies involved in generating these credits — especially agrochemical giants — want to see removals become widely usable to ensure a large and stable market. The next sections provide an overview of the approaches promoted by different corporate actors.

2.1 Industrial food and farming groups demand minimum standards for voluntary “insetting” credits

Agribusiness and representatives of the EU’s industrial agricultural system are pushing for certification credits to be generated on a voluntary basis and sold on voluntary carbon markets. Voluntary actions with minimum requirements would allow agribusiness stakeholders that have thus far escaped emissions reduction targets to avoid regulatory measures to address climate change and other environmental problems.

Echoing the EC’s carbon removals communication, they contend that carbon farming should be seen as a new and additional stream of income for farmers and foresters. Copa-Cogeca, the EU’s largest “big ag” lobby group, welcomes setting “common minimum standards for the certification of carbon removals”28 and contends that “market-based carbon crediting schemes are seen as the only viable solution in the long term.”29 The Danish Dairy Board stresses that producers and potential private buyers should make a “voluntary and market-based decision on possible participation.”30 This perspective is reinforced by the agriculture ministers in the EU’s Agriculture and Fisheries Council: “it [would be] appropriate that voluntary incentives at the level of land managers are promoted to strengthen the Union’s carbon sinks by sustainably storing more carbon in agricultural, forest and other natural ecosystems and maintain the existing carbon stocks."31

Agribusiness wants to limit the use of carbon farming credits to the food and agriculture sector. In their submissions to the EC, they take note of the finite quantity of such offsets and the increasing competition with other sectors, such as the fossil fuel industry. Lobby groups such as FoodDrinkEurope and the multinational food corporation PepsiCo argue that agribusinesses should have “preferential access”32 to carbon farming credits to prevent polluters from other sectors from depleting these limited offsets. Both underscore that “the demand for carbon credits that will come from non-food companies will compete with the ability of food companies to reduce emissions within their own value chains.”33 The dairy industry’s lobby European Dairy Association (EDA) emphasizes that if offsets take place outside of the value chain, stakeholders within the food and agriculture sector might have to “achieve even more ambitious emissions reductions to achieve net-zero targets set for the sectors as well as company targets.” The EDA further states that “carbon sequestration of pastureland can offset a significant share of total dairy livestock emissions,” contending that keeping carbon removals “within the value chain” would not only prevent double-counting of carbon removals in different sectors but would also provide a major barrier to greenwashing claims.34 While this might be true for companies from other sectors, it only increases the opportunity for food companies to maintain their current polluting industrial model of production.

Although food companies have been marketing the sustainability attributes of their products for years, companies like PepsiCo now stress that they do not automatically own rights to carbon benefits or any other environmental attributes generated on their supplier farms, even if they pay a price premium. From the company’s perspective, this lack of ownership could cause food manufacturers to shift their strategy from investing in projects in their supply chain to purchasing carbon credits outside their supply chains. PepsiCo contends that this would force agribusiness to pass on “the inflationary premium cost of the carbon credit” to consumers or lead to reduced payments for their suppliers. Consequently, the company advocates that such credits should be used for insetting to “ensure that the decarbonisation of the agriculture value chain is reflected in food products.”35 According to the EU Carbon+ Farming Coalition, insetting not only “forces organizations to examine their own operations,” but also would enable these companies to profit from “climate-friendly” labels on their products increasing “the valorization of sustainable products through initiatives such as product labelling and the on-going public reporting of scheme-level emissions removals.”36 In short, consumers would pay extra for products with these labels.

Copa-Cogeca echoes these concerns about fossil fuel or other non-agriculture industries compensating for their emissions reductions with agricultural carbon credits: “agriculture, forestry and land-use sectors cannot compensate for the entirety of fossil carbon emissions from other sectors.” According to Copa-Cogeca, “carbon credits […] should not be used by the industry to offset their emissions and release them from their duty to contribute to the EU’s environmental goals.”37

2.2 Agrochemical companies want to benefit as sellers and buyers of carbon credits

Agrochemical companies such as Norwegian Yara, Swiss Syngenta and German Bayer are subject to regulations under the EU ETS since fertilizer and agrochemical production is an industrial process. These companies are also indirectly affected through the Effort Sharing Regulation (ESR), where agriculture emissions other than carbon dioxide are regulated. Nitrous oxide emissions from agricultural soils represent the second-largest share of non-CO2 agriculture emissions in the EU,38 mainly caused by intensive fertilizer and animal manure application.39

As part of the EU Carbon+ Farming Coalition, Bayer advocates for the certification of “Land Mitigation Units” to be eligible for compliance and trading use following an “evolutionary approach.” This means that during this decade, the EU should focus on creating “principles and minimum requirements” for voluntary carbon markets. Post-2030, the company advocates for an EU-wide system anchored in the EU’s Land Use and Land Use Change accounting framework (LULUCF) that is eligible for compliance and trading use under LULUCF, the ESR and the ETS. The credits should also be applicable in “any future trading framework designated for the sustainable bioeconomy.”40 Yara argues that offsetting would provide “time to innovate for sectors not able to transform their value chains at the same pace.”41 Yet, this translates to delaying urgently needed climate action.

The certification framework is a financially lucrative opportunity for the agrochemical industry to benefit from EU-approved credits. The EU’s certification of these coalitions’ carbon credits as legitimate offsets could also help reduce their need for emissions reductions.

2.3 Fossil fuel companies want to weaken EU ETS through carbon farming

Emissions of Europe’s largest fossil fuel companies such as the Netherlands’ Shell, Norway’s Equinor and Italy’s Eni are also regulated under the EU ETS. These companies have a significant interest in accessing offsets to maintain their growth while appearing to reduce emissions. The EU ETS is being revised to increase pressure on polluters by integrating more sectors into the scheme and possibly ending, or at least reducing, the distribution of free allowances by 2030.1 Carbon removal credits present a major opportunity for these big polluters to offset emissions regulated under the EU ETS.

Shell states: “Verified carbon removal units are needed to limit cumulative GHG emissions and to allow some parts of industry and various energy system services to continue operating past 2050.”42 Equinor emphasizes that there should be “a single type of certificate…, which can be more easily traded and counted towards incentives or targets for emissions and removals in different sectors.”43 That way, permanent fossil fuel emissions could be offset through impermanent land-based removals, contributing to absolute increases in carbon emissions. This reinforces climate scientists’ concerns that the existing, yet limited potential of carbon sequestration in land sinks mainly indicates the depletion on land carbon sinks that resulted from past land use. Land does not serve as a sink for the level of fossil emissions that need to be addressed.44

In line with Eni and Shell, the International Emissions Trading Association (IETA) — a powerful emissions trading lobby group — stresses the need for rapid integration of carbon removals into the ETS, not later than 2030. The EC’s communication on carbon removals reflects this timeline. An IETA representative argued that early integration of carbon removals into the ETS would be necessary to ensure adequate demand.45 Shell echoes these concerns, stating that removals need to be integrated into the ETS much earlier than 2050 “to ensure there is enough available when net-zero is required.” The aim is for these removal offsets to kick in when free allowances under the ETS are phased out, or as Shell puts it, when “the allowance decline pathway first crosses the actual decline in emissions pathway.”46 In short, offsets are needed to keep from actually reducing fossil fuel production and, hence, emissions.

