EXECUTIVE SUMMARY

U.S. agricultural financial policy and institutions, both public and private, have not yet adapted to climate change. Instead, Congress responds to more frequent extreme weather events with larger and increasingly frequent ad hoc disaster payments and increasing subsidies for private crop insurance from taxpayer funds. These short-term responses are not sustainable fiscally, economically or environmentally.

This white paper summarizes how segments of U.S. agricultural and agribusiness finance could modify their policies and financial products to adapt to climate change in their own operations. Making agriculture finance climate resilient will enable farmers, ranchers and other clients to reduce greenhouse gases (GHGs) which have a global warming effect that drives extreme weather events. Climate-resilient finance will help farmers and ranchers adapt their operations and production practices to climate change trends over the short, medium and long term. This paper explores reforms in five segments of finance related to agriculture and agribusiness: crop and livestock insurance; loans; bonds to finance agricultural lending; agricultural price benchmarking commodity futures markets; and agribusiness financial disclosures to investors.

The contractual terms of agricultural insurance policies, loans and bonds must be modified to help farmers and ranchers reduce GHG emissions and adapt to climate change trends and events, making their operations more financially and environmentally sustainable. The trading of agricultural contracts in the futures and options markets requires climate-related regulations to help make futures prices into more reliable price benchmarks for the forward contracting of crops by farmers with their grain elevators. Agribusinesses should disclose climate-related financial risks and opportunities to investors and lenders to make their operations and supply chains financially, operationally and environmentally sustainable. Changes to Securities Exchange Commission (SEC) rules will be required to make those disclosures clear, comprehensive and comparable.

U.S. agricultural production usually begins not just with the assurance of taxpayer support from the Farm Bill, but with a loan from a local lender that likely belongs to either the federal Farm Credit System or Federal Deposit Insurance Corporation regulated private “farm bank” competitors. Both federal and private agricultural finance will become financially unstable if their risk assessments, credit policies and bond issuance terms continue to avoid internalizing climate change risks and costs. An increasing share of debt that cannot be repaid and eroding asset values are among the indicators of this financial instability.

The U.S. Department of Agriculture Risk Management Administration (RMA) regulates federally subsidized private crop insurance agencies. For most farmers, a crop insurance policy from such an agency is an important form of collateral to obtain agricultural loans. The RMA has not begun a rulemaking process to require private insurers to incorporate climate change risks into the calculation of policy premiums and indemnification rates for crop losses. If these risks are not internalized in insurance policies and pricing, premium rates will increase and indemnification rates will decrease, as climate change drives more severe and widespread damage from extreme weather events to agricultural production. If the price of insurance increases while the insurer’s liability falls, the resulting decrease of farmer participation in crop insurance could make certain crops uninsurable in some parts of the nation.

Another form of a farmer’s agricultural finance is to forward contract a crop with a grain elevator well before harvest to protect against a price fall in commodity futures markets, such as the Chicago Board of Trade (CBOT). The Commodity Futures Trading Commission (CFTC) regulates market participants and futures contracts, such as the globally price influential CBOT No. 2 yellow corn contract. The CFTC is studying how climate change will impact the deliverable supply of commodities, a critical factor in the design of futures contracts. The agency should modify CFTC rules and market data surveillance to help prevent massive market disruptions and contract defaults of market participants due to failure to incorporate climate risk weighting into trading strategies. These modifications would help make futures prices more reliable benchmarks for the setting of forward contracting prices by grain elevators and other first points of sale, such as livestock auctions.

Farmers and ranchers work in the value chains of transnational agribusiness corporations, including seed and pesticide firms; meat, poultry and dairy processors; farm machinery companies; and data collection and analysis firms, all of them claiming to be “climate smart.” These agribusiness companies are among the thousands of transnational corporations that do not disclose quantitatively their climate-related financial risks to investors, lenders and credit rating agencies as “material risks” to their operational and financial viability.

In general, the SEC does not comprehensively enforce “material risk” disclosure requirements. The SEC exempts privately held firms, which outnumber SEC registered companies on stock exchanges by 2-to-1, from registration and disclosure requirements. Current proposed climate financial risk disclosure legislation should be amended to mandate the SEC to require private equity owned companies, as well as publicly listed firms, to disclose climate-related financial risks with a robust enforcement mechanism to ensure compliance. Otherwise, climate disclosures, including reporting of corporate planning to adapt to climate change and reduce GHG emissions along their supply chains, will remain ineffective. Weak or “greenwashed” climate financial disclosures will delay robust climate policy action and contribute to radical climate instability, damaging both public and corporate interests.

OVERVIEW

In October 2018, the United Nations Intergovernmental Panel on Climate Change (IPCC) reported that greenhouse gases (GHGs) were warming the Earth far more and more rapidly than the IPCC had anticipated. Sea level rises, larger and more frequent wildfires, and food and fresh water shortages were some of the consequences projected by 2040 that will result from current business as usual industrial, energy, agricultural and financial practices.1 In June, The New York Times reported, “Levels of carbon dioxide in the atmosphere reached their annual peak last month, and once again were the highest in human history.”2 The record CO2 levels, despite the sharp declines due to the coronavirus pandemic’s impact on transportation and economic activity,3 testifies to the climate change momentum that is every bit as relentless and global as the spread of the pandemic.

Accelerating this momentum is the U.S. and global financial system. According to a recent Center for American Progress (CAP) article,4

Based on the best available estimates, 37 banks extended nearly $2.7 trillion in direct fossil fuel financing since 2016.5 Large insurers and asset managers continue to increase financing to carbon-intensive industries as well.6 Banks and insurers also regularly transfer their risk to others in the financial system via derivatives, securitization, and other complex financial instruments, meaning that financial sector financing and financial support for carbon emissions is undoubtedly far greater, especially since in a crisis, that risk transfer may not stick. [i.e., the derivatives contracts may default.]

Banks will loan to even the most highly indebted shale oil and gas firms as the firms wait for COVID-19-related government rescues7 because there is no rule or capital charge to prevent them from financing “zombie” companies and further destabilizing the climate.8 Given this vast climate-related financial momentum towards radical and prolonged climate instability unmitigated by U.S. financial regulators, it is no wonder the CAP article is titled “Financial Markets and Regulators Still in the Dark About Climate Change.”

This white paper does not analyze climate-related financial risk in all of finance. Instead we give an overview of distinct but overlapping segments of U.S. agricultural finance and explore the prospects for using agricultural finance instruments for reducing GHGs and adapting U.S. agriculture to climate change impacts. Are agricultural financial regulators likewise in the dark about climate change? We start with a state of play on U.S. agricultural policy and climate change.

The U.S. Department of Agriculture (USDA) spends far more in response to climate-related extreme weather events than it does on adapting to climate change. USDA devoted about 0.3% of its Fiscal Year (FY) 2019 budget of $144 billion to help farmers adapt to climate change, largely through its Climate Hubs program of 10 regional offices with an $11 million annual budget that has remained flat since 2015. The Climate Hubs are regionally specific agriculture and climate change knowledge distribution platforms. There was yet another round of taxpayer funded emergency disaster payments, capped by Congress at $3.1 billion for 20199 and administered by the Farm Services Administration (FSA). Even following the “bomb cyclones” of extreme precipitation flooding in the spring of 2019, top USDA officials and county FSA offices alike were silent in discussing the possibility that the bomb cyclones were symptomatic of climate change.10

In June 2019, the Aspen Institute and the U.S. Farmers and Ranchers Alliance, which counts feed grain, meat and dairy commodity groups and chemical inputs companies on its board,11 convened a climate change meeting that included USDA Secretary Sonny Perdue, two former USDA secretaries, the president of the American Farm Bureau Federation, and representatives from environmental and anti-hunger organizations. The guest list was confidential, no press was allowed and there was no announced plan of action. The extreme and widespread drought of 2012 and extreme precipitation of 2018-2019, which prevented the planting of 20 million acres, has led to new conviction, even among prior skeptics, that something more must be done than paying larger and more frequent ad hoc disaster payments for the damage of climate change-related weather events.12 Currently, some degree of drought affects about 27% of the United States, with rangeland and pasture in their worst conditions since the 2012 extreme drought, according to USDA.13

If a plan of action results from the June 2019 meeting and is implemented, U.S. agricultural and agribusiness finance will have to change to enable widespread adaptation to climate change and mitigation of GHGs caused by agricultural activities. Greatly scaled up implementation of Climate Hub knowledge and some of the dozens of policy proposals and techniques for GHG mitigation and adaptation14 will need to be financed beyond what taxpayers can provide to USDA. Furthermore, climate-resilient finance needs to be structured throughout the agricultural supply chain, instead of being limited to taxpayer subsidized crop and livestock insurance for farmers and ranchers to receive payments for losses related to climate events.