2.4 EC’s carbon removal certification framework could boost global carbon offsets

The EC states that the certification framework will apply to the EU only. Yet, the mechanism is envisioned to serve as a blueprint for international carbon offset trading. The European fossil fuel industry sees this as a promising way forward: Equinor states that carbon certificates must “consider the rules of Article 6 of the Paris Agreement” to enable “cross-border fungibility of negative emission credits.”47 The EU Carbon+ Farming Coalition — dominated by global agrochemical companies — similarly demands a “transition towards a robust international market for carbon credits in the future,” arguing that such a market “could permit the scale, market confidence and value creation required to drive the transition at the pace needed to achieve European and global climate objectives.”48 Brussel’s largest food industry lobby group, FoodDrinkEurope, also envisions the certification framework “ideally contribut[ing] to carbon markets globally.”49

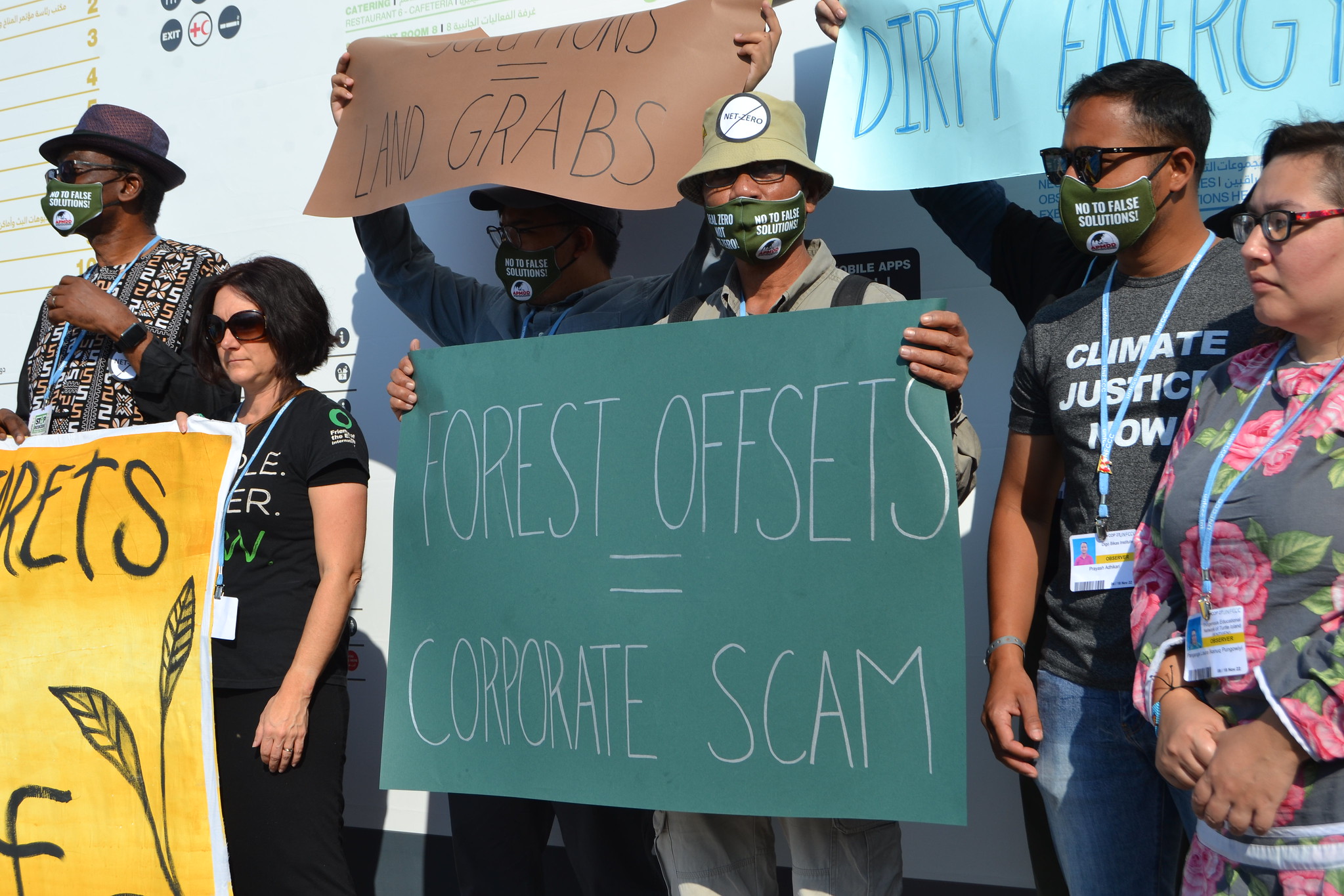

This could enable the trade of EU carbon farming offsets on international markets and vice versa, leading to double-counting of emissions reductions or removals in the national inventories of both the origin and the buyer country50 and worsening land grabbing. Serious climate justice concerns, human rights violations, threats to the livelihoods of local communities and land grabbing have been documented from international land-based offset schemes, such as REDD+ for numerous cases.51

Protesters at COP27. Photo by Friends of the Earth International, used under creative commons license.

2.5 Public funds diverted to carbon markets instead of direct support for agricultural transition

In various corporate submissions, opinions on the role of public finance in carbon farming, especially payments from the Common Agriculture Policy (CAP), diverged between the farm lobby and agrochemical and other food and beverage companies. The CAP provides support largely to large-scale farming with a 59.3-billion-euro budget in 2022 for EU agriculture support. CAP funds enable agribusiness to pay farmers below the cost of production with the public payments filling the income gap. The farm lobby appears to not want CAP funds to be diverted from that purpose because public payments allow companies to maintain their profits.

Copa-Cogeca argues that CAP funds, “cannot directly reward ecosystem services in a proper manner.”52 The lobby group argues that carbon farming should lead to the creation of an additional income stream for farmers. Besides, using CAP funds for carbon farming credits could lead to WTO challenges, they argue.53 Similarly, the German big ag farm lobby Deutscher Bauernverband noted that the CAP is not apt to support additional climate services in the long term.54

In contrast, various agrochemical, food and beverage actors, including Yara’s Agoro Carbon Alliance,55 the Carbon+Farming Coalition, Bayer, PepsiCo and the European Dairy Association identified the possible or necessary role of public funding in the carbon farming scheme to fill financial gaps.

These companies’ submissions stress the role that public finance will play to help farmers meet the costs of implementing carbon farming practices and to reduce financial risk. They argue that both private and public funding would be needed to scale up carbon farming. The Agoro Carbon Alliance states that “the share of the CAP in the total funding needed for the implementation of carbon farming practices might be substantial.”56 PepsiCo affirms that “a carbon credit mechanism can be a powerful tool to trigger… change but [farmers] will also need parallel support such as financing via the Common Agricultural Policy (CAP) to invest in that change in the first place.”57 Along the same lines, Bayer emphasizes that CAP payments “will stay relevant in the future, including with a view to financing transition costs connected to carbon farming. System changes may lead to temporary declines in economic return hampering farmers to adopt these changes.” The company adds that there would be an “obvious need for co-funding to get to the desired results.”58

IATP has documented that carbon credits are costly to set up with high risk and thus ill-suited for farmers to make a transition to climate-friendly practices.59 These corporate submissions confirm how high the costs would be for farmers to become part of carbon farming credit schemes. Corporations are advocating for diverting CAP funds to set up risky carbon markets. Instead, CAP money could be far better spent directly supporting farmers to transition to agroecological practices instead of supporting industrial agriculture. The CAP has the instruments, the budget and the enormous potential to be a game changer for sustainable farming in Europe in and of itself.