This paper reviews some of what has been proposed to reduce the climate-related risk to U.S. agricultural finance and modify the terms of finance to support mitigation of GHGs and adaptation to climate change. The paper is organized in five parts:

1. A summary of research on the impact of climate change on agriculture and the urgency of change to agricultural finance to enable mitigation and adaptation;

2. U.S. crop, and to a much lesser extent, livestock insurance against climate-related risk and losses: feasibility of GHG reduction and adaptation insurance requirements and premium incentives;

3. Federal and private agriculture credit: changing the terms of credit and the bond issuance to finance credit to support mitigation and adaptation;

4. Changing the terms of price risk management in the agricultural commodity futures markets to

internalize the price of climate-related financial risk (Commodity Futures Trading Commission);

5. Mandating clear, comprehensive and comparable corporate climate-related financial risk disclosure, particularly in the agribusiness sector, to investors, lenders and credit rating agencies (Securities and Exchange Commission).

Because climate change is a global phenomenon, the conclusion to the paper identifies impediments and drivers to encouraging the international adoption of climate-related financial risk measures. The Chair of the Board of Governors of the Federal Reserve System Jerome Powell has suggested that, in the near future, the Fed will join more than 30 other central banks belonging to the Network for Greening the Financial System (NGFS).15 The NGFS has begun to publish scenario-based studies of the impacts of climate change on macro-economic factors and the ability for central banks to backstop the financial system and its corporate clients.16 The federal and private agricultural credit and insurance system likewise will have to publish such studies to inform changes to their instruments and policies for climate-resilient agriculture.

Given the existential threat that unmitigated climate instability presents not just to the financial system but also to the habitability of the planet,17 we cannot understand too soon how climate-related risk, if ignored in agricultural finance, will exacerbate negative climate-related impacts on agriculture and rural communities. Then, we must put that understanding into policy action. As one USDA scientist told Politico for its investigation of 45 Agricultural Research Service climate change studies that USDA political appointees refused to publicize, “You can only postpone reality for so long.”18

1. URGENCY

The scale of the agricultural climate change challenge

According to the National Oceanic and Atmospheric Administration (NOAA), since 1980, the years with 10 or more extreme weather events in the United States causing $1 billion in damages are 1998, 2008, 2011-2012 and 2015-2019.19 NOAA estimates the damage of 265 extreme weather events from 1980 to 2020 to have cost $1.175 trillion.20 Droughts, expected to become more severe, frequent and prolonged under climate change, currently are estimated to cost U.S. agriculture about $10-14 billion annually.21 The Fourth National Climate Assessment in 2018 reported that the 2012 drought affected two-thirds of U.S. counties and resulted in $14.5 billion in production loss payments from the federal crop insurance program.22

The assessment stated, “In the late 1990s, U.S. agriculture started to develop significant capacities for adaptation to climate change, driven largely by public-sector investment in agricultural research and extension” but warned that “these approaches have limits under severe climate change impacts.”23 If public sector agricultural research budgets continue to shrink, relative to private sector budgets,24 the private sector will need to assume a greater share of the burden of agricultural adaptation to severe climate change impacts for agriculture and agribusiness to thrive.

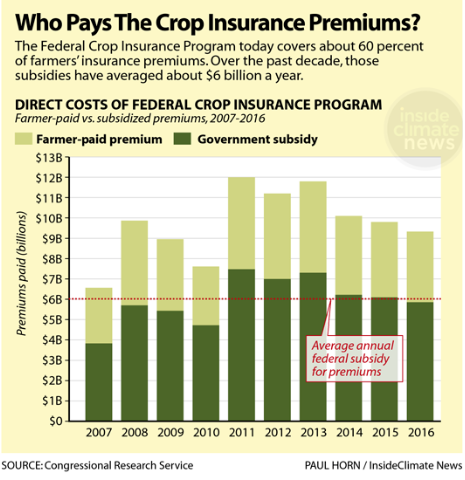

The reduction of GHGs caused by U.S. agricultural production, necessary to help reduce the U.S.'s contribution to global warming, begins from a baseline in the emissions inventory that is daunting in scale. According to the USDA’s Economic Research Service,25 U.S. agriculture emitted an estimated 698 million metric tons of carbon-dioxide equivalent in 2018: 12.3% as carbon dioxide, 36.2% as methane, and 51.4% as nitrous oxide. Increases in carbon storage (sinks) offset 11.6% of total U.S. greenhouse gas emissions in 2018 (EPA 2020). Carbon sinks include forest management to increase carbon in forests, increases in tree carbon stocks in settlements, conversion of agricultural to forest land (afforestation), and crop management practices that increase carbon in agricultural soils.

When faced with such a large emissions number to reduce, it is a consolation that agricultural and forestry practices have offset more than one-tenth of total U.S. emissions. Furthermore, better management practices, if scaled up with financial and technical support, could offset and prevent yet more emissions. How can financial instruments and policy be focused on the full value chain of agricultural and agribusiness GHGs reduction and adaptation?

Climate change policy suffers from what Mark Carney, the now former chairman of the Bank of England and of the Financial Stability Board (FSB) of central bankers, called the “tragedy of the horizon” in a 2015 speech to the Lloyds of London insurance group.26 In this tragedy, the very human tendency to deal with immediate problems first delays action on problems that, even if recognized as urgent, seem to be in a far-off horizon and for the next generation to deal with. But with climate change, next generation action will be too late to prevent radical climate instability. To begin to break this “tragedy of the horizon,” Carney announced that the FSB would launch a task force for the voluntary disclosure of climate-related financial risks and opportunities by major emitting corporations and their banks, as a first step in “managing what gets measured.”

What we might call the “tragedy of the agricultural horizon” is that U.S. agricultural climate change policy focuses almost entirely on farmers and ranchers, rather than on the agribusinesses that control the value chains in which farmers and ranchers are employed. This control is partly exercised contractually in vertical integration from raw materials production to transportation, processing and retailing, e.g., by Walmart and Costco.27 Control is also organized by the interlocking agricultural input and processing oligopolies that claim to be able to make agriculture “climate smart” through using Big Data to reduce agri-environmental damage while increasing agricultural production to “feed the world.”28 For agribusiness, the “tragedy of the agricultural horizon” focus on climate change mitigation and adaptation at the farm level has allowed firms to avoid reporting clearly and comprehensively their own climate change financial liabilities and risks.

Only four of the top 35 the meat and dairy processing companies fully report the emissions created by their supply chains, according to an application of environmental Life Cycle Analysis in the GLEAM methodology of the United Nations Food and Agriculture Organization.29 The 13 largest dairy corporations increased their aggregate emissions by 11% from 2015-2017. None of these companies verified their supply chain emissions, nor did they present plans to help limit global warming to 1.5° C30 consistent with the Article 2 objective of the voluntary 2015 Paris Agreement of the U.N. Framework Convention on Climate Change.31 (Non-reporting or under-reporting is only the tip of an agribusiness climate change iceberg, according to researcher Timothy A. Wise. He has tracked agribusiness campaigns in several countries that advocate practices and inputs contrary to IPCC recommendations on reducing GHG emissions and adapting to climate change.32)

In financial reporting terms, these dairy companies are not required to report to investors, lenders, credit rating agencies or other interested parties their emissions as a material risk factor to their future financial and operational viability. Nor are they required to report their plans for reducing absolute emissions nor for adapting their suppliers and processing and transportation operations to climate change. In the fourth part of this paper, we propose some rules for such reporting to the U.S. SEC, with appropriate incentives and enforcement measures for failure to comply.

Because of the current regulatory failure to include climate-related risk in agribusiness financial reporting, farmers under severe economic stress, rather than giant agribusiness firms, are often depicted as the principal source of agricultural resistance to climate mitigation efforts, particularly if mitigation is connected to the regulation of agricultural operations. Failure to disclose climate-related risk in financial reporting is part of the broader agribusiness externalization of the environmental and socio-economic costs of agricultural and food production that are offset, to a small extent, with taxpayer and USDA technical assistance to farmers.33

Focal points

■ The “tragedy of the agricultural horizon” is that further delayed action increases climate instability and that most U.S. government response to the agricultural impacts of climate change focuses on farmers, rather on agribusinesses. Climate change policy must focus on the agribusiness value chains in which farmers are employed.

■ Agribusiness failure to report climate-related financial risks to investors and regulators is part of a more general failure to take action to reduce and pay for the external impacts of agricultural and agribusiness production.

Agricultural mitigation and adaptation in the current U.S. farm economy

It is an understatement to say that even before the COVID-19 pandemic, U.S. agricultural economic fundamentals were dire. How dire is not indicated by the record levels of U.S. farmer debt,34 since that debt is borrowed mostly at historically low and fixed interest rates. How dire is not even indicated by dependency on taxpayers to enable what is routinely characterized as the “most affordable food supply in the world.”35 In 2019, USDA estimated that about $19.5 billion in direct payments to farmers and $10.5 billion in taxpayer subsidized crop insurance indemnities would together account for about one-third of $88 billion of U.S. farm net income.36 (Another year of oversupply without supply management pointed to a sixth year of low to below cost of production commodity prices in 2020, which likely will result in more taxpayer compensation for market failure.37)

So dire that $23.5 billion in pandemic-related relief for farmers — and indirectly for the pesticide, fertilizer and other input industries depending on farmer purchases — passed by Congress in March was followed in April by a proposal for another $50 billion in relief.38 If that latter relief bill were enacted, well over half of U.S. net farm income would derive from public funding. Even with COVID-19-related and non-COVID-19-related government payments, the typical Illinois 1,600 acre grain farm is projected to have a negative $25,000 net income in 2020.39 In this dire economic state, U.S. agriculture and transnational agribusiness must overcome the financial and technical challenges of reducing GHGs and adapting to climate change.

U.S. agricultural emissions have increased by more than 10% since 1990.40 In addition, there are many categories of emissions related to agriculture that are reported outside of the agriculture category; on-farm energy and fuel use; land change use (e.g., converting conservation land into crop land); the production of ammonia nitrate fertilizer; agricultural transportation, to say nothing of emissions from food processing, packaging and other inputs to retail food and energy and textile products derived from agricultural commodity production.

The Environmental Protection Agency (EPA) identified the increase in the number and size of concentrated animal feeding operations (CAFOs), particularly for dairy cattle and swine, as a major contributor to the rising agricultural emissions trend. CAFO liquid manure storage and the spreading of liquid manure on nearby agricultural fields contributed to increases in methane, with a global warming potential at least 28 times that of carbon dioxide. Increased use of synthetic nitrogen fertilizer accounted for most of the increase in nitrous oxide emissions, nearly 300 times as potent as carbon dioxide for heating up the planet. Regrettably, according to EPA data, U.S. GHG removals resulting from land use, land use change and forestry also declined.41

The EPA report did not distinguish between those agricultural practices that increased emissions and those that decreased emissions. That is not a policy failing of the report but is a consequence of EPA’s decision to follow the IPCC format for reporting emissions. However, the unsustainability for agriculture of the increasing frequency and severity of extreme weather events that are associated with failures to decrease emissions adds not only to agricultural insurance costs, but also to overall agricultural financial instability. Agricultural finance policymakers will be forced to make choices about what kinds of agricultural practices and inputs it will support and which it will not.

For example, under the current climate momentum future, lending in support of orthodox solutions to avoiding agricultural productivity loss will no longer be possible, at least not on the large scale of industrialized agriculture. According to the Fourth National Climate Assessment, “Expanded irrigation is often proposed as a strategy to deal with increasing crop water demand due to higher trending temperatures coupled with decreasing growing season precipitation. However, under long-term climate change, irrigated acreage is expected to decrease, due to a combination of declining water resources and a diminishing relative profitability of irrigated production.”42 If the financial success of your client depends on a loan to expand irrigation, according to what terms does an agricultural lender make the loan when the profitability of irrigated production declines to the point where there is no amount of refinancing of the loan that will enable the borrower to pay back even interest on the principle? If, instead, a client who can document success in dryland agricultural production wants a loan to extend water-retaining soil health conservation practices, does a lender make that loan, even though the loan is smaller and could be paid off more rapidly, without the loan refinancing that is more profitable to the lender?

Focal points

■ U.S. agricultural economic fundamentals are in a dire state. Nevertheless, the U.S. must make widespread and rapid changes to the production practices of crop, horticulture and livestock agriculture to avoid widespread climate-related damage and costs to agriculture and rural communities.

■ Scientists have identified the sources of U.S. GHG emissions increases and the current agricultural production practices that must change if U.S. agriculture is to adapt to survive. Agricultural finance policy makers will have to make sometimes difficult choices about which practices they will finance and at what cost.

2. SUBSIDIZED FEDERAL CROP INSURANCE

An unsustainable way to pay for losses related to chronic and catastrophic climate events under current production practices

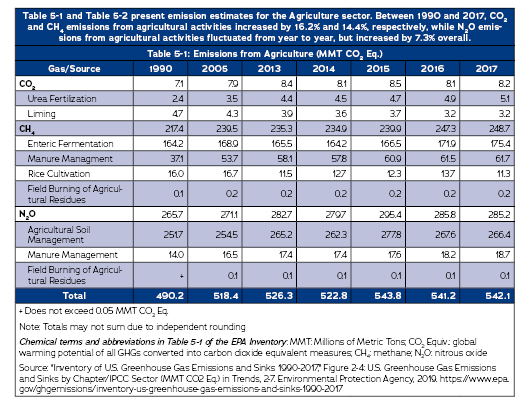

This section gives an overview of the U.S. crop insurance system and later exemplifies changes to insurance policy and premiums that might assist GHG mitigation and agricultural adaptation to climate change. The USDA’s Risk Management Administration (RMA) is the reinsurer for each of the private insurance companies that receive taxpayer subsidies to insure, in 2016, $100 billion in U.S. agricultural commodities.43 Reinsurance covers the losses that private insurance companies cannot indemnify. A 2018 USDA analysis of crop insurance indemnification reports that about 80% of indemnification payments from 1948-2016 occurred from 2001-2016, indicating both the increase in farmer participation in crop insurance after it became federally subsidized in 198044 and the acceleration of climate event impacts on U.S. insured crops: “The top ten weather and climate-related COL [cause of loss] are listed in Table 1 according to value of losses. These totaled $104.69b and $83.47b for the time periods 1948-2016 and 2001-2016, respectively. Regardless of the time period, drought and excess moisture comprise greater than two-thirds of aggregated indemnities. The top seven COL, including drought, have remained the top COL since 1948 over the Nation and have also comprised almost 90% of nationwide indemnities.”45

From the viewpoint of designing and marketing agricultural financial products to increase adaptation to climate change, based on historical data, requiring agricultural practices to adapt to drought and excessive precipitation would appear to have the most impact on the reduction of crop loss and corresponding indemnifications. However, future climate change impacts may not correspond to historical data nor do these causes of loss report the causes of GHG emissions increase.