3. A wide scope of certification for a large supply of offsets

A carbon removal framework should provide a precise and scientifically grounded definition of carbon removal. Crucially, it must delineate between carbon removals and the broad and diffuse concept of carbon farming. However, industry actors see this as an opportunity to include different kinds of accounting tricks that would increase their possibilities to offset their emissions and greenwash their operations. This section looks at different industry proposals that could further muddy the waters of the conversation instead of bringing clarity.

3.1 Carbon farming vs. carbon removals: need for delineation instead of conflation

Corporations are advocating for a wide scope of what can be certified in the legislative framework, including emissions reductions, avoided emissions, emissions intensity reduction and carbon removals. Such a wide scope would increase the supply of available offsets, offering companies more choices to offset a larger share of their emissions.

For instance, Copa-Cogeca advocates for credits for emissions reductions and carbon sequestration, as well as for carbon storage.60 By making this distinction, the lobby group appears to admit that carbon sequestration in ecosystems is not equal to permanent carbon storage. The EU Carbon+Farming Coalition suggests the framework should include both emission reductions and carbon sequestration, as both are “contributing to the decrease of atmospheric carbon.”61 Such statements are entirely misleading as removals might reduce the concentration of atmospheric carbon, but emissions reductions only lead to fewer emissions being added to the atmosphere (see Box 1). PepsiCo advocates for incentivising emissions reductions in farming practices “to achieve a climate neutral land sector by 2035.”2,62 Food Drink Europe,63 PepsiCo, the Danish Dairy Board,64 the European Dairy Association65 and agrochemical company Syngenta66 advocate for crediting systems that would also reward avoided emissions through past practices that “keep… carbon in the soil.”67

While carbon sequestration, avoiding and reducing emissions all have a role to play in the land sector’s contribution to climate mitigation, it would be dangerous to certify and trade them all as offsets under a single framework (see Box 1) — especially a framework that was supposed to exclusively deal with real carbon removals. Still, the proposal of a more expansive definition of carbon farming incentives3 and certification framework also received support from the EU Council, which calls for an assessment of “the potential implications of broadening the scope of the EU regulatory framework for the certification of carbon removals to agricultural GHG emission reduction, including an increased incentive for land managers to reduce GHG emissions at farm level.”68

For the sake of the integrity of any definition of carbon removals, the European Commission needs to clearly distinguish between the broad concept of carbon farming and a clear, narrow definition of permanent carbon removals though corporate interests push in the opposite direction.

3.2 More offsets through inflated baselines

To accurately determine if carbon has been sequestered in soils or if emissions from soils have been reduced, it is crucial to set a reasonable baseline. Meaningful baselines refer to a level of emissions or carbon stocks, either in the past or at the starting point before implementing a measure. Yet, some companies inflate their climate action by referring to projections of a future baseline predicated on a business-as-usual scenario. Equinor, for example, argues that credits should be issued if the project diverts from a “business-as-usual scenario” in the future.69 This practice essentially creates credits based on how much less someone has polluted compared to the future projection of emissions levels. Similar to the UNFCCC instrument to reduce emissions from deforestation and forest degradation — REDD and REDD+ — inflated baselines lead to an overstatement of claimed emissions reductions.70 More offsets become than if they had been created from past baselines. Companies like Nestlé also use this strategy to inflate their actual climate action in their sustainability reporting (Figure 3).71

Figure 3: Nestlé’s carbon reduction targets using their projected 2030 business-as-usual emissions as the baseline rather than their actual emission numbers from 2018. Source: Nestlé, “Accelerate, Transform, Regenerate: Nestlé’s Net Zero Roadmap,” 2021, p. 12.

3.3 Credits for avoided emissions through “smart intensification” using agrochemicals

Agrochemical companies have long advocated for so-called “sustainable intensification” to improve “land use efficiency.”72 Aside from expanding their role as carbon credit aggregators themselves, they could benefit from a broad scope of certification by ensuring a space for their products in future agricultural systems. Actors like the German Industrieverband Agrar — which represents global players such as BASF, Bayer and Syngenta — and Yara also advocate for the recognition of avoided emissions in the EU’s carbon removal framework based on the rationale that intensification leads to less land use change.

Industrieverband Agrar, for example, emphasises the role of the intensity of tillage on the soil carbon content.73 Reduced tillage and increasing yields on the other hand are often based on increased use of pesticides and fertilizers. The lobby group contends that mineral fertilizers, nitrogen efficiency measures, pesticides or precision agriculture would allow not only upscaling productivity on farming land but also increasing root mass and crop residues, which add soil carbon. In return, these effects would permit the “conversion of less productive agricultural systems into grasslands or forests and the restoration of peatlands.”74 Yara stresses that carbon farming should acknowledge that “the use of mineral fertilizer… has increase[d] crop yield per ha and in turn prevented GHG emissions… from land use change for agriculture.”75 In contrast, agrochemical companies’ approach to organic fertilizers is dismissive. Bayer proposes that manure or compost that is used to increase soil organic carbon content should be considered carbon that has been moved, not removed from the atmosphere.76

In addition, these companies suggest that agricultural non-CO2 emissions could be avoided through other agrochemical products that they produce and market. These products include nitrogen inhibitors and biostimulants that are intended to reduce the level of nitrous oxide emissions caused by fertilizer application on soils, as well as new additives for manure storage.77 Yara also contends that the use of agrochemicals efficiently leads to lower emissions intensity for growing crops and animals compared to national or regional averages and thus should be rewarded as “low-emitting farm activities.”78 A leaked text of the EC’s proposal suggests that carbon farming credits could be derived from such baselines, both for avoided emissions and emissions intensity reductions (see Box 2).

3.4 Feed additives, biogas and more: preferences of the industrial livestock sector

Similarly, the European dairy sector emphasises its progress in improving its “carbon footprint per produced unit of milk,”79 thus, decreasing emissions intensity. These reductions are usually achieved through further intensification of production and technological improvements. Accordingly, the European Dairy Association affirms that the definition of carbon farming practices should “be broad enough to cover activities in all EU member states”80 and stresses in line with the Danish Dairy Board that the scope of carbon farming “should be extended to include intensive farming practices and animal sectors that have a positive climate impact.”81 Possible practices for certification could include feed additives or manure management that are intended to reduce the methane emissions from industrial livestock production.82 Such measures are allowed for certification, for example, in the French carbon offset scheme, Label Bas Carbone, run by the French government. Under the French presidency of the EU Council, the former French Agriculture Minister Julien Denormandie promoted the French scheme in the EU Council as a potential model for the certification framework.83 Rewarding emissions intensity reductions in the absence of absolute cuts also perpetuate industrial intensive livestock production that continues to lead to various harmful environmental, social and health impacts beyond climate change (see Box 2).

BOX 2: Emissions intensity: improvements can still lead to increasing emissions

Many fertiliser and livestock companies have set climate targets that are limited to emissions intensity reductions. Emissions intensity is emissions per litre or kilogram of meat, milk or fertiliser. Bayer emphasizes that it has “committed to help reduce our customers’ in-field GHG emissions in major agricultural markets by 30% per kilogram of crop yield by 2030.”84 The research in our Emissions Impossible Europe report shows that many of the top 20 European meat and dairy companies with climate targets, including the pork giant Danish Crown, Swedish Arla and Danone, have set emissions intensity targets for their supply chain emissions.85 Supply chain emissions in the livestock sector stem mainly from the animals themselves and represent upward of 90% of these companies’ livestock-related emissions. As long as these emissions intensity reductions fail to lead to cuts in total emissions, reductions in “per unit” emissions are meaningless. If total production levels continue to increase, total or “absolute” emissions will continue to rise even as emissions intensity is reduced (Figure 4).

Figure 4: Emissions Intensity

4. Industry brushes aside concerns about measurement and reversibility of land-based carbon sequestration

The EC communication and various industry submissions acknowledge that there are trade-offs involved in existing agriculture Monitoring, Reporting and Verification (MRV) protocols used for the certification of carbon credits. The industry calls on the EC to “find the right balance between requirements ensuring credible and reliable certificates and those driving costs (such as extensive monitoring and insurance programs).”86 However, they gloss over major issues that make soil carbon sequestration unsuitable for certification as a carbon removal. These include reversibility and non-permanence of carbon sequestration on land; the lack of certainty about the amount of carbon that has been sequestered and if that carbon sequestration has been additional to what would have taken place in any case; as well as the question about who is liable for the loss and reversal of carbon sequestration during a project period.

The EC and industry appear to consider those issues to be resolvable through technological innovations, like remote sensing and modelling, and accounting schemes. The following sections highlight a selection of critical issues related to the MRV of carbon credits and how companies envision solving them.

4.1 Industry tactics to avoid issue of permanence

Permanence is maybe the single most critical issue concerning land-based carbon offsets. The IPCC stressed that land-based carbon sequestration is vulnerable to natural disturbances, human actions and the effects of the climate crisis itself.87

Yet, according to Syngenta, reversibility and impermanence of land-based sequestration are problems associated with how a private market is set up. The company suggests that the EU could ensure “long-term permanence”88 by not only incentivizing carbon removals but by also paying for the avoidance of the release of sequestered carbon. Such a notion ignores the fact that soil carbon sequestration is likely to be reversed due to factors outside of a farmer’s control, e.g., drought, flooding, fires or even rising temperature. The proposed solution might disincentivize farmers to actively apply practices that lead to reversals, but it does not address reversibility itself. In contrast, Bayer downplays permanence by stating that soil organic carbon pools are naturally variable: while growing crops leads to short-term reversals of soil carbon through harvesting and natural disturbances, it would “not necessarily impact long-term removal.”89

Others, like Rabobank,90 Copa-Cogeca,91 Yara’s Agoro Carbon Alliance,92 Bayer93 or the fossil fuel company Eni,94 propose to use accounting mechanisms to solve the non-permanence issue at least in their carbon accounting methodology. These include insurance and buffer systems that are meant to compensate for “future released emissions”95 in case of the reversal of credited carbon sequestration, using ton-year accounting4,96 or “flexible longevity thresholds of 5, 10, and 15 years.”97 Shell advocates for applying a concept of “expected permanence”98 without further definition. However, accounting mechanisms are unable to deal with the climate impact of generating carbon credits from impermanent removals. In case of a reversal of the carbon sequestration, both the reversed sequestration and the legitimized greenhouse gases would be released into the atmosphere.

Recognizing these issues, PepsiCo wants assurance regarding liability related to the loss of carbon from credits purchased. It argues that “carbon credits must represent emissions reductions or removals that will not be reversed after the issuance of that unit. Any reversal should be accounted for by the landowner5 by paying back the credit lost at the price of the carbon at the moment of the reversal.”99 In essence, PepsiCo is advocating that land managers be held accountable for any liability for the loss of carbon for any certified credit purchased.

4.2 Simple MRV at the cost of rigorous measurement

While costly, direct soil sampling is the most reliable way of measuring soil carbon. Even this method, however, delivers variability in results between samples and neighbouring plots.100 Yet, industry stakeholders, such as Bayer, disregard this reality and contend that direct sampling is “cost prohibitive at scale.”101 To address the costs, actors like Bayer, Agoro Carbon Alliance and the EU Carbon+Farming Coalition call for a hybrid system of modelling and direct sampling combined with other technological innovations that do not exist yet.102

The EC and industry stakeholders suggest that certification must be simple, cheap and robust at the same time, thereby not generating “an unnecessary administrative and economic burden for farmers and foresters.”103 A study of the non-profit organisation CarbonPlan on existing agriculture MRV protocols suggests that carbon farming methodologies can either be robust and costly or simple and cheap at the cost of real climate impact.104 CarbonPlan concluded that in existent MRV protocols the “lack of rigorous standards makes it hard to ensure good climate outcomes.”105

Yara’s Agoro Carbon Alliance contends that the lower accuracy in measurement of hybrid models would be “compensated by an overall net volume increase in removals,”106 which, per Yara’s logic, would ensure an overall increasing net sink. Copa-Cogeca circumvents the uncertainty of measurement altogether by advocating for certifying “carbon farming practices” rather than “carbon credits.” The group contends that certification of carbon farming practices would enable farmers to generate credits based on “an evaluation of the estimated environmental gains generated through the implementation of a specific carbon farming practice.” The farm lobby group seems to suggest that actual measurement would not be necessary; however, the EC could set up proxies for the quantification of soil carbon sequestration.107 For instance, a methodology could assume that practising no-tillage on one hectare of land results in a certain amount of carbon sequestered by default. The farmer would be paid based on the credits generated through this default sequestered amount and baselines generated from more assumptions about how much the average local or regional practice sequesters. In essence, the certification would be based on assumptions (and not on actual measurements) about how much the average practice sequesters in contrast to how much the credited practice will sequester in addition.

To date, the EC plans to create their own methodologies for the certification of carbon removals but considered the accreditation of already existing methodologies as another possible avenue. The latter option is supported, for instance, by the Agoro Carbon Alliance. They suggest setting up a “framework for the flexible implementation of the various modelling approaches” that is not determined by the EC but provided by private companies. From their perspective, these might be less accurate but more cost efficient.108 Thus, “different models for modelling SOC could be accepted for use without being proved in all cases by peer reviewed scientific publications.”109 The accreditation of methodologies developed by the same companies that want to use offsets themselves or operate as carbon credit aggregators might reduce costs for the European Commission but will unlikely contribute to the needed integrity and reliability of those schemes.