To reiterate, according to the EPA greenhouse gas inventory for agricultural (not food system) emissions, GHG mitigating crop and livestock insurance would target the following principal causes: urea (nitrogen) fertilization; liming (applying lime to soil to reduce the acidity that inhibits fertilizer nutrient uptake); enteric fermentation (livestock digestion emissions); manure management; agricultural soil management; rice cultivation. Crop and livestock insurance policies could be written, according to federal standards, to reduce premiums and increase indemnification payouts for farmers and ranchers complying with practices applied to reduce these sources of GHG emissions.

Likewise, crop and livestock insurance policies could be written according to federal standards to adapt to climate change, e.g., according to USDA’s regionally specific “Adaptation Resources.”46 Farmers and ranchers complying with USDA approved adaptation practices and strategies would qualify for insurance premium reductions on a whole farm or per practice per acreage basis.

Indeed, as a result of sustainable agriculture advocacy in the 2014 Farm Bill,47 RMA already offers Whole Farm Revenue Protection (WFRP) policies with increasing premium discounts for planting up to seven crops.48 Crop diversification and rotation have climate adaptive benefits. WFRP follows traditional risk management principles by pooling risks to protect up to 85% of historic revenue by insuring across risks, instead of insuring against just one risk. The WFRP, however effective in protecting the revenue of diversified farms and however beneficial to climate change adaptation, does not apply to the largescale mono-cropped operations that are currently the major beneficiaries of federal crop insurance. An analysis of WFRP participation during 2015-16 reported that sales of WFRP policies were concentrated in the Pacific Northwest and California,49 areas in which multi-crop horticulture predominates.

The same analysis concluded, “The liability for WFRP is about 1% of the liability for all other federal crop insurance programs, but WFRP has significantly higher liability per policy, premium per policy, premium subsidy per policy, and indemnity per policy than all other federal crop insurance programs. This suggests that WFRP is a relatively small program that is still in its infancy but that, on average, higher-value assets were insured under WFRP than under other crop insurance plans.”50 Liability coverage is greater but so is the average cost of premiums relative to single crop insurance policies covering about 99% of all crop insurance liability.

According to the National Sustainable Agriculture Coalition (NSAC), greater farmer participation in WFRP will depend in part on RMA rulemaking and administration of the program’s private insurance agencies. A NSAC blog summarizing WFRP amendments in the 2018 Farm Bill concluded, “The new changes for the 2020 crop insurance year should help make the policy more attractive to farmers, especially in these times of more extreme weather and more regular disaster years. However, until crop insurance agents actively promote the policy and become more familiar with it, its growth will remain limited. Agent training remains paramount, as does finding ways to further simplify the recordkeeping and paperwork requirements.”51 As ever, the efficacy of legislation and regulation depends on effective administration.

To begin to develop a strategy for non-whole farm climate-resilient crop insurance, it is first necessary to understand the legislative structure of crop insurance and beneficiaries of the current crop insurance programs. According to the Congressional Research Service,

Since its inception in 1938, the federal crop insurance program has expanded from an ancillary program with low participation to a central pillar of federal support for agriculture. In 2015, the program provided over $102.5 billion of insurance protection (liability) for over 100 crops (excluding hay, livestock, nursery, pasture, rangeland, and forage) on about 238 million acres, or 86% of eligible acres. Policy offerings and participation were smaller for the livestock sector — $1.3 billion in liability on less than 3% of total eligible livestock inventory.52

The prime driver of this expansion has been legislation that shifted crop insurance delivery from the RMA supervised Federal Crop Insurance Corporation (FCIC), a wholly state-owned enterprise, to FCIC subsidized private crop insurers. Many of these private insurers are owned by the American Farm Bureau Federation53 and to a lesser degree by the National Farmers Union and other smaller organizations.

Delivery of insurance via subsidies to private entities is more costly to taxpayers, according to the General Accountability Office (GAO). The powerful farm organization and crop insurance lobby has blocked GAO proposed reforms to reduce those costs: “As of March 2020, Congress had not enacted legislation to reduce premium subsidy rates or limit premium subsidies available to individual farmers, as GAO suggested in March 2012.”54 The widespread economic expansion of federally subsidized crop insurance and the politically effective lobby against insurance cost containment have at least two lessons: 1.) any proposed change, whether in legislation or regulation, will encounter a powerful lobby with an economic incentive, at least in the short term, to preserve the status quo; 2.) as the costs of premium subsidies increase under more severe and widespread impacts of climate change, there may be a political tipping point in Congress to mandate well-documented use of mitigation and adaptation practices as a condition for policy holder insurability.

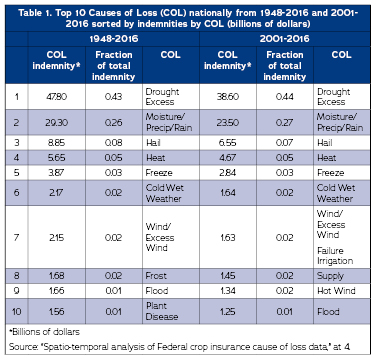

The FCIC pays for the administrative and operating costs of the quasi-private insurers, amounting to an annual premium subsidy of 15% from 2007 to 2016.55 The FCIC is also the all-important reinsurer for those insurers against their losses from indemnifying policy holders, including the Catastrophic Loss Adjustment Expense. The FCIC total subsidy premium amounts to an average of $6 billion annually, about 80% of which goes to the 20% of farmers who monocrop the largest scale acreage. According to Vincent Smith, an agricultural economist at Montana State University, “The upshot has been a 35-year evolution of the crop insurance program into a large and costly (over $8 billion annually) subsidy program that mainly redistributes tax revenues to relatively wealthy farm operators and landowners and to a crop insurance industry that in all likelihood would not exist absent the federal subsidy program.”56

Used with permission of Inside Climate News

Notwithstanding this severe criticism, it is very unlikely that taxpayer-subsidized crop insurance will disappear from the Farm Bill, in part because of the broad political constituency for the program from the direct beneficiaries — farmers and the private insurance companies — to the numerous indirect beneficiaries, including agricultural chemical and seed dealers; crop consultants; farm machinery dealers, agricultural lenders; grain and oilseed elevators; livestock feed manufacturers, etc. But equal, if not more important to the durability of taxpayer subsidized crop insurance, is the requirement of agricultural lenders that borrowers document their insurance coverage for the crop production that the loan is to finance. Crop insurance is loan collateral, just as the value of land, machinery or the yield history of row crops is.

Crop insurance, agricultural credit and good agricultural practices A study of the structural linkage between crop insurance and agricultural credit, based on data from the federal Agricultural Resource Management Survey (ARMS), concluded, “Farms that use crop insurance have higher levels of all types of debt; operate more acres; rent a higher share of acres operated; have operators with higher education levels; have higher sales volume; are more likely to produce field crops [corn, soybeans, cotton and wheat]; are less likely to produce specialty crops [horticulture, so-called minor grains] and livestock [hogs, sheep, dairy cattle, beef cattle and feeder cattle]; and are more likely to have farming as the primary occupation of the principal operator.”57 Any changes to crop insurance to mitigate GHG emissions and adapt to climate change will have to be coordinated with similar changes to the terms of agricultural credit to be effective in mitigation and adaptation. Changes to make crop insurance and agricultural credit climate resilient will have to be marketed successfully to the kind of farms identified in the ARMS survey.

Professor Smith comments, “The current U.S. crop insurance program encourages farmers to adopt production practices that will not be sustainable in the face of climate change, and in the short term contribute to greenhouse gas emissions.”58 To the extent the crop insurance program enables farmers to farm unsustainably, with no mitigation or adaptation rules or outcomes required to receive subsidized insurance premiums, there is no insurance incentive to adopt voluntary mitigation and adaptation measures. (Field trials show slight corn and soybean yield increases on land that has been covered cropped, except in the 2012 drought year, when the yield increase was 9.6% for corn and 11.6% for soybeans.59) Even though such measures build soil health and reduce input costs, they are unlikely to be employed voluntarily if a mitigation measure, such as planting cover crops or rotating crops, is believed to imperil the yield-based insurability of the cash crop.