5. Conclusion

The planned legislation leaves a multitude of open questions and poses great risks to climate ambition in the EU. The complexity and technicality of discussions about carbon farming leaves key stakeholders, including food growers, food workers, land managers and civil society, largely out of the process. Carbon farming is a critical part of the proposed carbon removal certification framework. The powerful and outsized representation of agribusiness and fossil fuel corporations in this process put the EU on a dangerous trajectory, opening the floodgates for offsets, watering down compliance targets and allowing companies to greenwash their operations. The initiative diverts critical public human and financial resources away from the urgent task of emissions reductions. Financing that would go towards setting up these carbon farming offsets that benefit big polluters would be far better utilised for directly supporting farmers toward an agroecological transition. The European Commission must not be fooled by the industry proposals that would be disastrous not only for the climate and biodiversity but would also hamper a transformation of the EU’s agricultural system.

Agricultural practices that restore soil carbon must be one part of the restoration of agricultural ecosystems and a wider transformation of the sector to agroecology. Activities that sequester carbon in land sinks must be rewarded without the problematic creation of risky carbon credits. Biodiversity, climate adaptation and resilience must be non-negotiable objectives of these practices; their climate mitigation potential is a valuable addition, not the other way around.

Photo of Phacelia tanacetifolia cover crop by Gilles San Martin, used under creative commons license.

Footnotes

1. The EU ETS is in trilogue negotiations between the European Commission, the European Parliament and the European Council at the moment of publication of this report. Among others, it is being discussed when, how and under which conditions free emissions allowances (emissions permits) might be (partially) phased out from the EU ETS to raise its ambition to meet the 55% net emissions reduction target that the European Union set in 2021.

2. In the context of the revision of the EU climate legislation to adapt it to the EU’s 55% net emissions reduction goal, the EC proposed in 2021 the creation of a combined land use, forestry and agriculture sector (AFOLU), with the goal to achieve climate neutrality in that combined sector by 2035. So far, non-CO2 agriculture emissions have been kept separate under the Effort Sharing Regulation. This EC proposal was deleted in the co-decision process that was finalized in November 2022. (European Commission, “Proposal for a Regulation of the European Parliament and of the Council amending Regulations (EU) 2018/841 as regards the scope, simplifying the compliance rules, setting out the targets of the Member States for 2030 and committing to the collective achievement of climate neutrality by 2035 in the land use, forestry and agriculture sector, and (EU) 2018/1999 as regards improvement in monitoring, reporting, tracking of progress and review,” 14 July 2021 https://eur-lex.europa.eu/resource.html?uri=cellar:ea67fbc9-e4ec-11eb-a1a5-01aa75ed71a1.0001.02/DOC_1&format=PDF)

3. Bayer argues that there should be no certification of avoided emissions/maintenance of existing carbon stocks within the carbon farming and carbon removals framework. Yet, it should be rewarded differently and not disregarded.

4. “Ton-year accounting refers to a family of techniques for calculating how many tons of temporarily stored CO₂ are physically equivalent to avoiding the emission of CO₂ in the first place. A central idea in ton-year accounting is that the climate impacts of CO₂ can be characterized by the quantity of CO₂ involved and the time it resides in the atmosphere. Within this framework, a larger quantity of CO₂ stored for a shorter period of time and a smaller quantity of CO₂ stored for a longer period of time can claim equivalent climate outcomes.” (CarbonPlan, “Unpacking ton-year accounting,” 31 January 2022, https://carbonplan.org/research/ton-year-explainer (accessed July 10, 2022)).

5. In many cases the land manager is not the owner of the land on which carbon removal projects might be conducted. In many regions of the EU, farmers rent land for their farming activities.

Endnotes

1. European Commission, “Communication from the Commission to the European Parliament and the Council: Sustainable Carbon Cycles,” 15 July 2021, https://ec.europa.eu/clima/system/files/2021-12/com_2021_800_en_0.pdf (accessed July 10, 2022).

2. Nestlé, “Accelerate, Transform, Regenerate: Nestlé’s Net Zero Roadmap,” 2021, https://www.nestle.com/sites/default/files/2020-12/nestle-net-zero-roadmap-en.pdf (accessed July 10, 2022).

3. Bayer, “This Is How We Protect The Climate,” https://www.bayer.com/en/sustainability/climate-protection (accessed July 10, 2022).

4. Shell, “Our Climate Target,” https://www.bayer.com/en/sustainability/climate-protection (accessed July 10, 2022).

5. Eni, “Reducing greenhouse gas emissions,” https://www.eni.com/en-IT/low-carbon/ghg-emission-reduction.html (accessed July 10, 2022).

6. New Climate Institute & Carbon Market Watch, “Corporate Climate Responsibility Monitor,” February 2022, https://newclimate.org/resources/publications/corporate-climate-responsibility-monitor-2022 (accessed July 27, 2022).

7. European Commission, “Communication from the Commission to the European Parliament and the Council: Sustainable Carbon Cycles”

8. IPCC, “Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change,” 2022, [P.R. Shukla, J. Skea, R. Slade, A. Al Khourdajie, R. van Diemen, D. McCollum, M. Pathak, S. Some, P. Vyas, R. Fradera, M. Belkacemi, A. Hasija, G. Lisboa, S. Luz, J. Malley, (eds.)]. Cambridge University Press, Cambridge, UK and New York, NY, USA. doi: 10.1017/9781009157926IPCC AR6 WG III (Chapter 12, pp.12-38)

9. IPCC, “Summary for Policymakers Headline Statements,” 04 April 2022, https://www.ipcc.ch/report/ar6/wg3/resources/spm-headline-statements/ (accessed August 16, 2022).

10. IPCC, “Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change,” 2021, [Masson-Delmotte, V., P. Zhai, A. Pirani, S.L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M.I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J.B.R. Matthews, T.K. Maycock, T. Waterfield, O. Yelekçi, R. Yu, and B. Zhou (eds.)]. Cambridge University Press. In Press. (Chapter 5, p. 63); Crowther, T.W., Todd-Brown, K.E., Rowe, C.W., Wieder, W.R., Carey, J.C., Machmuller, M.B., Snoek, B.L., Fang, S., Zhou, G., Allison, S.D. and Blair, J.M., “Quantifying global soil carbon losses in response to warming,” 2016, Nature, 540(7631), pp.104-108, https://www.nature.com/articles/nature20150?cookies=accepted; Pellegrini, A.F.A., Ahlström, A., Hobbie, S.E., Reich, P.B., Nieradzik, L.P., Staver, A.C., Scharenbroch, B.C., Jumpponen, A., Anderegg, W.R.L., Randerson, J.T., Jackson, R.B., “Fire frequency drives decadal changes in soil carbon and nitrogen and ecosystem productivity,” 2018, Nature 553, 194–198, https://doi.org/10.1038/nature24668; Melillo, J.M., Frey, S.D., DeAngelis, K.M., Werner, W.J., Bernard, M.J., Bowles, F.P., Pold, G., Knorr, M.A. and Grandy, A.S., “Long-term pattern and magnitude of soil carbon feedback to the climate system in a warming world,” 2017, Science, 358(6359), pp.101-105, https://harvardforest.fas.harvard.edu/sites/default/files/Melillo%20et%20al_Science_101.full.pdf; Nottingham, A.T., Whitaker, J., Ostle, N.J., Bardgett, R.D., McNamara, N.P., Fierer, N., Salinas, N., Ccahuana, A.J., Turner, B.L. and Meir, P., “Microbial responses to warming enhance soil carbon loss following translocation across a tropical forest elevation gradient,” 2019, Ecology Letters, 22(11), pp.1889-1899. https://onlinelibrary.wiley.com/doi/pdf/10.1111/ele.13379?casa_token=xjyWi_YP2HgAAAAA:k-vLkdrVlrqx0zdlT3pDSdgcppUbQPFiE0zfIswnINEHeTAzOhrYjE94hG6kY-wSGPzkJnfda1E37wE; Soong, J.L., Castanha, C., Hicks Pries, C.E., Ofiti, N., Porras, R.C., Riley, W.J., Schmidt, M.W. and Torn, M.S., “Five years of whole-soil warming led to loss of subsoil carbon stocks and increased CO2 efflux,” 2021, Science advances, 7(21), p.1343. https://www.science.org/doi/full/10.1126/sciadv.abd1343

11. Mackey, B., Pentrice, I.C., Steffen, W., House, J.I., Lindenmayer, D., Keith, H. & Berry, S., “Untangling the confusion around land carbon science and climate change mitigation policy,” 2013, Nature Climate Change, 3(6), pp.552-557. https://www.nature.com/articles/nclimate1804

12. European Commission, “Communication from the Commission to the European Parliament and the Council: Sustainable Carbon Cycles,” p.20.

13. Ibid., p.22.

14. Friends of the Earth International, “Fossil Futures Built on a House of Cards,” July 2022, https://www.foei.org/wp-content/uploads/2022/06/Fossil-futures-built-on-a-house-of-cards_report-2022.pdf (accessed July 10, 2022).

15. IPCC, “AR6 WGIII Annex I: Glossary,” 2022 [van Diemen, R., Matthews, J.B.R., Möller, V., Fuglestvedt, J.S., Masson-Delmotte, V., Méndez, C., Reisinger, A., Semenov, S.] https://report.ipcc.ch/ar6wg3/pdf/IPCC_AR6_WGIII_Annex-I.pdf, pp. I-33.

16. Shell, “Voluntary Carbon Credits,” https://www.shell.com/business-customers/trading-and-supply/trading/shell-energy-europe/clean-energy-solutions/voluntary-carbon-credits.html?gclid=Cj0KCQjwz96WBhC8ARIsAATR251Zs3rL3eOsDiJwabgvVbl5ogN-c3gZhUQdSd4SqMf1QRU3H5U8GD4aAlc3EALw_wcB (accessed August 16, 2022).

17. Carbon Market Watch, “EU ETS 101. A beginner’s guide to the EU’s Emissions Trading System,” February 2022, https://carbonmarketwatch.org/wp-content/uploads/2022/03/CMW_EU_ETS_101_guide.pdf p.12 (accessed November 8, 2022).

18. Adam Morton, “Australia’s carbon credit scheme ‘largely a sham’, says whistleblower who tried to rein it in,” 23 March 2022, https://www.theguardian.com/environment/2022/mar/23/australias-carbon-credit-scheme-largely-a-sham-says-whistleblower-who-tried-to-rein-it-in (accessed July 27, 2022).

19. Shell, “Shell Environmental Products’ Project Portfolio,” https://www.shell.com/shellenergy/othersolutions/welcome-to-shell-environmental-products/shell-global-portfolio-of-emissions-reduction-projects.html#iframe=L3dlYmFwcHMvMjAxOV9FUFRCLw (accessed July 10, 2022).

20. Nestlé, “Accelerate, Transform, Regenerate: Nestlé’s Net Zero Roadmap,” p.37.

21. Carbondirect, “Assessing the State of the Voluntary Carbon Market in 2022,” 06 May 2022, https://carbon-direct.com/2022/05/assessing-the-state-of-the-voluntary-carbon-market-in-2022/ (accessed July 27, 2022).

22. Friends of the Earth International, “Fossil Futures Built on a House of Cards.”

23. Bayer, “Bayer launches its decarbonization program for agriculture in Europe,” 29 June 2021, https://media.bayer.com/baynews/baynews.nsf/id/Bayer-launches-its-decarbonization-program-for-agriculture-in-Europe (accessed July 10, 2022).

24. Agoro Carbon Alliance, “About us,” https://agorocarbonalliance.com/about-us (accessed July 27, 2022).

25. World Economic Forum, “EU Carbon+ Farming Coalition,” https://www.weforum.org/projects/eu-carbon-farming-coalition (accessed July 10, 2022).

26. EIT Food, “Partners,” https://www.eitfood.eu/partners (accessed July 10, 2022).

27. International Dairy Federation, “C-sequ Life cycle assessment guidelines for calculating carbon sequestration in cattle production systems” September 2022, in: Bulletin of the IDF No. 519/2022, https://cdn.shopify.com/s/files/1/0603/5167/6609/files/Bulletin_of_IDF_B519_CSequ_Life_cycle_assessment_guidelines_for_calculating_carbon_sequestration_in_cattle_production_systems_CAT_d27849b4-519c-4951-8a6c-108db7cba6ea.pdf?v=1663055790 (accessed November 21, 2022).

28. Copa Cogeca, “Draft Copa-Cogeca Reflection Paper on the Certification of Carbon Removal,” 01 May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3253942_en p. 1 (accessed July 10, 2022).

29. Copa Cogeca, “Draft Copa-Cogeca’s answer to the Roadmap on “Restoring sustainable carbon cycles,” 05 October 2021, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13066-Climate-change-restoring-sustainable-carbon-cycles/F2678798_en p.1 (accessed August 16, 2021).

30. Danish Dairy Board, “Feedback from: Danish Dairy Board Brussels s.a.,” 27 April 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3250525_en p.1 (accessed August 16, 2022).

31. Council of the European Union, “Council conclusions on the Commission communication on sustainable carbon cycles in the agricultural and forestry sectors,” 04 April 2022, https://data.consilium.europa.eu/doc/document/ST-7728-2022-INIT/en/pdf p.4 (accessed July 10, 2022).

32. Food Drink Europe, “FoodDrinkEurope contribution to the public consultation on EU rules for a certification of carbon removals,” 02 May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3254509_en p.2 (accessed July 10, 2022).

33. Ibid.

34. European Dairy Association, “Certification of carbon removals – EU rules: EDA feedback to the Commission’s call for evidence,” https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13066-Climate-change-restoring-sustainable-carbon-cycles/F2679101_en p.1 (accessed July 10, 2022).

35. PepsiCo, “PepsiCo’s position on the European Commission’s call for evidence for an impact assessment on the certification of carbon removals,” 29 April 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3251812_en p.4 (accessed July 10, 2022).

36. EU Carbon+ Farming Coalition, “Certification of Carbon Removals – Response to Call for Evidence,” 02 May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3254530_en p.11 (accessed July 10, 2022).

37. Copa Cogeca, “Feedback from: COPA-COGECA,” 01 May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3253926_en (accessed July 10, 2022).

38. European Environment Agency, “Greenhouse Gas Emissions from Agriculture in Europe,” 15 December 2021, https://www.eea.europa.eu/ims/greenhouse-gas-emissions-from-agriculture (accessed July 10, 2022).

39. Wang, C., Amon, B., Schulz, K., & Mehdi, B., “Factors That Influence Nitrous Oxide Emissions from Agricultural Soils as Well as Their Representation in Simulation Models: A Review,“ Agronomy, 2021, 11, 770, https://mdpi-res.com/d_attachment/agronomy/agronomy-11-00770/article_deploy/agronomy-11-00770-v2.pdf?version=1618481302.