To the extent that the historical yield per acre of a crop remains the sole metric for the liability the insurer assumes in the policy, business as usual will continue. To integrate mitigation and adaption into crop insurance, the RMA will have to write a rule in which a farmer’s failure to document practices to reduce GHGs and adapt to climate change will reduce the insurer’s liability and increase the farmer’s per crop premium.

The 2018 Farm Bill, for the first time, mandates USDA recognition of cover cropping as a “good agricultural practice,” making it possible to insure cover crops without requiring the termination of the cover crop prior to cash crop planting.60 Although certain cover crops are insurable, there is not yet a federal premium discount to foster widespread continuous cover crop adoption. Nor are other good agricultural practices yet insurable, although the Conservation title of the 2018 Farm Bill includes more budget and technical support for good agricultural practices.61

A crop insurance policy for increasing GHG emissions and how to change it

To the contrary, federally crop insurance offers premium discounts for planting monocrops that have a documented history of increasing GHG emissions. For example, in 2008, FCIC ruled that planting genetically engineered corn hybrids lowered risk against crop loss. Farmers planting at least 75% GE corn would pay a lower taxpayer subsidized premium.62 Regardless of the market price of corn (near or below the cost of production since 2014),63 there is an insurance premium incentive, as well as a Farm Bill commodity program revenue insurance incentive, to plant corn and even corn on corn in successive planting seasons.

The nitrogen fertilizer needs of corn result in both leakage of harmful nitrates into the water system and climate warming nitrous oxide emissions. A three-year field study on fertilization techniques to optimize corn yield while reducing nitrous oxide emissions begins with noting, according to a literature review, “nitrogen use efficiency (NUE) in corn production systems remains generally low: just 30%–59%.”64 Such studies can be translated into agricultural extension materials to teach fertilizer and soil management techniques to mitigate GHGs. But from an insurance policy design viewpoint, would it be feasible to calibrate insurance premiums according to crop specific, per acre increases in NUE?

Current crop insurance is either revenue and/or yield focused. Development of actuarial tables of NUE for certain soil types in certain growing regions would be a measurement that insurance agencies could use to develop climate-resilient insurance policies and premiums. A NUE-related premium discount could make it economically rational for a farmer to accept reduced yield from more efficient NUE in exchange for long-term sustainable yields without large expenses for repeated use of synthetic nitrogen fertilizers to “shock” nutrient depleted soil.

Making U.S. livestock insurance climate resilient

Federally subsidized insurance for livestock (swine, lambs, dairy cattle, beef cattle and feeder cattle) is a very tiny program compared to that of subsidized crop insurance. Federal subsidies for the crop insurance program of the 2018 Farm Bill account for about 9% of its $428 billion 2019-2023 spending, whereas livestock insurance is not even the smallest sliver of the Farm Bill spending pie chart.65 Livestock insurance program policies indemnify ranchers and farmers for the cost of livestock deaths, e.g., due to animal disease, extreme weather events or transportation accidents. Other policies protect against revenue loss from livestock price declines.66

From the perspective of mitigation and adaptation, the small federal support for livestock insurance is puzzling, since as IATP and others have shown, a life cycle analysis of meat and dairy products derived from livestock production documents major emissions from the global meat and dairy industries.67 However, better livestock management practices reduce these emissions. For example, according to the National Sustainable Agriculture Coalition,

Cattle and other ruminant livestock emit enteric methane (CH4) whether raised on pasture or in confinement. However, management-intensive rotational grazing systems (MIG) shrink the GHG footprint of livestock production by eliminating manure storage facilities, improving forage quality (30 percent reduction in enteric CH4), and sequestering at least one ton of SOC/ac-year (Soil Organic Carbon per acre per year) in grazing lands.68

Despite the environmental benefits of MIG systems, there is neither an insurance policy designed for nor a federal insurance premium subsidy to support MIG producers. By contrast, the Farm Bill’s Environmental Quality Incentive Program (EQIP) has been weakened in rulemaking to allow concentrated animal feeding operations (CAFOs) to access EQIP funding merely if they have a manure management plan by the end of the EQIP funding cycle, with no requirement to implement the plan to receive funding.69 By insuring CAFO livestock, USDA supports an animal husbandry system that increases methane emissions.

The USDA’s Risk Management Administration (RMA) helps ranchers locate RMA approved private insurance agents who will insure against adjusted gross revenue loss by means of policies that indemnify policy holders for 70-100% of the livestock cash price if it falls below the projected price, e.g., for beef cattle, at the end of the policy period.70 The indemnification formula includes head and weight of cattle with a cap on herd size. But that formula includes no incentives concerning husbandry practices, mitigation of GHG emissions or adaptation to climate change, e.g., by paddock and rotational grazing, to increase the amount of the indemnification for loss or reduce the insurance premium.

An RMA regulation to support climate-resilient grazing would require private insurers to issue policies that pay higher rates of indemnification for loss of MIG livestock grazed on carbon sequestering pastures than paid for livestock feeding on nitrous oxide releasing corn.

Focal points

■ The main causes of the increasing U.S. agricultural emissions and the climate-related causes of loss that require indemnifications from taxpayer subsidized private crop insurers are well understood. However, this research has not been incorporated into Risk Management Administration rulemaking for climate resilient crop insurance policies.

■ Despite the success of the Farm Bill’s Whole Farm Revenue Insurance programs to enable diversified production with climate stabilization co-benefits, about 99% of U.S crop insured acreage must become more climate resilient. The 2018 Farm Bill defined cover crops to increase soil health, including CO2 sequestration, as a “good agricultural practice.” This definition is an important step towards designing crop policies, premiums and indemnification payout rates to make crop insurance climate resilient.

■ A widespread increase in farmer use of climate-resilient policies will depend on further resources for Farm Service Administration county officials and Natural Resource Conservation Service officials. Those officials will be trained to explain to farmers the economic, as well as environmental benefits of climate resilient crop insurance, particularly in the low to below cost of production crop prices that USDA projects for the coming decade.71

3. AGRICULTURAL CREDIT TERMS TO ENABLE GHG MITIGATION AND ADAPTATION TO CLIMATE CHANGE

Banks are beginning to “decarbonize” their operations, investments, loan portfolios and even credit terms. Simply divesting from lending to or investing in fossil fuels is not a holistic plan to change how banks operate to avoid accelerating climate instability. According to the Climate Safe Lending Network, “Managing risk means understanding the entire range of forces that could influence a borrower’s ability to repay. That clearly includes environmental risks, which are likely to become more significant as a consequence of climate change — especially when these risks are the force behind the impacts that society will face, including to health, food security and infrastructure.”72

A keyword-based search suggests that U.S. agricultural lending has not yet developed a robust plan to decarbonize loan portfolios and develop climate resilient credit terms. Instead the term “credit” in a search of “agricultural credit and climate change” turns up most frequently the buying and selling of CO2 emissions offset “credits” — liabilities turned into tradeable assets through the magic of financial engineering to minimize the costs to industry of reducing emissions. To begin to develop climate-resilient terms of U.S. agricultural credit that finance adaptation, as well as absolute emissions reductions (as opposed to the financial engineering of “net zero” emission targets), it is necessary to understand the federal institutional structure of U.S. agricultural lending.

The Farm Credit System (FCS) is a cooperatively owned Government Sponsored Entity (GSE) and for-profit enterprise, authorized by Congress in 1916 to provide adequate credit to agricultural enterprises and rural communities. In 2016, the FSC held about 42% of all U.S. farm debt, compared to 41% for commercial lenders. “As of March 31, 2016, FCS had $238 billion in loans outstanding, of which about 46% was in long-term agricultural real estate loans, 19% in short- and intermediate-term agricultural loans, 15% in loans to agribusinesses, 8% in energy and water/ waste water loans, 2% in export financing loans and leases, 3% in rural home loans, and 3% in communications loans.”73 As of December 31, 2019, the FCS website reports a $287 billion loan portfolio in 914,387 loans.74 To judge by its website, the FCS does not have a climate change program, although its “Opportunities in Ag” public engagement page indicates with a photo that FCS lenders finance wind power energy generation.