40. Bayer, “Bayer contribution Call for Evidence for an Impact Assessment for an EU Regulation for the Certification of Carbon Removals,” 29 April 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3251804_en p.4 (accessed August 16, 2022).

41. Yara, “Reply to the Roadmap Consultation: Restoring Sustainable Carbon Cycles,” 07 October 2021, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13066-Climate-change-restoring-sustainable-carbon-cycles/F2679083_en p.3 (accessed July 10, 2022).

42. Shell, “Shell response – Call for Evidence: Carbon Removals Certification – EU Rules,” 01 May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3253818_en p.1 (accessed July 10, 2022).

43. Equinor, “Equinor Response to EU Commission Roadmap on Restoring Sustainable Carbon Cycles,” 07 October 2021, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13066-Climate-change-restoring-sustainable-carbon-cycles/F2679484_en p.2 (accessed July 10, 2022).

44. Mackey, B., Prentice, I.C., Steffen, W., House, J.I., Lindenmayer, D., Keith, H. and Berry, S., “Untangling the confusion around land carbon science and climate change mitigation policy,” 2013, Nature climate change, 3(6), pp.552-557, https://www.nature.com/articles/nclimate1804

45. International Emissions Trading Agency, Statement in European Commission “Conference on Sustainable Carbon Cycles” in Panel “Plenary Session III: High expectation from society on carbon removals,” 31 January 2022, https://ec.europa.eu/clima/news-your-voice/events/conference-sustainable-carbon-cycles_en (accessed July 10, 2022).

46. Shell, “Shell response – Restoring Sustainable Carbon Cycles,” 07 October 2021, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13066-Climate-change-restoring-sustainable-carbon-cycles/F2678789_en p.1 (accessed August 16, 2022).

47. Equinor, “Equinor Response to EU Commission Roadmap on Restoring Sustainable Carbon Cycles,” p.2.

48. EU Carbon+ Farming Coalition, “Certification of Carbon Removals – Response to Call for Evidence,” p.6.

49. Food Drink “FoodDrinkEurope contribution to the public consultation on EU rules for a certification of carbon removals,” p.1.

50. Schneider, L., Duan, M., Stavins, R., Kizzier, K., Broekhoff, D., Jotzo, F., Winkler, H., Lazarus, M., Howard, A., Hood, C., „Double counting and the Paris Agreement rulebook: Poor emissions accounting could undermine carbon markets,” 11 October 2019, Science, 366 (6462), pp. 180-183 https://scholar.harvard.edu/files/stavins/files/double_counting_science_policy_forum_october_2019_published_version.pdf (accessed August 16, 2022.)

51. e.g., Carbon Trade Watch, “Protecting carbon to destroy forests: Land enclosures and REDD+,” April 2013, https://www.tni.org/files/download/redd_and_land-web.pdf (accessed July 10, 2022); Bonilha, P., “Lideranças Paiter suruí Pedem Extinção de Projeto de Carbono com a natura: CIMI. Conselho Indigenista Missionário,” 12 January 2015, https://cimi.org.br/2015/01/36894/https://cimi.org.br/2015/01/36894/ (accessed July 12, 2022); Lithgow, M., “Analyzing the Environmental Injustices of Carbon Offsetting: The Limits of the California-REDD+ Linkage,” March 2017, https://library2.smu.ca/bitstream/handle/01/26934/Lithgow_Matthew_MASTERS_2017.pdf?sequence=1&isAllowed=y (accessed July 12, 2022); De Haldevang, M., “BP Paid Rural Mexicans a “Pittance” for Wall Street’s Favorite Climate Solution,” 27 June 2022 https://www.bloomberg.com/features/2022-carbon-offset-credits-mexico-forest-bp/ (accessed July 12, 2022); Oakland Institute, “Evicted for carbon credits: Norway, Sweden, and Finland displace Ugandan farmers for Carbon Trading,” 14 October 2020, https://www.oaklandinstitute.org/evicted-carbon-credits-green-resources (accessed July 12, 2022).

52. Copa Cogeca, “Draft Copa Cogeca’s answer to the Roadmap on Restoring sustainable carbon cycles,” p.2.

53. Ibid.

54. Deutscher Bauernverband, “Kurzstellungnahme des Deutschen Bauernverbandes zur Initiative, Certification of carbon removals – EU rules,” May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3254660_en p.2 (accessed August 16, 2022).

55. Agoro Carbon Alliance, “AGORO Carbon Alliance’s response to the EU Commission’s call for evidence on the Certification of Carbon Removals,” May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3254497_en (accessed July 10, 2022).

56. Agoro Carbon Alliance, “AGORO Carbon Alliance’s response to the EU Commission’s call for evidence on the Certification of Carbon Removals,” p.5.

57. PepsiCo, “PepsiCo’s position on the European Commission’s call for evidence for an impact assessment on the certification of carbon removals,” p.3.

58. Bayer, “Bayer contribution Call for Evidence for an Impact Assessment for an EU Regulation for the Certification of Carbon Removals,” p.12.

59. Institute for Agriculture and Trade Policy, “Lessons for the EU’s carbon farming plans: Structural flaws plague U.S. agriculture carbon credits,” June 2022, https://www.iatp.org/sites/default/files/2022-06/2022_05_23_USLessons_CarbonMarkets4%20%281%29.pdf (accessed August 16, 2022); Institute for Agriculture and Trade Policy, “Rethinking the EU’s approach to carbon removals and agriculture,” 12 May 2022, https://www.iatp.org/blog/202205/rethinking-eus-approach-carbon-removals-and-agriculture (accessed August 16, 2022); Institute for Agriculture and Trade Policy, “A false solution: Why carbon markets don’t work for agriculture,” 05 February 2020, https://www.iatp.org/blog/202002/false-solution-why-carbon-markets-dont-work-agriculture (accessed November 10, 2022).

60. Copa Cogeca, “Draft Copa-Cogeca Reflection Paper on the Certification of Carbon Removal,” p.2.

61. EU Carbon+ Farming Coalition, “Certification of Carbon Removals – Response to Call for Evidence,” p.6.

62. PepsiCo, “Pepsico’s position on the European Commission’s Roadmap to restore sustainable carbon cycles,” 07 October 2021, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13066-Climate-change-restoring-sustainable-carbon-cycles/F2678800_en p.2 (accessed August 16, 2022).

63. Food Drink Europe, “FoodDrinkEurope contribution to the public consultation on EU rules for a certification of carbon removals.”

64. Danish Dairy Board, “Feedback from: Danish Dairy Board Brussels s.a.”

65. European Dairy Association, “Certification of carbon removals – EU rules: EDA feedback to the Commission’s call for evidence.”

66. Syngenta, “Syngenta contribution to the Call for Evidence for EU rules on certifying carbon Removals,” 02 May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3254547_en (accessed July 10, 2022).

67. European Dairy Association, “Certification of carbon removals – EU rules: EDA feedback to the Commission’s call for evidence,” p.1.

68. Council of the European Union, “Council conclusions on the Commission communication on sustainable carbon cycles in the agricultural and forestry sectors,” p.7.

69. Equinor, “Equinor Response to EU Commission Call for Evidence for an Impact Assessment – Certification of Carbon Removals,” 29 April 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3251919_en p.3 (accessed August 16, 2022).

70. e.g., Foodwatch, “Offsetting: ‘climate neutral’ through forest protection? An assessment of the ‘climate neutral’ claims related to the Tambopata-area: ‘REDD project in Brazil nut concessions in Madre de Dios, Peru,’” November 2021, https://www.foodwatch.org/fileadmin/-DE/Themen/Windbeutel/Bilder/2021/Dokumente/foodwatch2021_Tambopata-offset-project_Assessment.pdf (accessed November 10, 2022).

71. Institute for Agriculture and Trade Policy, “Emissions Impossible Europe,” 13 December 2021, https://www.iatp.org/emissions-impossible-europe p.23 (accessed August 16, 2022).

72. Yara, "Reply to the Roadmap Consultation: Restoring Sustainable Carbon Cycles,” p.1.

73. Industrieverband Agrar e.V., “Stellungnahme des Industrieverband Agrar e.V. zur Initiative: Zertifizierung des CO2-Abbaus - EU-Vorschriften,“ 02 May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3254432_en (accessed July 10, 2022).

74. Industrieverband Agrar, “Stellungnahme des Industrieverband Agrar e.V. zur Initiative: Klimawandel – Wiederherstellung nachhaltiger Kohlenstoffkreisläufe,“ 07 October 2021, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13066-Climate-change-restoring-sustainable-carbon-cycles/F2678693_en p.2 (accessed August 16, 2022).

75. Yara, “Reply to the Roadmap Consultation: Restoring Sustainable Carbon Cycles,” pp.1-2.

76. Bayer, “Bayer contribution: Call for Evidence for an Impact Assessment for an EU Regulation for the Certification of Carbon Removals,” p.9.

77. Industrieverband Agrar, “Stellungnahme des Industrieverband Agrar e.V. zur Initiative: Klimawandel – Wiederherstellung nachhaltiger Kohlenstoffkreisläufe.“

78. Yara, “Reply to the Roadmap Consultation: Restoring Sustainable Carbon Cycles,” p.2.

79. European Dairy Association, “Certification of carbon removals – EU rules: EDA feedback to the Commission’s call for evidence,” p.4.

80. Ibid., p.1.

81. Danish Dairy Board, “Feedback from: Danish Dairy Board Brussels s.a.,” p.1.

82. Ibid.

83. Agrafacts, No.11-22, 08 February 2022.

84. Bayer, “Bayer contribution: Call for Evidence for an Impact Assessment for an EU Regulation for the Certification of Carbon Removals,” p.14.

85. Institute for Agriculture and Trade Policy, “Emissions Impossible Europe.”

86. Equinor, “Equinor Response to EU Commission Call for Evidence for an Impact Assessment – Certification

of Carbon Removals,” p.3.

87. IPCC, “Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change,” p.63.

88. Syngenta, “Syngenta contribution to the Call for Evidence for EU rules on certifying carbon removals,” p.2.

89. Bayer Crop Science, “Bayer Crop Science comments on the Roadmap on Restoring sustainable carbon cycles,” 06 October 2021, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13066-Climate-change-restoring-sustainable-carbon-cycles/F2677524_en p.4 (accessed August 16, 2022).

90. Rabobank, “Carbon Farming: Four actions the EU can take to make it happen,” 22 February 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F2888732_en (accessed July 10, 2022).

91. Copa Cogeca, “Draft Copa-Cogeca Reflection Paper on the Certification of Carbon Removal.”

92. Agoro Carbon Alliance, “AGORO Carbon Alliance’s response to the EU Commission’s call for evidence on the Certification of Carbon Removals.”

93. Bayer, “Bayer contribution: Call for Evidence for an Impact Assessment for an EU Regulation for the Certification of Carbon Removals.”

94. Eni S.p.A., “Eni S.p.A. – Written contribution to the Public Consultation on “Certification of carbon removals – EU rules,” 02 May 2022, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13172-Certification-of-carbon-removals-EU-rules/F3254562_en (accessed August 16, 2022).

95. Copa Cogeca, “Draft Copa-Cogeca Reflection Paper on the Certification of Carbon Removal,” p.2.

96. Rabobank, “Carbon Farming: Four actions the EU can take to make it happen,” p.2.

97. Bayer, “Bayer contribution: Call for Evidence for an Impact Assessment for an EU Regulation for the Certification of Carbon Removals,” p.11.

98. Shell, “Shell response – Call for Evidence: Carbon Removals Certification – EU Rules,” p.1.

99. PepsiCo, “PepsiCo’s position on the European Commission’s call for evidence for an impact assessment on the certification of carbon removals,” p.4.

100. McConkey, B., ST. Luce, M., Grant, B., Smith, W., Anderson, A., Padbury, G., Brandt, K. & Cerkowniak, D., “Prairie Soil Carbon Balance Project. Monitoring SOC Change Across Saskatchewan Farms from 1996 to 2018. Change in SOC at Field Level Component,” 2020; Gross, C.D. and Harrison, R.B., “The case for digging deeper: soil organic carbon storage, dynamics, and controls in our changing world,” 2019, Soil Systems, 3(2), p.28. https://mdpi-res.com/d_attachment/soilsystems/soilsystems-03-00028/article_deploy/soilsystems-03-00028-v3.pdf?version=1561004461.

101. EU Carbon+ Farming Coalition, “Certification of Carbon Removals – Response to Call for Evidence,” p.9.

102. Agoro Carbon Alliance, “AGORO Carbon Alliance’s response to the EU Commission’s call for evidence on the Certification of Carbon Removals,” p.3; EU Carbon+ Farming Coalition, “Certification of Carbon Removals – Response to Call for Evidence,” p.9; Bayer, “Bayer contribution: Call for Evidence for an Impact Assessment for an EU Regulation for the Certification of Carbon Removals,” p.10.

103. Copa Cogeca, “Draft Copa-Cogeca Reflection Paper on the Certification of Carbon Removal,” p.2.

104. CarbonPlan, “Depth Matters for Soil Accounting,” 17 June 2021, https://carbonplan.org/research/soil-depth-sampling (accessed July 10, 2022).

105. CarbonPlan, “A buyer’s guide to soil carbon offsets,” 15 July 20121, https://carbonplan.org/research/soil-protocols-explainer (accessed July 10, 2022).

106. Agoro Carbon Alliance, “AGORO Carbon Alliance’s response to the EU Commission’s call for evidence on the Certification of Carbon Removals,” p.1.

107. Copa Cogeca, “Draft Copa-Cogeca Reflection Paper on the Certification of Carbon Removal,” p.2.

108. Agoro Carbon Alliance, “Position Paper from Agoro Carbon Alliance on leveraging Agricultural Voluntary Carbon Credits,” October 2021, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13066-Climate-change-restoring-sustainable-carbon-cycles/F2678366_en p.5 (accessed August 16, 2022).

109. Agoro Carbon Alliance, “AGORO Carbon Alliance’s response to the EU Commission’s call for evidence on the Certification of Carbon Removals,” p.1.

Downloads