The Farm Credit Act of 1971 codified prior laws governing the FCS.75 The Farm Credit Act of 1971 was amended in the Agricultural Credit Act (ACA) of 1987 after Congress voted a $4 billion rescue package for the FCS, following the U.S. farm mortgage crisis. The ACA allows the four FCS banks and their branch offices (“lending associations”) to make these kinds of loans:

■ Agricultural real estate loans

■ Agricultural production and intermediate-term loans (e.g., for farm equipment)

■ Loans to producers and harvesters of aquatic products

■ Loans to certain farmer-owned agricultural processing facilities and farm-related businesses

■ Loans to farmer-owned agricultural cooperatives

■ Rural home mortgages

■ Loans that finance agricultural exports and imports

■ Loans to rural utilities

■ Loans to farmers and ranchers for other credit needs

The FCS is owned by the members of the four FCS banks and 72 agricultural credit associations (ACAs), each of which is governed by a farmer or rancher member board. As summarized in a 1974 law review article, “The district federal land banks are now completely owned by the local federal land bank associations which are completely owned by the farmer borrowers. The district federal intermediate credit banks are now completely owned by the local PCA’s [Production Credit Associations] which in turn are completely owned by farmer-borrowers. Similarly, the [FCS] bank for cooperatives is owned by their borrowers.”76

The FCS is regulated by the Farm Credit Administration (FCA), which receives its funding from FCS institution assessments and which, among other functions, acts as the bank examiner for FCS banks and ACAs.77 The complex FCS ownership structure and the FCA dependence on the FCS for its funding could make FCA lending policy change, including regarding climate change, difficult to agree and enforce without the consent of the ownership structure. FCA board member testimony to the House of Representatives agriculture committee in 2017 emphasized the FCS’ multi-generation service to lending association members. Committee members in turn lauded the FCA and FCS.78

However, since the 1974 law review article, the funding needs of the FCS have grown to greatly exceed what the farmer and rancher owners of the ACAs can provide. To finance FCS lending, the Federal Farm Credit Funding Corporation offers fixed rate, floating rate and retail bonds at 1-30-year maturities, plus shorter-term discount notes. The bonds have AAA and AA+ credit ratings and the interest accrued on the bonds is generally tax exempt, making the bonds very attractive to investors. The debt is not guaranteed by the U.S. government, but by the FCS Insurance Corporation, another GSE.79

The terms of bond issuance, as well as the credit terms, could be subject to climate change criteria, e.g., issuing “green bonds” at higher interest rates for financing agricultural real estate lending on favorable terms to operators who agreed to climate adaptative land management practices. But any changes in bond issuance or lending would have to be agreed by the FCS regulator, the FCA, and possibly require new congressional authority.

Climate financial resilience and the Farm Credit Administration’s “safety and soundness” mandate

It has been almost a decade since the FCA published its Statement on Climate Change Adaptation Policy.80 The statement concluded:

As a small Agency of fewer than 300 employees, FCA has limited resources and expertise in the area of climate change adaptation. We will therefore be leveraging the experience of larger agencies such as the U.S. Department of Agriculture and the other financial regulators as they develop their plans and will consult with them as needed. We will also be relying on additional guidance from the Interagency Climate Change Task Force. — Leland A. Strom, CEO and chairman, Farm Credit Administration

This task force has not met during the Trump administration. However, other U.S. financial regulators, such as the regional banks of the Federal Reserve System81 and the CFTC, are beginning to calculate climate change as a systemic financial risk.82 The FCA likely will have to begin developing studies and rules for the FCS to incorporate into their lending and bond issuance requirements. The FCA has a statutory obligation to ensure the stability of federal agricultural finance, just as the Fed has a statutory responsibility to ensure the stability of the entire financial system. Climate change is a systemic risk to that stability.

A 2015 rule finalizing FCA reorganization reaffirmed that FCA is a “safety and soundness” regulator mandated to ensure that all FCS activities promote financial stability: “The Office of Examination evaluates the safety and soundness of FCS institutions and their compliance with law and regulations and manages FCA’s enforcement and supervision functions.”83 Because the Federal Reserve System for non-agricultural lending is likewise governed by “safety and soundness requirements” under the Bank Holding Company Act, the FCS is sometimes considered a “mini-Fed.”

Racial discrimination in agricultural finance: climate change impacts

All farmers need agricultural finance to be able to adapt to climate change. However, there is a long history of USDA discrimination against Black, indigenous and other people of color that has blocked their access to agricultural finance and technical assistance provided to their white farming neighbors. Partial redress for discrimination against Black farmers, resulting from two lawsuits (colloquially Pigford I and Pigford II) against USDA just for the period 1983-1997 resulted by 2011 in “approximately $1.06 billion in cash relief, tax payments, and debt relief” for about 16,000 eligible claimants.84

But an average $60,000 of direct and indirect financial restitution is far too small for federal discrimination that resulted in bankruptcy and forced land and building auctions. Land ownership and intergenerational land transfer are indispensable building blocks for agricultural climate justice. The Federation of Southern Cooperatives has advocated for more than a half century to prevent loss of Heirs’ Property among Black farmers who died without a will or written title to the land they had farmed for decades.85

Indeed, almost 90 years of legalized segregation and discrimination followed the end of Reconstruction in 1877 and its grants of land to Freedmen. The lack of land tenure and finance resulted in a struggle to maintain Black titled ownership of land. Nevertheless, reports indicate that some 210,000 Black farmers came to own about 14 million acres by about 1910.86 By the Great Depression, Black farmers owned a total of 15 million acres. But the economic toll of the Great Depression, the Great Migration fleeing the violence of white supremacists and racial discrimination in county-administered New Deal agriculture programs were among the causes of Black land and intergenerational wealth loss.87 By 1967, when the Federation of Southern Cooperatives was founded, fewer than 20,000 Black farmers owned 2.3 million acres.88 According to the 2012 USDA agricultural census, 44,629 Black farmers worked 3.6 million acres, about 0.4% of total U.S. farmland.89 (This number is very likely an over count, due to a USDA change in census methodology.90) The 2017 USDA census counted 29,788 Black farmers owning land and 11,083 renting land, totaling about 4.1 million acres.91

Black farmers mostly operate small and diversified farms and have a long history of sustainable agricultural innovation.92 USDA and private lending policies to force farmers to “get big or get out” had a particularly devastating impact on Black farmers and their rural communities.93 The agribusinesses, land owners and farmers controlling 99.6% of U.S. farmland and receiving 99% of agricultural credit will be largely responsible for mitigating — or not — agricultural and food-related GHGs.

The 2018 Farm Bill section for “Beginning, socially disadvantaged and veteran farmers” offers a suite of Farm Services Administration agricultural financial products, including microloans, for applicants whose credit history and farming experience would not qualify them for loans from other sources. The section also offers organic crop insurance, conservation loans and disaster relief assistance, among other programs, totaling $485 million over 10 years.94 However, USDA classifies 17% of two million U.S. farmers as “beginning” and 41% as “socially disadvantaged,” including the following groups subject to racial and/or gender discrimination: “American Indians or Alaskan Natives, Asians, Blacks or African Americans, Native Hawaiians or other Pacific Islanders, Hispanics, and women.” USDA classifies 30% of farming operations as “socially disadvantaged.”95 In sum, allowing for overlapping categories, there may be one million farmers applying annually for assistance from that one Farm Bill program.

Black farmers have been urged to adapt to climate change,96 but federal resources to do so are minute. Adaptation is place based and agronomically scale neutral, enabling even small-scale land holders to build agricultural natural resource equity for their operations with relatively small amounts of credit, e.g., to experiment with different coverage crops for paddock grazing and other agroecological practices. However, to scale up adaptation to the point where you can make a living from farming, without depending on a non-farm job, usually requires more land and more credit. Continued discrimination against Black and other minority-operated farms will significantly inhibit their successful and prosperous adaptation to climate change.

Unfortunately, USDA’s history of discrimination continued during the Obama administration even after the Pigford lawsuits had been settled. Nathan Rosenberg and Bryce Wilson Stucki note that, “If black farmers’ share of loans had been commensurate with their share of the farming population, they would have received about twice as much as they did, or another $300 million. If their lending totals reflected their proportion of the U.S. population, they would have received 16 times what they actually received, or an extra $5 billion.”97

Adequate farm credit and crop insurance are issues of both climate and justice. The financial consequences for USDA habits of deception, dishonesty and discrimination against Black farmers have been relatively small for the federal budget. If these practices continue in the USDA response to climate change, even the most highly subsidized industrialized agriculture operations will be devastated.

According to John Brake, “While the Federal Reserve System does not make loans to farmers, the policies set by the Board of Governors have a direct effect on credit availability to farmers through commercial banks. In general, the Federal Reserve System has not emphasized policies for the specific purpose of affecting farm lending rates and terms. Yet, these matters are of concern to the Board.

A considerable amount of research on agricultural finance takes place in the Federal Reserve System.”98 Soon Fed research on climate change99 likely will percolate through the FCS research for its bond issuance. FSC member banks and ACAs, if asset aggregated in 2016, would comprise the ninth-largest U.S. bank, according to the American Banking Association, a members compete with FCS lending associations.100 In other words, the FCS, in Federal Reserve System terms, is a Systematically Important Financial Institution.

The central banks of the Network for Greening the Financial System assume that climate change is a systemic financial risk requiring research and regulation to manage that risk. To manage the climate-related risks that affect the FCA “safety and soundness” mandate, the FCA should change how it regulates the FCS, which in turn will develop credit and bond issuance policies to reduce its climate-related financial risk. But what these policy changes are and how rapidly they can be incorporated into FCS local lending requirements is far from certain.

Any reduction in the climate financial-related risk of the FCS and its lending associations will require FCA to take regulatory action to implement its safety and soundness statutory obligations. Indeed, changes in FCA policies to reduce FCS climate-related financial risk should be framed as part of the reforms proposed to strengthen FCA’s statutory mandate to ensure its financial stability.

According to FCS critics, the FCA has failed to monitor the deteriorating credit quality of FSC lending association loans: “Before conditions worsen further the FCA must become more aggressive in its safety-and-soundness supervision of FCS institutions, including monitoring the lending relationship between the associations and the FCS banks that fund them. To that end, the FCA needs to abandon its longstanding practice of not publishing its enforcement orders and other regulatory actions.”101 If the FCA developed climate-resilient credit requirements, in part to improve the credit quality of the lending association portfolio by incorporating climate risks, it would need to publish proposed requirements for comment and publish enforcement orders to increase compliance with the requirements by lending association members. No regulator can remain independent of and effective for the regulated entity and the public interest if regulatory actions and enforcement orders are not published for comment. Even if Congress decided to appropriate the FCA budget to reduce its budgetary dependence on FCS fees, the FCA would remain a weak supervisor of the FCS lenders if its regulatory and enforcement actions cannot be subject to public review and comment.

Climate-resilient private agricultural lending

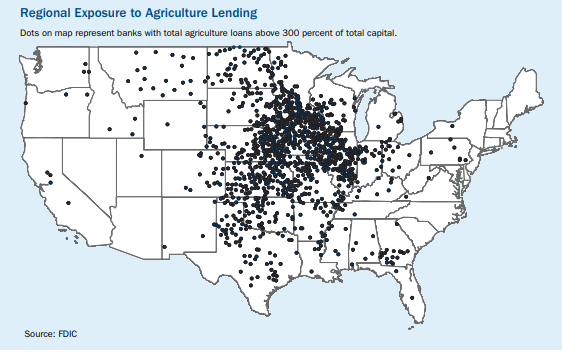

The regulatory outlook for climate resilience in the private agricultural credit system is difficult to foresee. In 2019, the Federal Deposit Insurance Corporation (FDIC), which is the primary regulator of community banks and insures the losses of depositors to the U.S. banking system, surveyed its agricultural loan exposure risks. The FDIC reported, “As of first quarter 2019, there were 1,315 farm banks representing nearly one-quarter of all FDICinsured institutions. During first quarter 2019, agriculture loans held by FDIC-insured institutions totaled $184 billion.”102 A “farm bank” is one whose loan portfolio is 25% agricultural. The farm bank loan risk exposure is overwhelmingly concentrated in the Midwestern row crop and livestock growing states, which have a high degree of climate vulnerability, according to the Fourth National Climate Assessment.103

Perhaps not surprisingly, the FDIC views low commodity prices paid to farmers by agribusiness as their chief risk, especially because USDA’s “long-term forecast [of] real agricultural commodity prices will continue to decline over the next ten years as global production outstrips demand.”104 Presumably, then, the FDIC expects the cash receipts of USDA’s net farm income definition to continue to decline while the government payments portion increases, under a business as usual scenario.

The upshot of falling commodity prices and rising operational costs is that the financial stability of private agricultural finance is at risk: “Loan growth at farm banks has outpaced deposit and asset growth since the downturn in the farm economy began. As a result, farm banks continue to meet agricultural credit demand at the expense of balance sheet liquidity.”105 Despite risk indicators that point to agricultural financial instability, the FDIC does not consider climate change to be a systemic financial risk.

The FDIC 2018-2022 strategic plan states,

The FDIC dedicates significant resources to the continuing identification of emerging issues... For example, the FDIC is currently monitoring trends, opportunities, and risks in financial technology (fintech); evaluating fintech’s impact on banking, deposit insurance, oversight, inclusion, and consumer protection; and formulating strategy to respond to opportunities and challenges presented by fintech to supervised institutions.106

Source: “2019 Risk Review,” Federal Deposit Insurance Corporation, at 17. https://www.fdic.gov/bank/analytical/risk-review/full.pdf

It is understandable that the FDIC would be concerned about fintech firms performing banking functions without banking regulation or oversight of fintech accounts107, while its regulated banks compete with fintech. But it is incomprehensible that FDIC would not regard climate change as an “emerging issue,” particularly for the one-quarter of its banks that are “farm banks.”

Wall Street banks have been reducing their agricultural and agribusiness loan portfolios since 2015, the year after farmgate commodity prices began their now six-year decline. The FDIC farm banks located in rural America cannot so readily exit the sector, since farm and ranch operations are a large share of their client base.108 The largest source of a farm’s equity and its loan collateral is the value of the farm’s land, which varies greatly according to region, agricultural land use, agricultural and general economic conditions, and agronomic conditions.109 Econometric studies have projected a decrease in U.S. farmland value due to climate change factors.110

Before agricultural loan officers can incorporate climate change risk into their loan terms, the FDIC and the Office of the Comptroller of Currency would have to incorporate climate change risk into the regulation of private lending.111 Agricultural and rural lending is often a small part of a community bank’s total loan portfolio, unlike the loan portfolios of FCS lending associations. If legislation and/or regulation of community banks are required to add climate change risk analysis to their agricultural portfolios, would they have to add it also to their non-agricultural portfolios, e.g., in renewable energy lending?

For example, private lenders advise farmers and ranchers on how to invest in wind energy and solar farms as a revenue stream and even as a “cash crop.”112 Since both forms of renewable energy require major infrastructure investment and the price of renewable energy competes in the much larger investment universe of electric energy futures contracts, lenders should disclose to their farmer clients the long-term risks of alternative energy investment. Just as private lenders evaluate the forms of collateral in a loan application, borrowers need to understand the climate-related financial risks in the bank’s credit products. (This white paper does not include Farm Services Administration lending nor so-called alternative agricultural lenders, the latter the last resort for farmers in desperate circumstances, who will pay higher interest rates and accept other stringent conditions in exchange for the opportunity to farm for another year.113)

Focal Points

■ There is an urgent need to incorporate conditions for climate resilient agricultural practices into both federal agricultural and private agricultural lending. Climate resilient agricultural finance reform is required to ensure the safety and soundness of agricultural finance, as well to reduce agricultural GHGs and enable agriculture to adapt to climate change.

■ Some reform may be accomplished through regulatory actions. However, because U.S. agricultural lending is bifurcated between the Farm Credit System and private agricultural lending, each with separate statutory authorizations (the Farm Credit Act and multiple authorizations for private lenders), it is likely that new legislation applied to both federal and private lenders will be required to achieve uniform outcomes without the commercial disadvantages inherent in the current bifurcated system.

■ Because both the FCS and private lenders rely on bond issuance to finance their operations, it is crucial that federal and private lender bonds have the same climate resilient terms. Whether agricultural bonds from private lenders have the tax-exempt status of FCS bonds will be a major legislative battle in the process to agree on a climate-resilient agricultural lending law.

4. MANAGING PRICE RISK IN THE AGRICULTURAL AND CARBON EMISSIONS DERIVATIVES MARKETS UNDER CLIMATE CHANGE

Climate change will impact, to varying degrees and at varying times, all asset classes regulated by the CFTC. These asset classes include physical commodity derivatives contracts (agriculture, energy, base and precious metals and environmental assets such as CO2 emissions offsets), financial commodity derivatives (interest rates, foreign exchange rates, credit default swaps) and “exotics,” such as digital currency derivatives and “mixed swaps”, e.g., offsetting oil price risks with a bundle of foreign exchange derivatives. The prices of these contracts will be affected by the market participants’ and trading exchanges' evaluation of the economic impact of extreme weather events and chronic climate trends, e.g., the impact of hurricanes on Eastern Seaboard hog CAFOs that supply the underlying asset of lean hog futures contracts.

The largest banks, their corporate clients and hedge funds trade contracts in all or most of these asset classes to manage their raw materials price risks and/or to benefit from financial speculation. The following section just concerns agricultural contracts and CO2 emissions offset contracts whose underlying assets are offset projects, such as manure lagoon methane digesters. The taxpayer subsidized digesters’ methane reductions are converted into CO2 equivalent credits for emissions offset trading. A very short primer on trading theory and operations will set the context for climate change-related financial risk in trading these contracts.

Futures contracts of varying duration, e.g., 90 days, are bought, sold and/or rolled over, i.e., traded, from one contract period to the next to manage price risks over the duration of the contract. In theory, effective price risk management should prevent unexpected price increases or decreases by a strategy of offsetting price risks e.g., most simply by offsetting a contract bet “long” to increase prices with a contract bet “short” to decrease prices. Agricultural traders, transporters, processors and retailers (in aggregate, “commercial hedgers”) trade wheat, corn, livestock, cotton, coffee bean, etc., contracts for physical delivery at a fixed price or to settle by cash payment to lock in a price at a future date or dates. In the argot of commodity markets, trading “discovers” the futures contract price.

If the markets are functioning well, the futures price will converge with the cash price for a commodity as the contract approaches its expiration date. Convergence between the futures price and the cash price should serve as a reliable benchmark price, e.g., for grain elevators. To simplify114, the elevator operator takes the futures price, subtracts from it storage costs, electricity costs, propane gas costs (for drying grains to prevent fungal diseases), handling costs, interest rate costs (e.g., for building the elevator) insurance, etc., and adds their profit objective to offer a price at which an elevator will buy a commodity from a farmer or rancher for an agreed delivery date, quantity and commodity characteristics, e.g., percentage of humidity allowed in a grain sample.115

If the basis between the futures price and the cash price is too wide, as research in Kansas wheat elevator operations has shown,116 elevators may increase the cost of buying a crop in advance of the harvest to the point where farmers no longer use forward contracting to lock in a price at the elevator for their future harvest. Forward contracted production is often used as collateral for an agricultural loan. Without the forward contract, a farmer must depend on the farm’s land value, the farm’s yield history and the crop insurance contract to obtain the loan.

However, price formation can be disrupted both episodically and chronically by several factors. For example, the CFTC is currently investigating unusual price movements in both livestock and oil contracts.117 In the case of the West Texas Intermediate crude oil contract, it is likely that excessive speculation resulted in a situation where the speculator was forced to sell the May 2020 contract at any price because it had no capacity to take physical delivery of the contract. Incidents of excessive speculation and market manipulation harm some market participants in the contract and may harm the reputation of the trading venue for having failed to prevent excessive speculation and/or market manipulation. As investors pressure companies to disclose comprehensively, clearly and in comparable terms their Climate Value at Risk (CVaR),118 part of that disclosure will concern their derivatives trading in both physical and financial commodities.

Unmitigated climate instability presents risks of repeated destruction of underlying assets and disruption of contract delivery systems that could affect most market participants. For example, consider the climate-related financial risk problem of CFTC verification of exchange Deliverable Supply Estimates (DSEs) for physical derivatives contracts. The CFTC attempts to prevent excessive speculation by limits on the number of contract positions held by a financial speculator with no commercial interest in producing, processing or transporting the commodity that is the underlying asset of the contract.

The position limit is derived as a percentage of the exchange DSE of the commodity divided into numbers contracts per commodity. DSEs are not simply the physical supply of the commodity that could be physically delivered per contract specifications, but a more complicated formula of what the exchange considers to be the supply that it is remunerative to buy or sell at specific delivery locations. Climate change will affect not only growing zones, plant and animal diseases reducing production, precipitation patterns and drought, but also the economic viability of storage and shipping facilities damaged by extreme weather events — all factors that should be included in the DSE calculation.

Advising the CFTC on how to make futures contract trading climate resilient

The CFTC’s request for public input to its Market Risk Advisory Committee (MRAC) Subcommittee on Climaterelated Financial Risk in 2019 was a welcome step forward. The request signaled the agency’s recognition that climate change poses financial risks to all the asset classes it regulates. The Subcommittee could recommend that the CFTC conduct a 360-degree review of CFTC definitions, core principles, rules, guidance, data monitoring and enforcement, market surveillance, research and outreach, to analyze how they might need to be modified for market participants and exchanges to respond effectively to climate-related financial risk.119

Or the Subcommittee could propose that the CFTC staff conduct a more limited review of current and planned industry practices to manage climate-related financial risks. The Subcommittee is expected to produce a report with recommendations for review by MRAC’s voting members.120 The MRAC recommendations are unlikely to be agriculture specific, but because CFTC rules apply to more than one asset class, they will apply to agricultural futures contracts.

Trading emissions offset credits derived from agricultural activities to reduce GHGs

MRAC may recommend that the CFTC research an expansion of carbon emissions permit and emissions offset credit trading from primary markets, such as the California cap and trade system, into the derivatives markets. Such research may be recommended in no small part because many of the MRAC members represent banks, hedge funds and exchanges that would benefit from emissions derivatives trading. However, derivatives contracts must be based on a standardized underlying asset, e.g., No. 2 yellow corn, in highly exchange specified contract language. U.S. federal legislation has yet to authorize standardized emission offset credits that could serve as the underlying asset of an emissions offset derivative contract.

Because, as documented above, most U.S. farmers are in dire economic straits, there is bipartisan political support in Congress for federal payments to farmers to reduce their GHG emissions through different technologies, e.g., methane digesters on CAFOs and practices to sequester soil carbon through good soil health management.121 These payments would constitute another revenue stream to partly compensate for chronically low commodity prices and high farm operating costs.

The Senate’s Growing Climate Solutions Act of 2020 would create emissions offset credits to be traded on voluntary emissions markets without emissions caps and on compliance markets with caps, such as the California emissions trading program. The bill would authorize USDA to oversee a program of technical assistance providers for and third-party certifiers of agricultural and forestry emissions offset projects that would standardize emissions reductions into tradable emissions offset credits. The Secretary of the USDA, with an advisory council, would determine the historical baseline from which emissions would be reduced and would also define standards for the verification and permanence of emissions reductions.

The short bill includes a very short enforcement section that prohibits the submission of “knowingly fraudulent information” and authorizes the Secretary to determine an appropriate civil penalty to apply to violators.122 But the bill is silent about what emissions markets are to do with the already traded emissions offset credits that were certified for trade based on fraudulent information.